(Bloomberg) — Hedge funds have made a profit of about $1.25 billion on paper by betting against the shares of Danish medical equipment company Ambu A/S over the past year.

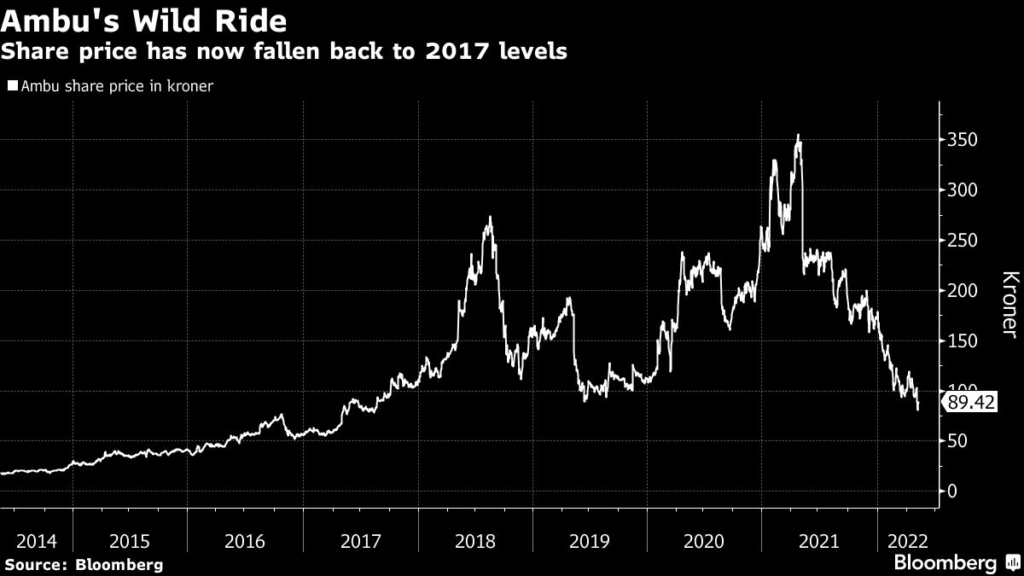

That’s according to an analysis of Ambu’s short interest and share price by S3 Partners. Shares in Ambu — the most shorted company in Europe — fell 70% over 12 months as supply chain problems and a slower-than-expected return of elective procedures in hospitals led the firm to cut its financial outlook four times in less than a year.

S3, a technology and data analytics firm, says investors may further increase positions that stand to gain from a drop in Ambu shares.

“There’s little reason for shorts to exit their positions,” Ihor Dusaniwsky, head of predictive analytics at S3 in New York, said by email. “They’re more likely to continue shorting more shares into a winning trade.”

The health-care supplies company cut its sales and profit forecast last week, blaming fewer hospital procedures amid staffing shortages, as well as rising input costs for its products. The stock fell 21% over the subsequent two days, bringing short sellers’ 12-month mark-to-market profits to $1.25 billion, according to S3.

Shares have fluctuated wildly in the past decade and Ambu has been the subject of aggressive short selling before. S3 gives the firm a so-called Crowded Short score of 92.5 out of 100, the highest among companies in Europe’s Stoxx 600, while it also has the region’s highest short interest as a percentage of its free float, at about 34%, according to S3.

The company’s business case hinges on selling single-use medical products, such as endoscopes that let doctors examine a patient’s digestive tract. The stock soared to a record in early 2021 as the pandemic heightened fears of cross-contamination in hospitals, but has since given up most of the gains.

Ambu’s chief executive officer, Juan Jose Gonzalez, said in an interview last week that a high level of short interest is normal for a growth company. “We know that in a couple of years from now, the company will be more mature and our strategy will be better understood, so this will reduce over time,” he said.

Investors with the biggest short positions in Ambu:

- Marshall Wace 1.72%

- BlackRock Investment 1.39%

- Kintbury Capital 0.97%

- Kuvari Partners 0.95%

- Marshall Wace Asia 0.7%

- WorldQuant 0.6%

- Millennium 0.52%

- RTW Investments 0.51%

- AHL Partners 0.5%

- AQR Capital 0.5%

Source: Danish Financial Supervisory Authority

The last time short interest topped 30% of the free float, in September 2019, the stock rebounded and hedge funds dropped their shorts. But back then, analysts tracking the stock were generally positive, with four out of seven telling investors to buy. Now Ambu has just one buy recommendation out of nine, according to data compiled by Bloomberg.

“For shorts to get squeezed out of their positions we would have to see a substantial uptick in Ambu’s stock price to offset recent short side gains and turn this profitable trade into a losing one,” S3’s Dusaniwsky said.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.