(Bloomberg) —

TerraUSD, the controversial algorithmic stablecoin, slumped on Wednesday as crypto markets await a rescue led by primary backer Do Kwon.

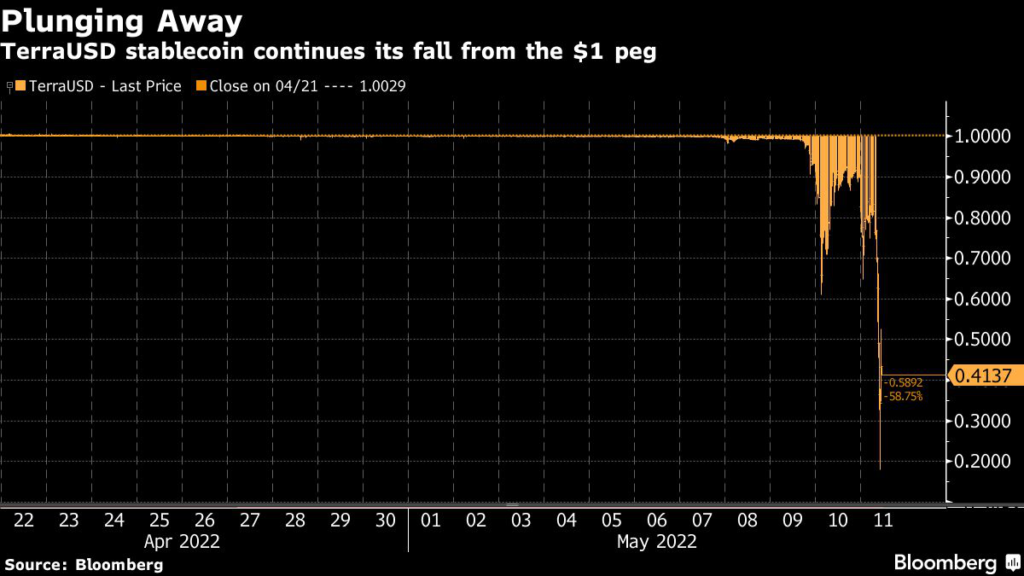

The token fell further from its intended 1-to-1 peg to the US dollar to trade at around 50 cents at 10 a.m. in London, wiping out billions of dollars of value, data compiled by Bloomberg show. Luna, a coin that’s part of the peg mechanism for TerraUSD, tumbled 83% over the past 24 hours, according to CoinMarketCap.

Broader crypto markets showed few signs of getting caught up in the turmoil, with stablecoins like Tether holding their pegs and major tokens including Bitcoin and Ether trading little changed.

TerraUSD’s market value now stands at $7.7 billion, CoinMarketCap data show. It was worth $18.4 billion before crashing from its peg.

The plunge in TerraUSD, or UST, has reignited the debate over algorithmic stablecoins. Over the weekend, the token lost its intended peg to the US dollar, falling to about 99 cents. A wave of selling followed, and by Monday evening UST had hit 60 cents. On Tuesday, following an earlier tweet from Kwon that he was “close to announcing a recovery plan,” the token rallied to around 94 cents.

“The market is displaying a clear lack of confidence in this ship’s ability to right itself,” said Mati Greenspan, chief executive officer of Quantum Economics.

Unlike conventional stablecoins like Tether’s USDT or Circle’s USDC that are backed by real-world highly liquid cash equivalents or dollars, algorithmic tokens are designed to maintain their peg (and investor confidence) through a combination of mathematical equations and active trading. In the case of UST, investors can exchange one unit of the token, no matter what price it’s currently trading at, for $1 worth of Luna. The embedded arbitrage trade helps keep UST at or close to $1, or so the theory goes.

Fadi Aboualfa, head of research at crypto custodian Copper, said in an email that TerraUSD’s complex approach to algorithmic management means a drop was “destined to happen in any significant downtrend.”

“The simplest protocols with a clearly defined economic structure will win,” Aboualfa wrote.

Kwon and a group of investors known as the Luna Foundation Guard had previously issued $1.5 billion in loans denominated in both Bitcoin and UST to external firms in an attempt to support the peg.

(Updates with comment from analyst in fourth paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.