(Bloomberg) — A group of lenders led by Bank of America Corp., Credit Suisse Group AG and Goldman Sachs Group Inc.. faces a narrow path to avoid losses on one of the biggest buyout financings of the past decade. Private credit firms awash with cash can only do so much to help.

The blowout of high-yield spreads in recent months is making it increasingly difficult for underwriters to offload the debt for the take-private of Citrix Systems Inc. to investors at levels close to what they’d committed to when the deal was announced in January. That’s especially true for the riskiest piece of the $15 billion financing, a $4 billion loan that’s expected to be replaced by unsecured bonds.

While private-capital providers such as Ares Management Corp. have taken advantage of the sell-off by snapping up junk-rated debt that public markets have little appetite for, the timing of the Citrix acquisition means that a private credit solution could be trickier to slot into place than for other leveraged buyouts.

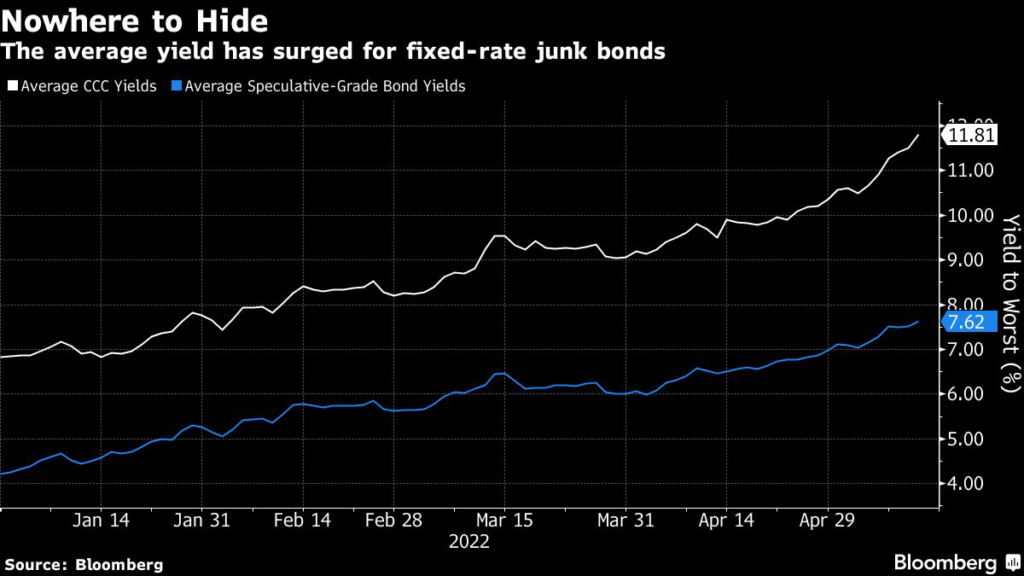

The Citrix financing, which supports Vista Equity Partners and Elliott Investment Management’s purchase of the workspace software maker and its combination with Vista portfolio company Tibco Software Inc., was underwritten at the end of January, when the riskiest CCC rated junk bonds were yielding less than 8%.

The banks agreed to a cap of 9% on the nearly $4 billion unsecured bridge loan, according to people with knowledge of the matter. Last month, a group of private lenders led by Apollo Global Management Inc. made an offer to buy a large chunk of the financing at around the cap, though discussions had mostly focused on the secured piece of the financing, which includes a $7.05 billion term loan and a $4 billion bridge to secured bonds.

But the 9% cap for the unsecured piece is now well below the latest average yield for CCC rated bonds, which on Thursday stood at 11.81%. This means the banks risk having to sell the debt at a steep discount in order to hold the interest of private credit firms — a move that could eat into underwriting fees and even result in outright losses.

In contrast, lenders on the recent $11.2 billion financing for Elliott and Brookfield Asset Management Inc.’s buyout of TV ratings provider Nielsen Holdings Plc had guaranteed a maximum coupon of about 11% on the unsecured portion of that deal, according to the people, who asked not to be identified because the terms are private. An Ares-led consortium swooped in and replaced this roughly $2 billion unsecured bridge facility with a second-lien loan, for an all-in yield of between 9-10%, they said.

This left the two sponsors with a lower cost of capital compared to their worst-case scenario. It also allowed the underwriters to sell the riskiest piece of the financing without any major losses, though they missed out on some fees as is typical when broad syndications are swapped out for privately placed loans.

Representatives for Bank of America, Credit Suisse, Goldman Sachs, Vista, Elliott and Brookfield declined to comment.

In a separate deal, Goldman Sachs’ private credit arm also recently stepped in with an $865 million second-lien loan to help fund Brookfield’s purchase of auto-dealership software business CDK Global Inc. The loan replaced a planned unsecured bond of the same size that was part of a larger $5.9 billion debt financing.

Vista, Elliott and their bankers are still discussing options for the Citrix financing and have so far opted to wait until closer to the deal’s expected closing in June to make a decision.

With only a few weeks to go, the clock is ticking.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.