(Bloomberg) — The creation and redemption of shares in two Terra exchange-traded products issued by VanEck and 21Shares were suspended on Friday as the week’s meltdown in the digital-asset space continued to take its toll.

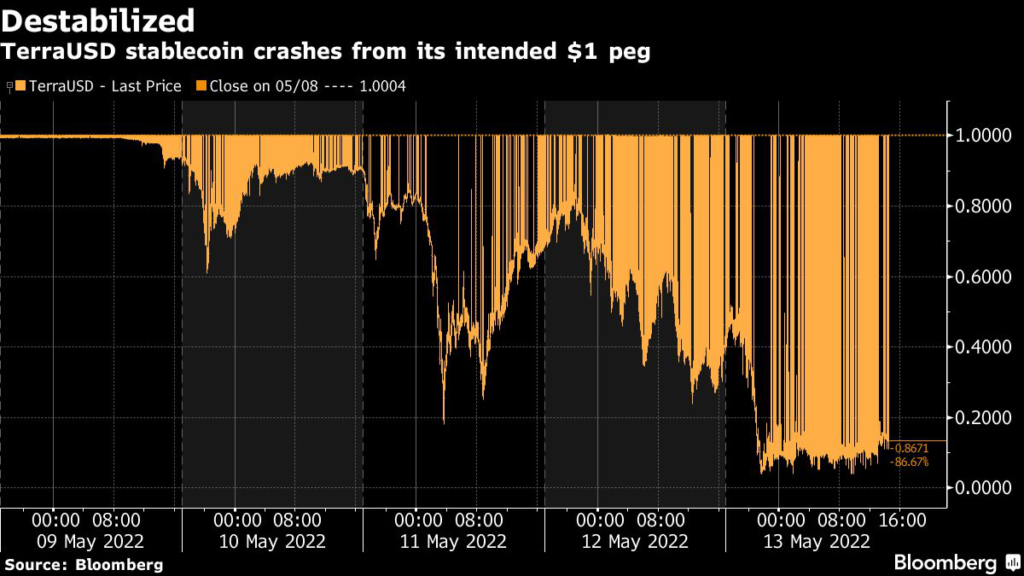

Issuers of the 21Shares Terra ETP (ticker LUNA SW) and the VanEck Terra ETN (VLNA GR) both said the process has been halted for now amid the turmoil facing the TerraUSD stablecoin, which crashed from its US dollar peg on May 9.

Luna, the token that was supposed to help TerraUSD hold the peg, has lost almost all of its value as of Friday, according to CoinGecko.

“We will continue to closely monitor this fast-evolving situation on the underlying,” Hany Rashwan, chief executive officer and co-founder of 21Shares, a crypto ETP provider, said in a statement.

“The Luna network is currently operating intermittently and inconsistently producing blocks and cannot operate normally. Therefore transactions can still be performed but in a disrupted environment.”

Meanwhile, VanEck in a statement said it will do the same.

The company didn’t immediately respond to an emailed request for comment.

“The low value of Luna caused issues and risks for the Terra network which trigger the decision by Terra validators to halt the network,” the issuer said on Friday.

“At this point it is unclear when (and if) the network will be restarted.”

LUNA SW, a crypto ETP domiciled in Switzerland, tracks the investment results of Luna. It tumbled 99% on Thursday, approaching zero, having closed at 22.29 Swiss francs on May 6, before the Terra meltdown.

VLNA GR, an ETP incorporated in Liechtenstein that seeks to replicate the price and yield performance of a digital-asset portfolio that invests in Luna, dropped by a similar magnitude.

“It makes sense to me.

I don’t know what else they’re supposed to do,” said James Seyffart, a Bloomberg Intelligence ETF analyst. “The underlying market is a mess itself. UST and Luna are worthless or at least nearly worthless.

The ETPs are obviously going to have a hard time operating.”

The disruption to the two funds came as an uneasy calm returned to the crypto market, which saw $270 billion of value erased in this week’s meltdown.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.