The JSE firmed ahead of the weekend, along with global peers although there are still some turbulent conditions with concerns around tightening monetary policies. US Fed chair Jerome Powell reaffirmed to investors on Thursday evening that the central bank would still raise interest rates by 50 basis points at the next two FOMC meetings.

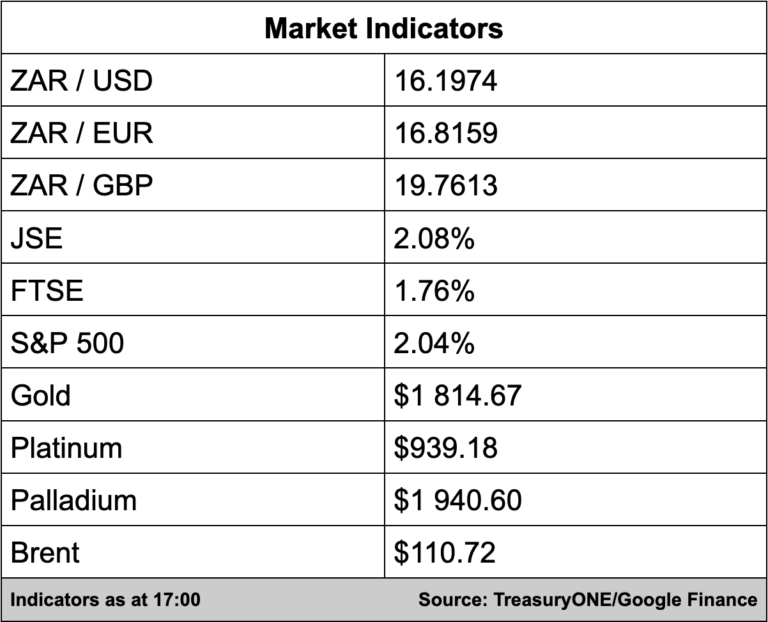

The JSE’s All Share Index ended 2.08% up to 68,650.66 points with Montauk surging 14.55%, Northam adding a whopping 12.80%, and Impala Platinum adding 10.36%.

“Stocks have suffered sharp losses this week, particularly on Wall Street, as investors seek safety also amid the Ukraine war and Chinese lockdowns,” reports AFP.

On the currency front, it was a stable week of sorts for the rand as it floated between the R15.95/$ and R16.30/$ range.

“The rand did trade at more fortunate levels during the morning, but as the theme has been for the most of this week, weakness occurred once the US came into play. We are currently trading just below R16.20, having seen the rand look at trading below R16.00 this morning,” says TreasuryONE.

The forex trading house added, “A positive note on the rand has been that the continued weakness of the euro has not affected the rand as much, but the R16.30 handle is becoming a more important technical level by the day. Looking at other EM’s we see a relatively mixed bag, with the rand is still the weakest since the move into the dollar started in mid-April.”

It has not fared as well on the commodity front this week.

“Gold briefly saw itself trade below $1,800 earlier today but did correct to $1,820 at the time of writing. Palladium is currently up over 2% for the day, but one needs to keep in mind that the metal traded below $1,900 for the first time in a long time. Platinum has not moved much today and closes on $940 this afternoon,” comments TreasuryONE.

It adds, “Looking further down the board, we have seen Copper find support around $9,000 and regained nearly $200 since trading there yesterday. Brent Crude is closing the week on a strong note, gaining 3.1% for the day to trade at $110.50.”