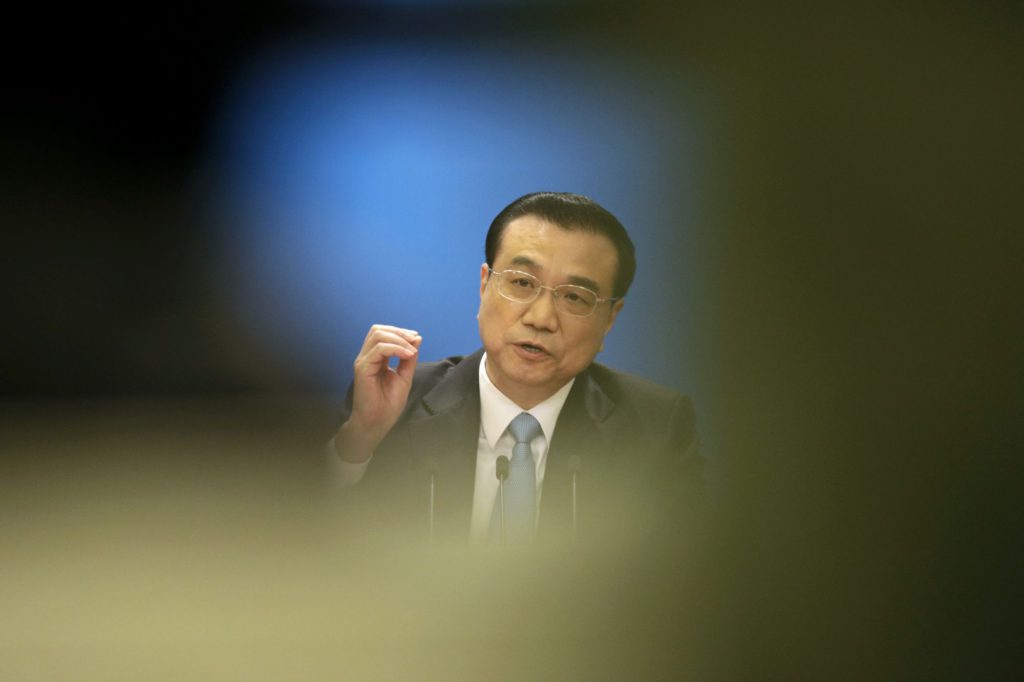

(Bloomberg) — Chinese Premier Li Keqiang told local governments to “act decisively” on measures to support growth in the coming weeks in an effort to bring the economy back on track as soon as possible.

Everyone should “add a sense of urgency” to their actions to counter “further intensified new downward pressure” on the economy, Li said Wednesday during a trip to Yunnan province in southwestern China, according to a report in the official Xinhua News Agency.

He encouraged local authorities to roll out new measures this month if possible, adding that policies outlined in this year’s government work report or in prior economic meetings should be enacted by the end of June.

Li’s focus on moving quickly in the next couple of months implies that policy makers “might want to leave room for additional fiscal policy support in the second half of the year,” according to Goldman Sachs Group Inc. economists including Maggie Wei. They wrote in a report that the government could consider the issuance of central government special bonds, a form of extra stimulus that Beijing has rarely resorted to unless for specific purposes, such as the fight against the pandemic in 2020.

The Chinese premier also reiterated support for digital platform companies and their public listings, echoing comments made by Vice Premier Liu He earlier this week that provided another sign Beijing may be ready to let up on a yearlong clampdown on technology firms.

Li’s comments are the latest from senior government officials urging more action to shore up economic growth this year after Covid outbreaks and lockdowns walloped economic activity in March and April. Data this week showed China’s industrial output and consumer spending last month slid to the worst levels since the pandemic began, while the jobless rate climbed to 6.1%. Youth unemployment hit a record.

Read More: China’s Economic Activity Collapses Under Xi’s Covid Zero Policy

Those challenges are making Beijing’s full-year economic growth target of about 5.5% seem further out of reach, and analysts have been skeptical that the government can achieve that goal while also sticking to Covid Zero. Goldman economists just cut their growth forecast for the year to 4% from 4.5%, citing the zero-tolerance policy.

Achieving growth and stabilizing employment might still be challenging to policy makers in the third quarter, especially ahead of the 20th Party Congress later this year, the Goldman economists wrote late Wednesday. That’s when President Xi Jinping is widely expected to seek a historic third term in office.

Even so, Li said China still has enough policy room to deal with the growing headwinds facing the economy, citing stable consumer prices and a measured approach from China toward easing. The People’s Bank of China hasn’t been aggressive with its approach to monetary policy this year, having only cut its policy interest rates once in January and reducing the reserve requirement ratio, the amount of money banks have to hold in reserve, a single time.

Li also said at the Yunnan meeting that steps would be taken to stabilize land and property prices to ensure the healthy development of the property market. Reasonable housing demand would be supported, he said, according to Xinhua. The central bank cut mortgage rates for first-time homebuyers on Sunday.

(Updates throughout with additional details and comments from Goldman Sachs economists.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.