(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

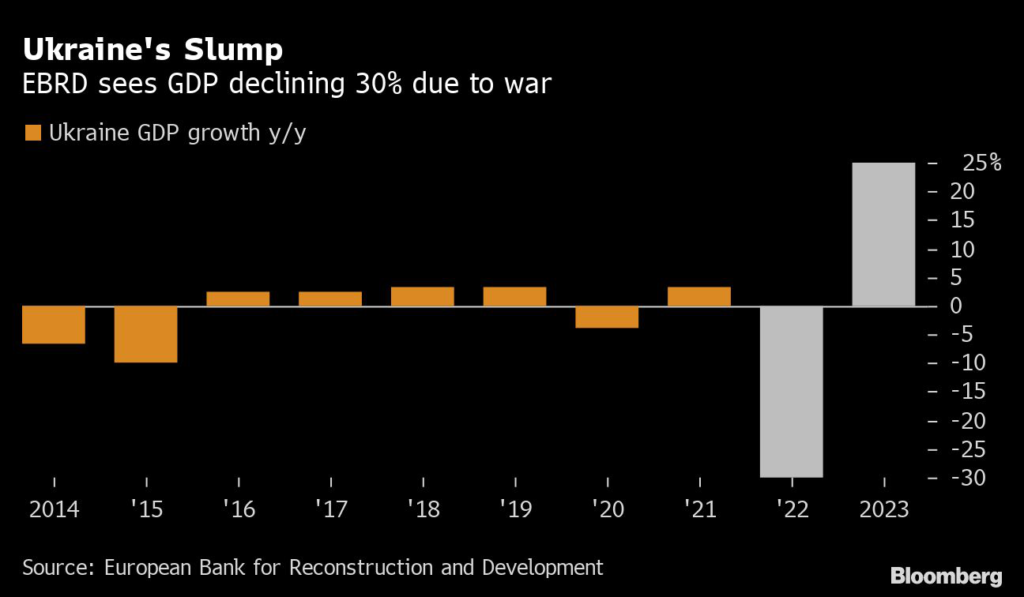

Ukraine’s economy will plunge by almost a third in 2022, more than previously expected, in a scenario in which the war ends this year, the European Bank for Reconstruction and Development said.

The expected downturn is deeper than the 20% contraction the EBRD estimated in March because of a “larger-than-previously-expected contraction in Ukraine as the war drags on,” it said in its report.

Russia’s invasion has upended trade in energy, agricultural commodities and fertilizers and disrupted supply chains, resulting in slower growth across eastern Europe. Gas prices in Europe have risen to historic highs, fueling inflation across the region and putting manufacturers at a disadvantage compared with U.S.-based companies where gas is as much as four times cheaper, the EBRD said.

“Aside from direct war damage, agricultural production is hampered by lack of fuel, access to seeds, fertilizer and equipment,” the bank said in its report. Ukraine, which accounts for almost 10% of global wheat exports, 14% for corn and 37% of sunflower oil, is not expected to be able to plant or harvest up to 20%-30% of its agricultural land.

Speaking in Marrakesh, Morocco, EBRD President Odile Renaud-Basso said the bank would disburse 1 billion euros ($1.1 billion) this year to sectors of Ukraine’s economy that have been hit by the war. The bank is also working to phase out its holdings in Russian companies, she said.

The forecasts assume that a cease-fire will be negotiated this year and reconstruction of the country can begin in 2023, with the economy projected to grow 25% next year.

The war has also revealed vulnerabilities in global supply chains, according to the EBRD. Two Ukrainian companies account for about 35% of the global supply of purified neon, a key component for the manufacture of semiconductor chips.

Russia’s economy is expected to shrink 10% this year and stagnate in 2023, according to the EBRD.

(Updates with comment on investment from EBRD to Ukraine in fifth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.