(Bloomberg) — It turns out that after the Terra stablecoin imploded last week and cryptocurrency prices plummeted, Bitcoin enthusiasts saw some buying opportunities.

Investors added $299 million to products focused on the world’s largest digital asset in the span as Bitcoin tumbled roughly 14%, according to data compiled by CoinShares. Funds focused on Solana, Ether, Polkadot and others, meanwhile, saw outflows.

The flows into Bitcoin suggest investors were flocking to its “relative safety,” wrote James Butterfill, investment strategist at the firm. And the cash infusions are “a strong signal that investors saw the recent UST stablecoin de-peg and its associated broad selloff as a buying opportunity.”

Bitcoin, which spawned the cryptocurrencies industry, is often thought of as the most resilient of digital assets. It’s the oldest, biggest and arguably has the greatest name recognition. In addition, it has a devoted group of fans, who often refer to themselves as Bitcoin maximalists, and who are betting the coin is the currency of the future.

The cash additions came during a rough stretch for digital assets. Charts for cryptocurrencies looked like drawings of waterfalls last week, with prices plunging as the Terra algorithmic stablecoin unraveled. Amid the mayhem, two Terra exchange-traded products — one from 21Shares and another from VanEck — suspended operations.

At its height, the selloff also engulfed the $76-billion stablecoin Tether, which is a key trading transmission vehicle in the crypto ecosystem. And the week saw the highest liquidation volume in Bitcoin futures since December, according to Arcane Research.

“Without question, this is one of the most significant events in crypto history,” said Chiente Hsu, co-founder and CEO at ALEX, a DeFi platform. “I highly doubt we would’ve seen Bitcoin dip below its $28k support level were it not for the contagion of fear Terra created,” Hsu said, citing the coin’s drop last week below that threshold.

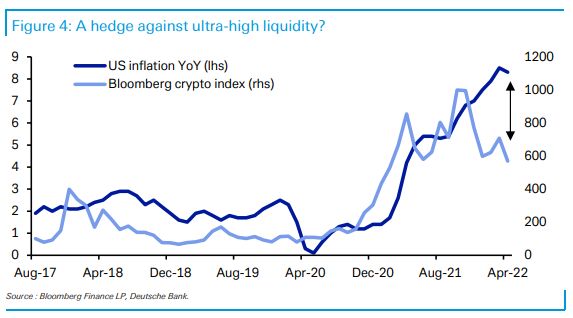

Still, what happened in the crypto market shouldn’t have come as a surprise, according to Deutsche Bank’s Marion Laboure and Galina Pozdnyakova. Cryptos are increasingly correlated to tech and US equities. US stocks also sold off last week, with the S&P 500 losing 2.4% in the five-day stretch through Friday. In addition, the idea that Bitcoin could be seen as a hedge against inflation has been “debunked,” they wrote in a note.

“When Federal Reserve turned hawkish and prospects of higher rates deflated valuations, cryptocurrencies followed suit,” the pair wrote. “In May, they have tanked, despite the latest 8.3% gain in the US Consumer Price Index (CPI).”

Things have calmed down since last week, though Bitcoin is starting the week lower, falling as much as 6.3% to trade at $29,072 on Monday. Other coins have been caught up in the downtrend too, with Bitcoin Cash dropping more than 6% as of 1:50 p.m. in New York, and Solana and Avalanche each also falling.

Scott Sheridan, CEO of tastyworks, says Bitcoin is going through a maturation process. He likened it to periods of turbulence for the stock market, whereby companies were able to establish themselves as sturdy.

“Bitcoin is going through a very similar period right now where it’s being put to the test to see not only if the underlying concept of Bitcoin is viable but also if it can withstand the volatility that can come in a free market,” he said. Still, he added, “I’m also not entirely sure this current phase we’re in is over.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.