Get ready for a massive fuel price increase next month, which will hit our wallets like a runaway freight train.

The Automobile Association (AA) is predicting huge increases across the board, with a litre of petrol likely to cost R3.47 more than at current levels.

The latest estimates predict an increase of between R1.93 and R1.97 a litre for petrol in the first week of June, while diesel is expected to rise between R1.60 and R1.62 a litre.

Adding to our woes is the return of the full general fuel levy (GFL) of R1.50, which government suspended two months ago but that temporary reprieve is set to lapse at the end of May.

The AA has said the combination of fuel price increases and the return of the GFL has been driven by international oil prices and the rand versus US dollar exchange rate.

The motoring body believes the increases will result in “price shocks never seen before.”

The AA said the big question now is what government intends to do to help cushion the blow for consumers, given the prediction that baseline prices are expected to rise significantly in June.

But analysts have warned there is little the government can do to curb rising costs given it is being driven by outside factors.

And the knock-on effect of a fuel price increase has implications for other costs of living expenses as economist Bonke Dumisa notes while speaking with EWN.

Dumisa says the rising fuel price is likely to push the consumer price index up, which would make it more expensive to pay for home loans and other products.

Meanwhile, business owners have denounced the hefty increase with Vukile Nkosi, owner of an Engen fuel station in Johannesburg, saying he was likely to sell less litres, meaning his profitability would go down.

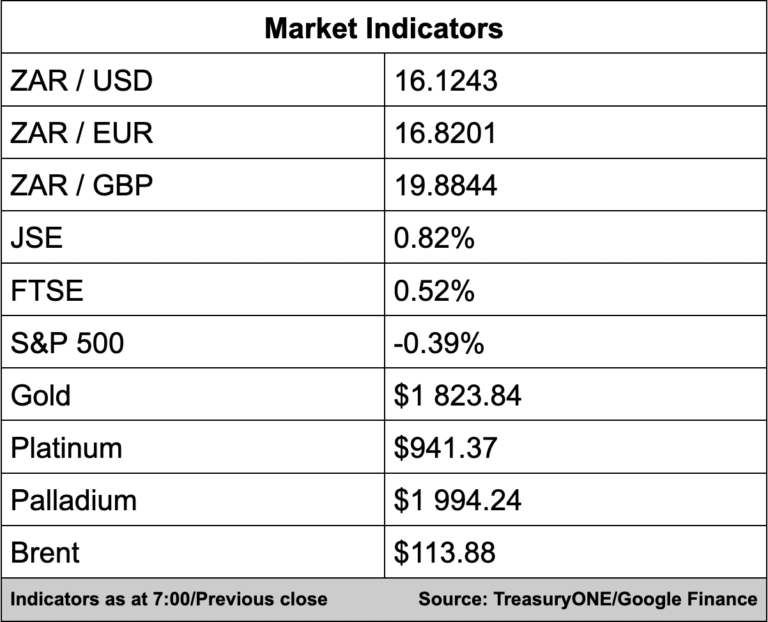

In the currency markets, the rand weakened significantly yesterday morning, breaching the R16.30/$ level at one point before closing at R16.16/$ last night.

This morning the local unit is trading firmer at R16.08/$ with the dollar slipping further on the back of news China is easing some of its Covid restrictions in Shanghai.

Precious metals were on the back foot for most of the day yesterday will this morning gold and platinum are trading unchanged at $1,824 and $946 respectively.

Palladium has given up some of its gains to be trading at $2,009.

Brent crude rallied to close at $114.24 as some Russian oil seems to be getting through the European embargo. Both Brent and WTI are trading relatively flat this morning at $114.00 and $113.90, respectively.

Here’s a round-up of articles we’re reading:

SA Business

Power grid unreliable & unpredictable, says Eskom as it battles to keep power on – EWN

SARB Governor, Kganyago places U-Bank under curatorship – SABC

Second union announces plans to strike at SARS – Fin24

Global Business

Fliers splurge on most expensive seats as travel restarts – Daily Maverick

White House hits back after Bezos knocks Biden on economy – AFP

SpaceX Employees Offer to Sell Shares at $125 Billion Valuation – Bloomberg

Tech

Twitter CEO explains why finding bots in a random sample of 100 users won’t work.

Elon Musk replies with poop emoji. – Business Insider

Hacker Shows Off a Way to Unlock Tesla Models, Start Engine – Bloomberg

Musk Says Twitter Deal at Lower Price Is ‘Not Out of the Question’ – Bloomberg

Markets

Asian stocks up after Wall Street dip on China’s Covid-bruised data – AFP

Dollar knocked from 20-year high; yuan slide pauses – SABC

ECB to hike deposit rate 25 bps in July, ditch negative rates by end-Sept – SABC