(Bloomberg) — Brazil’s central bank said much of the impact of its “intense and timely” cycle of interest rate hikes is still to come even as it left the door open to smaller borrowing cost increases amid a tough inflation outlook.

Policy makers wrote that a likely extension of tightening with a smaller increase in June was appropriate to bring inflation expectations to target, according to the minutes of the May 3-4 rate-setting meeting, when the board raised borrowing costs by a full percentage point.

“It was emphasized that the current monetary tightening cycle was quite intense and timely and that, due to monetary policy lags, much of the expected contractionary effect and its impact on current inflation are still to be seen,” they wrote in the minutes published Tuesday. Their strategy, together with tightening that’s been implemented, “reinforces the cautious monetary policy stance and emphasizes the uncertain scenario,” they wrote.

Policy makers led by Roberto Campos Neto are fine-tunning the end of a tightening cycle that has added 10.75 percentage points to borrowing costs in about a year. They face persistent double-digit inflation along with rising consumer price forecasts. Civil servants are demanding higher wages to make up for lost purchasing power, adding to pain from costlier raw materials.

Read more: Traders Get It Right in South America Doubting Central Banks

What Bloomberg Economics Says:

“The minutes were slightly more hawkish than the post-meeting statement, in our view, and consistent with the possibility of additional hikes in the second half of the year as the yield curve is currently pricing in. We see relevant risks that inflation expectations for 2023 remain above target for some time; this may lead to a higher terminal rate than the BCB now has planned.”

— Adriana Dupita, Latin America economist

— Click here for the full report

Swaps rates on the contract due on January 2023, which indicate investor expectations for monetary policy at year’s end, slipped two basis points in morning trading.

Deterioration

In the minutes, central bankers wrote that “an additional deterioration was observed in both the short-term inflationary dynamics and the longer-term projections.” Some policy makers wrote high current inflation contaminated forecasts “beyond what was expected.”

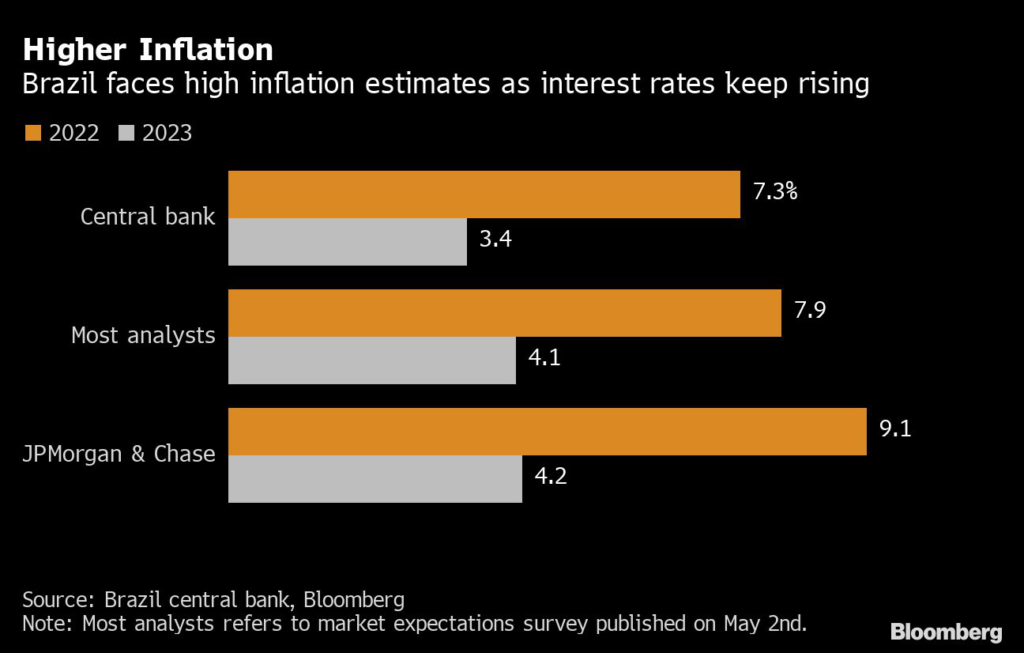

Annual inflation topped 12% in early April, driven by higher oil costs after Russia’s invasion of Ukraine. Major Wall Street banks now see consumer price increases above 9% at year’s end, well above the 2022 target of 3.5%.

On Monday, state-controlled oil company Petroleo Brasileiro S.A., commonly known as Petrobras, raised diesel prices to 4.91 reais ($0.96) per liter from 4.51 reais per liter, according to a statement. Gasoline costs were kept unchanged.

“Deteriorating inflation expectations a pretty common theme” in today’s minutes, said Brendan McKenna, strategist at Wells Fargo & Co. He sees another hike of either 50 or 75 basis points in June, while an additional increase in August isn’t “completely taken off the table either.”

Growth Risk

In a separate release on Tuesday, Brazil’s retail sales rose 1% in March, with purchases of office supplies and books driving the gains. That was more than the 0.5% median forecast from analysts in a Bloomberg survey.

Still, extending the hiking cycle may prove difficult, as most analysts see gross domestic product growth at just 0.7% this year, according to the latest central bank survey of economists.

“The Committee highlighted that economic growth came in line with expectations, but the tightening of financial conditions brings a risk of greater-than-anticipated deceleration in the quarters ahead, when its impacts tend to be more evident,” central bankers wrote in the minutes.

Brazil’s central bank is also weighing more challenging global outlook, as the US Federal Reserve raises its borrowing costs. Last week, its Chair Jerome Powell said it would move “expeditiously” to tame inflation.

(Updates with analyst comment in fifth paragraph, market move in sixth)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.