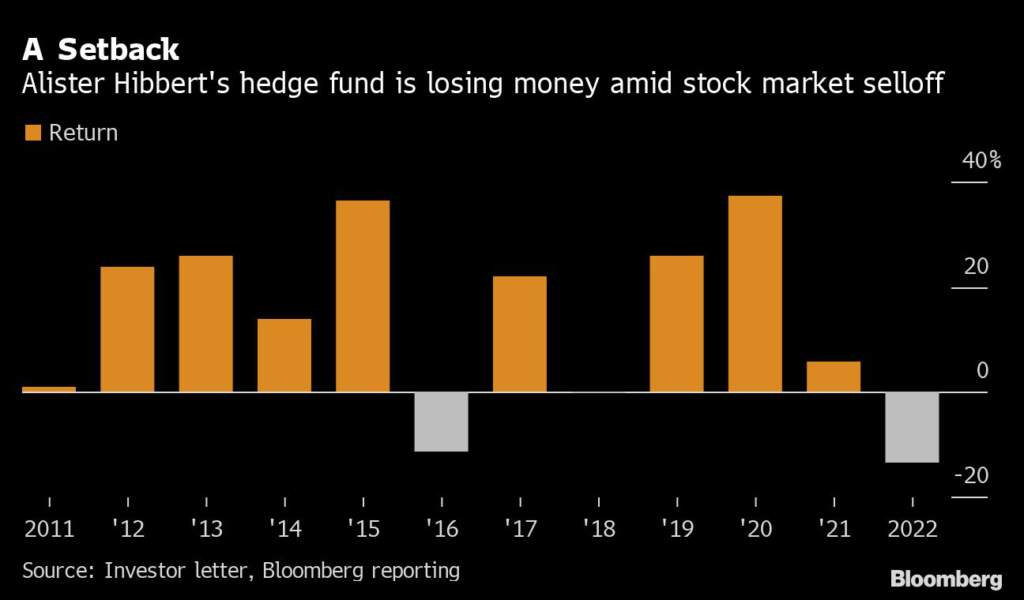

(Bloomberg) — BlackRock Inc. star money manager Alister Hibbert has turned bearish as his hedge fund endures its worst-ever losses amid a sharp decline in stocks.

The BlackRock Strategic Equity Hedge Fund tumbled 13% this year through April, a person with knowledge of the matter said. That exceeds its worst annual decline of 11%. The money manager, who has profited from the historic surge in stocks since starting the fund in 2011, turned net short for the first time ever this month, said the person. His portfolio was net long about 35% at the end of last year.

The reversal marks a seismic shift underway in global markets as soaring inflation forces central banks to end quantitative easing and raise interest rates. That has led to a selloff in markets with growth stocks, led by the technology sector, falling further in a setback for equity-focused hedge funds.

Hibbert has run his fund with a tilt toward growth stocks and owned shares such as Microsoft Corp. and Mastercard Inc. He flagged his cautious outlook earlier this year, telling clients that the strongest phase of economic recovery, characterized by soaring earnings and cyclical performance, was now over. The fund had about $9 billion of assets on Dec. 31.

“It is clear that the normalization of the economy post-pandemic is not going to be an entirely orderly process,” he wrote in a letter to investors in March.

A BlackRock spokesman declined to comment.

BlackRock shares have tumbled about 34% this year. In a March letter to investors, Chief Executive Officer Larry Fink expressed disappointment in the stock’s performance and cited challenging markets for the decline.

Hibbert has long been one of the best-paid risk-takers at the world’s biggest asset manager and key to BlackRock’s expansion into active management and driven-performance fees. He earned a nine-figure sum, more than triple the size of Fink’s $30 million payout in 2020.

Hibbert started the hedge fund more than a decade ago with just $13 million and turned it into one of the largest long/short money pools, generating annualized returns of almost 17% until last year. The fund has had only two annual declines. Hibbert also runs a concentrated long only fund — BlackRock Global Unconstrained Equity Fund — which is down about 20% this year, according to Bloomberg data.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.