If there is to be any hope of keeping the lights on in the future, then Eskom will have to add 50,000 MW to its energy generation capacity over the next 13 years – that’s more than the whole of the power utility’s present capacity.

Eskom executives were briefing the media on Wednesday with CEO André de Ruyter saying South Africans should not accept load shedding as “the new normal” and that the power utility had implemented load shedding on 32 days this year so far, up from 26 days over the same period last year.

To immediately end load shedding and be able to perform maintenance on its ageing fleet, Eskom would need an additional 4,000 MW-6,000 MW but COO Jan Oberholzer stressed this only solved the immediate power needs of the country and Eskom would need about five times more new generation capacity in the coming years.

Currently, Eskom has 45,000 MW of power generation capacity but over the next eight years it will retire 10,000 MW and by 2023 it will retire nine of its coal-fired power plants, which would amount to 22,000 MW worth of capacity eliminated.

What’s more, Eskom is saddled with nearly R400 billion of debt and to keep up with energy demand it has been burning through diesel reserves for its Open Cycle Gas Turbines.

The expenditure on these has amounted to R6.4 billion for the financial year to the end of March 2022 while in the previous year it was R4.1 billion.

But due to soaring global prices and demand brought on by events like the Russia-Ukraine War, Eskom expects to spend R15 billion or more in the current financial year on running its Open Cycle Gas Turbines.

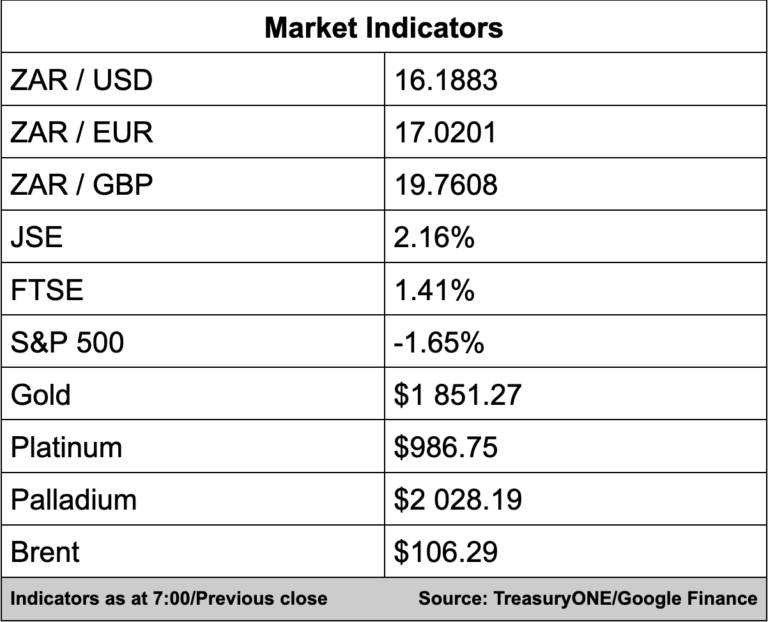

Persistently high US inflation has kept the dollar on the front foot after US CPI grew by 8.3% YoY versus market estimates of 8.1% with the rand weakening to R16.17/$ after the CPI number came out after previously firming to R16.00/$.

“This morning we see increased risk aversion as the Dollar strengthens further, and we have the Rand trading sharply weaker at R16.21,” says TreasuryONE.

Gold, platinum and palladium are trading weaker on the back of the firmer dollar with gold at $1,851, platinum at $984, and palladium is at $2,027.

“Fears of a global recession are weighing on commodity prices,” says TreasuryONE.

Brent crude jumped nearly 6.0% yesterday as the EU ban on Russian oil comes ever closer.

Brent has lost around 1.0% this morning and is trading at $106.30 a barrel.

Here’s a round-up of articles we’re reading:

SA Business

MTN links top executive pay to ESG outcomes, which include upping rural broadband – Fin24

Train wreck: how Transnet derailed SA business – Financial Mail (for subscribers)

Banking ombud reveals significant increase in complaints against banks – Sowetan LIVE

Global Business

Saudi Aramco becomes world’s most valuable company – AFP

Apollo Plans $1 Billion Financing for Musk’s Twitter Bid – Bloomberg

US inflation slowed in April but prices for many goods rising – AFP

Tech

Google Debuts Smartwatch to Rival Apple as It Expand Devices – Bloomberg

Google Is Remaking Search, Maps for the TikTok Generation – Bloomberg

Google’s ‘premium’ Pixel Tablet sure doesn’t look very premium – The Verge

Markets

JSE set to open to mixed Asian markets on Thursday amid stagflation fears – Business Day

Asian stocks down as inflation fears churn markets – AFP

Asian Cryptocurrency Stocks Drop on Fallout From Terra Collapse – Bloomberg