The JSE traded a touch firmer on Monday after it slipped into the red during the morning sessions with investors digesting very poor economic results out of China.

The local bourse added 0.82% with the All Share Index up to 69,212 points. Some of the top gainers today included Alphamin (6.95%), Thungela Resources (6.24%), and Barloworld (4.97%).

The losers today were Life Healthcare Group and Karooooo, slumping 4.84% and 4% respectively.

JSE heavyweight Naspers lost 1.97%

Vodacom lost 1.57% despite the telecom giant saying its revenue increased by 4.5% to R102 billion in the 2022 financial year with data traffic and demand for mobile money growing. While Bloomberg reports Vodacom “is mulling a bond issue and will pay a smaller proportion of its earnings in dividends as South Africa’s market-leading wireless carrier looks to finance new growth plans.”

Telecom peer Telkom followed suit, losing 0.08% while MTN and Blue Label Telecom added 0.95% and a health 3.96% respectively.

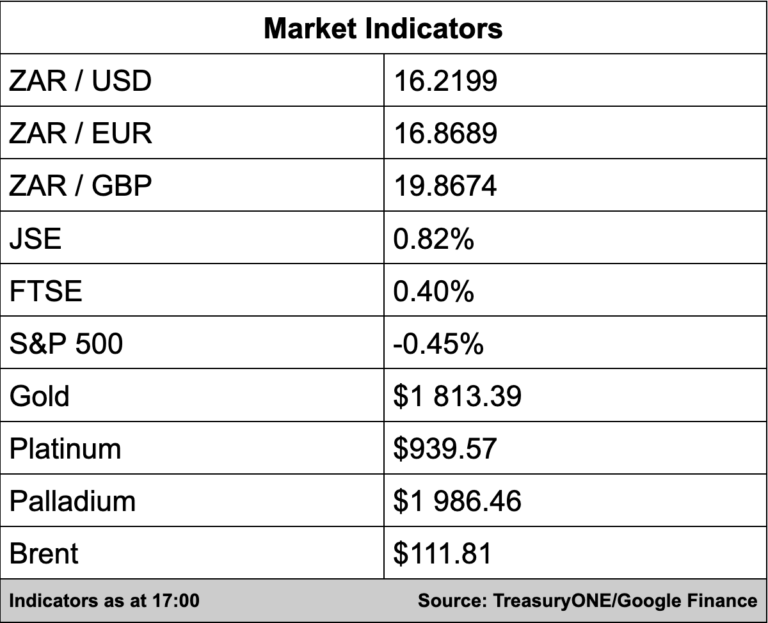

In the currency markets, the rand started the day on the back foot thanks to the Chinese economic data, which put the entire emerging market sector under pressure. The local unit briefly broke above the R16.30 level but the move was short-lived and the rand recovered some of its losses to currently trade at R16.22/$.

“We also had the SARB calling an emergency meeting earlier today to inform the public that UBank is going under curatorship. Worries about any other announcement were quashed, and the rand did not react to the news,” comments TreasuryONE.

The forex trading house adds, “We expect the rand to react to moves in the US dollar until the MPC meeting later on in the week, where we expect some local momentum could come to the fore with the expectation of an interest rate hike on the cards. The question now is whether it will be a 25 or 50 basis point hike.”

On the commodity front, gold briefly broke below the $1,800 per ounce level, but the break was also fleeting, with the yellow metal rebounding back above the $1,800 level and is currently trading at $1,812. Platinum and Palladium are trading at $940 and $1,992 per ounce.

After sustained pressure throughout the day, brent crude is trading higher in the afternoon session at $112.15 a barrel.