(Bloomberg) —

Bitcoin edged above $30,000 on Tuesday in cautious trading as the fallout over a collapsed stablecoin continued to keep sentiment in check.

The world’s largest cryptocurrency rose 2% to about $30,500 as of 9:08 a.m.

in London. Other coins from Ether to Avalanche also posted modest gains.

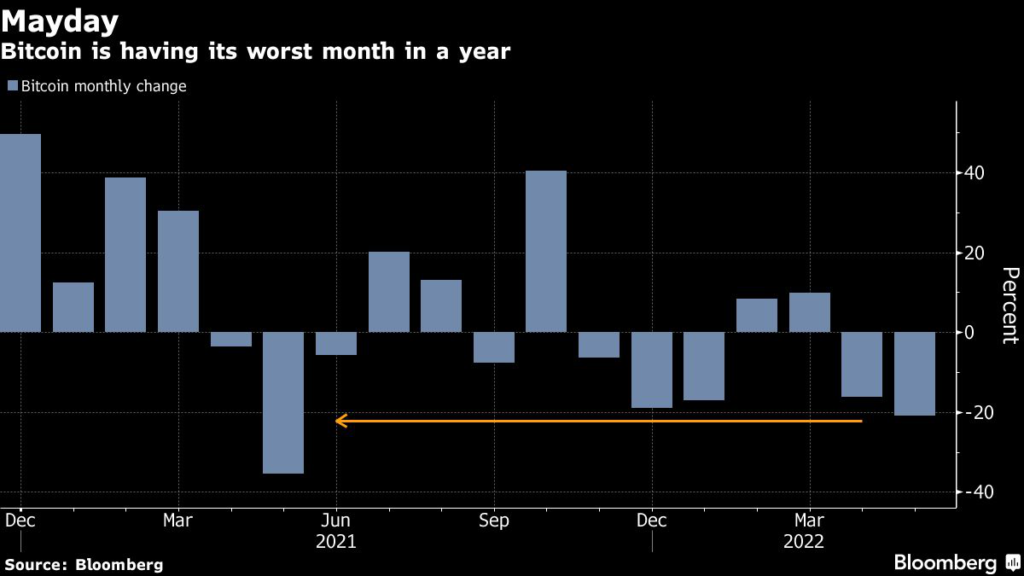

Bitcoin is nursing a 21% loss so far in May — the worst monthly slump in a year — following last week’s crypto sector turmoil over the collapse of the TerraUSD algorithmic stablecoin, also known by its ticker UST, and Tether’s brief dip from its dollar peg.

“Small amounts of dip buying tentatively gave Bitcoin a boost, but too much of the retail and institutional world still have massive wounds from the recent collapse,” Edward Moya, senior market analyst at Oanda, wrote in a note.

The stablecoin drama has spurred debate about the future for digital assets and the lessons to learn from the collapse of the Terra ecosystem.

Stablecoin “regulation seems likely” and could lower risk, Goldman Sachs Group Inc.

strategists Isabella Rosenberg and Zach Pandl wrote in a note. An alternative “government-backed medium” may even displace them, they said.

Investors have fled from cryptocurrencies and stablecoins alike since the crash began.

The total circulation of Tether, the largest and most systemically important stablecoin, has dropped by more than $7 billion since May 7 when Terra’s de-peg became apparent, data from CoinGecko show.

Though TerraUSD and Tether’s stablecoins operate differently, the subsequent drop in Tether’s own dollar-peg to 96 cents on May 12 triggered a wave of redemptions, prompting regulators to question whether such assets are suitable for mainstream adoption.

During the fiasco, Tether said it would continue to honor redemptions of USDT at a one-to-one value on its own site, while exchanges were beholden to the token’s actual market value at the time.

“The after effects of UST’s collapse could be felt for a long time and will likely expand regulatory oversight of the stablecoin space,” said blockchain data provider Kaiko in a Monday research note.

The tokens aren’t ready to be used by consumers to make payments, Rohit Chopra, director of the U.S.

Consumer Financial Protection Bureau, added in a Bloomberg Television interview.

On-Chain Data

The tick higher in Bitcoin prices has been accompanied by slightly brighter signs from blockchain trends, according to Darshan Bathija, chief executive officer and co-founder of Singapore-based crypto exchange Vauld.

On-chain data show the number of addresses holding between one to 10 Bitcoins has increased from 689,000 to 694,000 between May 9 and May 19, an “indication of confidence in the cryptocurrency’s recovery,” Bathija said.

The total market value of virtual coins has dropped about $420 billion dollars this month to $1.36 trillion, according to CoinGecko data.

Bitcoin is 56% off its record high from November last year.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.