By Brendan O’Brien

(Reuters) – Three small beds, two dressers and baskets full of clothes and other items cram a bedroom shared by three of Dontrael Starks’ children in the family’s Denver, Colorado, home.

Another child, who is autistic, has her own bedroom.

“We are pretty much on top of each other. We’ve just grown out of this house,” the 42-year-old homeowner told Reuters.

He shares a third bedroom with his wife and infant in the house they own. “I’ve tried to get out of my small house. I’ve been trying but it never works.”

Starks, who is Black and whose parents and grandparents faced difficulties of their own caused by housing discrimination, applied for a new city program that offers down payment and other assistance to residents and direct descendants of individuals who lived in a Denver neighborhood that was redlined between 1938 and 2000. On Monday, Denver officials announced Starks was among the first to be approved to get help.

Redlining, which occurred across the United States starting in the 1930s, kept Black Americans and other minorities from getting government-backed home loans because federal bureaucrats had deemed neighborhoods where most residents were non-white unworthy.

Discrimination in lending and other aspects of housing persisted even after fair housing legislation was enacted in 1968.

Neighborhoods to the west and north of central Denver that once appeared on maps crosshatched with red lines as a warning to lenders currently still lag in health, education, transportation and air quality metrics, according to city data.

Across the country, three out of every four areas that were once redlined remain low-to-moderate income today, according to a study by the grassroots network National Community Reinvestment Coalition.

“For far too long, communities of color have been excluded from the American Dream – cut off from the opportunity to invest in a home of their own, to grow wealth through equity, and to hand that wealth down to the next generation,” Denver Mayor Michael Hancock said in a statement Monday.

Denver has dedicated $800,000 to the initial phase of the program providing home buyers $15,000 or $25,000, depending on their income, to use for down payment or closing costs for a home in the Denver area.

Applicants must earn less than $150,000 a year and have a credit score above 640.

Currently 54% of white households and 41% of minority households own their homes in Denver, according to the Denver Office of Economic Development.

Nationwide, 72% of whites and only 43% of Blacks own their home, the largest source of wealth for Americans, the National Association of Realtors https://www.nar.realtor/newsroom/u-s-homeownership-rate-experiences-largest-annual-increase-on-record-though-black-homeownership-remains-lower-than-decade-ago reported.

Some Denver neighborhoods that were once redlined are now in demand by higher-income earners because the homes are relatively affordable in a city where, according to a Federal Reserve index, housing prices have increased six-fold since 1990.

Terri Gentry, a board member of the Black American West Museum & Heritage Center in Denver, noted incomes have not kept up.

“So how in the world are people supposed to be able to afford the cost of housing?” said Gentry, whose family has lived in Denver for generations.

Gentry said she hopes the redlining housing assistance program will help.

“I’ll never give up hope,” she said.

The conversation around redressing the impact of racism, often referred to as reparations, has gained attention following the police killings of George Floyd and other Black Americans in recent years.

“There are historic and current crimes and egregious racial discrimination and other discrimination as it relates to housing in Denver and every other city in America,” said Robin Rue Simmons, executive director of FirstRepair, an organization that informs local reparations efforts.

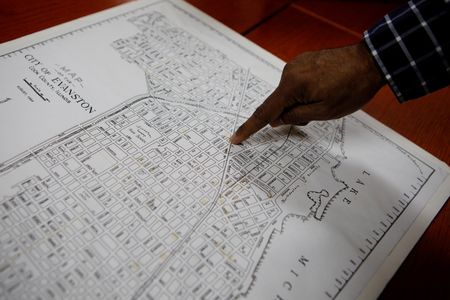

Simmons led an effort in Evanston, Illinois, that resulted in reparation offers to Black residents whose families suffered lasting damage from decades of discriminatory practices in that Chicago suburb.

The first phase will provide up to $25,000 to 16 eligible Black residents for home repairs, down payments or mortgage payments.

“Like the work in Denver, the work in Evanston and every other city in America is one small step of many that need to happen quickly,” Simmons said.

“We are in a state of emergency in terms of our racial gaps and the trajectory of the quality of life and life circumstances, particularly of Black residents.”

(This story corrects first paragraph description)

(Reporting by Brendan O’Brien in Chicago; editing by Donna Bryson and Aurora Ellis)