(Bloomberg) — Chinese miners and battery makers are forging closer ties as the accelerating shift to electric vehicles highlights the shortage of a metal that’s key to the clean-energy revolution.

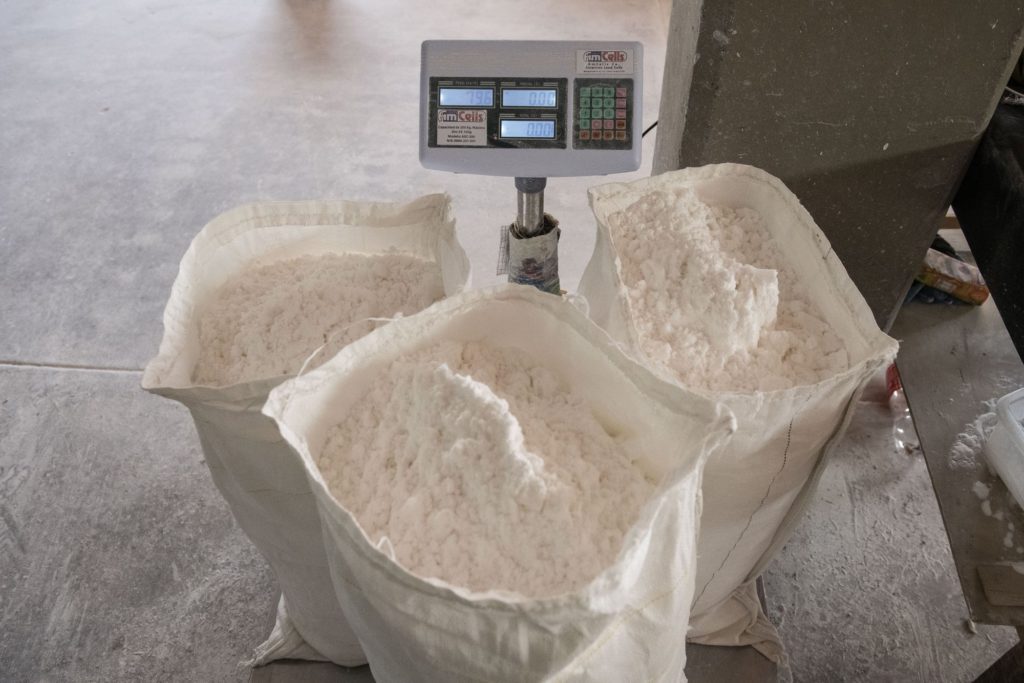

Lithium jumped more than 400% in China over the past year, unnerving Beijing and sparking a flurry of deals from Argentina to Zimbabwe. Battery manufacturers are rushing to secure supplies of lithium — a silvery-white material used in power packs — as EV demand pushes prices higher.

Chinese battery maker Gotion High-tech Co. is looking at cooperating with Argentina’s state-owned miner Jujuy Energía y Minería Sociedad del Estado, while weighing the construction of a lithium carbonate refinery in the region. In Zimbabwe, Chengxin Lithium Group Co. and Sinomine Resource Group Co. are setting up a joint venture to explore for the metal.

“Much of the new developments involve smaller players in China looking to secure resource supply overseas, a strategy that China has employed to gain control of the supply chain,” said Allan Ray Restauro, analyst at BloombergNEF. Nationalization in some countries may pose a risk to that strategy, he said.

Chinese mining giant Tianqi Lithium Corp. is teaming up with battery maker CALB. The companies will invest, cooperate and research in areas including battery-cell production and lithium salt refining, after signing a separate supply deal.

China’s domination of the battery metals industry is also forcing the U.S. and Europe to respond as supply chain woes during the pandemic showed the importance of having materials readily available locally. The Biden Administration has been pushing to accelerate U.S. production of key battery metals, while on Monday commodities trader Trafigura Group announced plans to invest in a new lithium refinery in the U.K.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.