The JSE gave up 1.40% on Thursday while global peers traded down as the effects of higher prices on earnings in the US and further monetary policy tightening on economic growth weighed heavily on traders’ minds.

The local bourse sank two per cent in morning trade following heavy losses during the Asian trading session and on Wall Street.

Europe’s main stock markets also opened sharply lower on Thursday.

Following a meeting of the Reserve Bank’s monetary policy committee, it was decided that South Africa’s repo rate would be increased by 50 basis points to 4.75% – the largest increase since January 2016.

Four members out of five voted for the increase while the other voted for a 25 basis point hike. The prime rate increases to 8.25%.

“The vote was based on more inflation pressure, especially on fuel and food prices.

The 50bps point hike helps the rand carry trade attractiveness, and we did see the rand strengthen after the announcement, although the market did price for the hike,” comments forex trading house TreasuryONE.

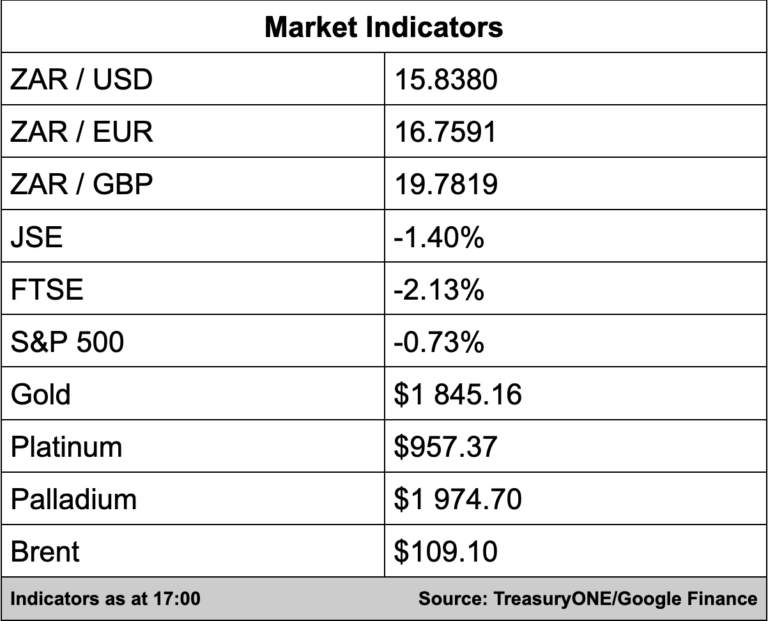

The rand made its way down to the R15.77/$ mark following the announcement but has since given up some of those gains and is currently trading at R15.85/$.

A weaker dollar also added to the momentum while it remains to be seen whether the dollar weakness will hold.

On the commodity front, it was a mixed bag with gold and platinum doing well while palladium and brent lost some momentum.

Gold is 1.5% stronger on the day and currently trading at $1,843 per ounce.

Platinum is at $957 per ounce, and palladium is at $1,976 per ounce. Brent threatened to break below $105 a barrel but has since traded slightly higher at $108.62 a barrel, says TreasuryONE.

In JSE-listed company news, Naspers slipped 0.82% while Prosus found greenery before the close to add a slim 0.21% after Tencent gave up a further 6.51% during trade in Hong Kong against the backdrop of poor earnings results and a government crackdown.

Prosus owns a 29% stake in Tencent.

Retailer Massmart (-6.89%) reported a 0.2% fall in its sales, which came to R30.4 billion for the 19 weeks up to May 8, said the company in a trading update.

Subsidiaries Game and Builders saw declining sales but Makro saw growth of 6.7% compared to the same period in the previous year.