Elon Musk looks to be getting a bout of cold feet with his impending marriage to Twitter on the rocks after the billionaire questioned the company’s claim that less than 5% of users on the platform are bots and threatened to pull the $44 billion sale unless the claim could be verified.

But is his latest attack against the bluebird social media network a negotiating tactic to lower the buying price or an excuse to abandon the deal?

Barron’s reports the market is increasingly losing confidence that the Tesla and Space X CEO will buy the company for the agreed-upon $54.20 a share.

Musk could be looking to pay a lower price for Twitter if the public claims surrounding bots cannot be proven or he could look to leverage a position where he can walk away from the deal and pay the $1 billion breakup fee if the deal isn’t completed.

That fee would hardly make a dent in Musk’s net worth, estimated to be over $200 billion, making him the wealthiest man in the world.

Analyst Dan Ives told CNN that there is a “60%+ chance from our view Musk ultimately walks from the deal and pays the breakup fee.”

Meanwhile, the Twitter board, for its part, has unanimously recommended that shareholders approve the deal while seemingly threatening some sort of legal action as the board seeks to rid itself of the company and enforce the deal with Musk.

A statement from the board, released on Tuesday evening, said, “The Board and Mr Musk agreed to a transaction at $54.20 per share.

We believe this agreement is in the best interest of all shareholders. We intend to close the transaction and enforce the merger agreement.”

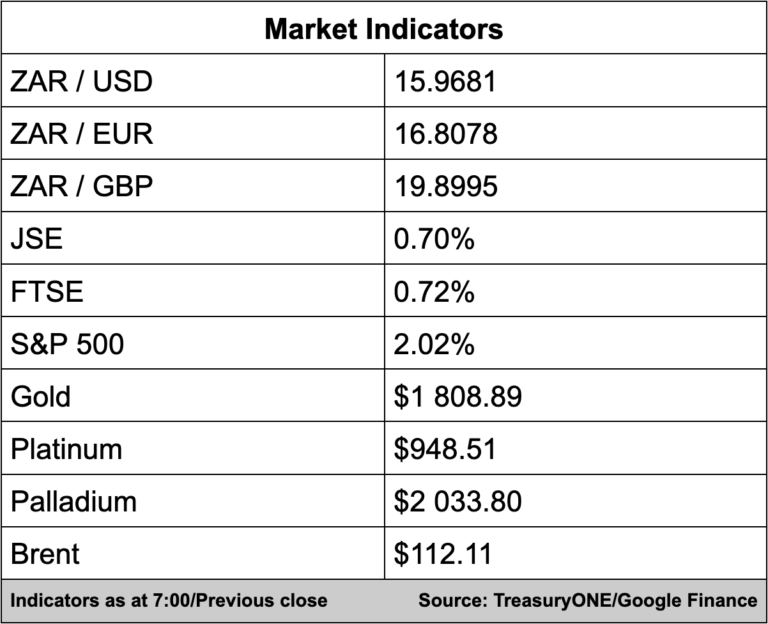

In the currency markets, the rand closed 1.7% stronger against the dollar as the US currency fell sharply against euro and pound.

“The pound was boosted by good employment data, which opens the way for the BOE to hike rates further, while reasonably hawkish comments from the ECB helped the euro,” says TreasuryONE.

The rand is trading marginally softer at R15.95/$ this morning on a slight recovery in the dollar.

“Traders will keep a close eye on today’s local CPI data, with economists expecting inflation to have increased by 0.6% MoM and by 5.9% YoY.

The market is expecting the SARB to hike rates by 50bps at tomorrow’s MPC meeting,” comments TreasuryONE.

It was a quiet day for commodities yesterday with gold softening slightly, but both platinum and palladium ended marginally stronger.

This morning gold is trading at $1,810, platinum at $951, and palladium at $2,038.

Brent is trading firmer at $112.40 a barrel, having closed over 2.0% weaker yesterday.

Here’s a round-up of articles we’re reading:

SA Business

Flight cancellations avoided as OR Tambo secures 20m litres of jet fuel – Fin24

Here is who really owns Vodacom – MyBroadband

Grocery delivery race heats up, Pick n Pay partners with Takealot (Mr D) – EWN

Global Business

Nasa and Boeing planning second uncrewed test flight of latter’s spacecraft for this week – Engineering News

Flight data shows China Eastern jet deliberately crashed: report – AFP

Retail data shows US consumer resilience as costs hit Walmart – AFP

Markets

Asian markets mixed after US retail data boosts Wall Street – AFP

Euro and sterling helped by improved market sentiment – SABC

The dollar and euro are on the verge of parity for the first time in 20 years — and it could happen within a month – Business Insider

Tech

Naspers Foundry invests R40 million in agritech startup Nile – Fin24

Getty Images is going to sell its iconic pics as NFTs – Fin24

China Economy Czar Vows to Back Tech Firms After Crackdown – Bloomberg

Picture: Elon Musk, Credit: Daniel Oberhaus (2018)