The world has become accustomed to soaring costs and regular increases in interest rates from central banks, and South Africans should be prepared for yet another interest rate hike today when the SA Reserve Bank announces the decision of its monetary policy committee (MPC) meeting.

South Africa’s consumer price index came in at 5.9% yesterday, unchanged from March but seemingly galloping past the 3%-6% target range that the Reserve Bank monitors closely and the response from the MPC is likely to be hawkish as it seeks to get a grip on inflation.

The expectation is that the MPC will announce a 50-basis point hike, says a senior economist at BNP Paribas South Africa, Jeff Shultz, as the Reserve Bank looks to get inflation to fall back towards 4.5%.

A 50-basis point increase would be the largest since January 2016.

“While high levels of uncertainty and a weak South African economy suggest that the decision is unlikely to be unanimous, we expect a stronger majority (4:1) than before to be in favour of front-loading hikes,” says Shultz.

The Bureau for Economic Research (BER) cites “rapid policy normalisation and the associated recent sharp weakening of the rand-dollar exchange rate, as well as the sustained upside risks to domestic inflation” as some of the factors for the increase.

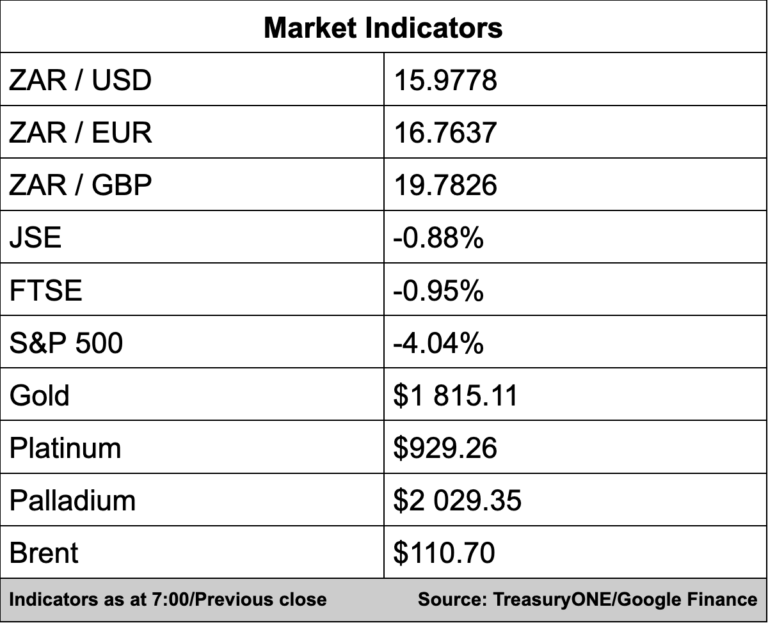

In the currency markets, the rand broke out of its narrow range with the market turning bearish towards riskier assets with a massive sell-off in the US equities market, says TreasuryONE.

This morning the rand is trading at R15.97/$ after it touched R16.08/$ overnight.

The market has mostly priced in a 50-basis point hike, “Anything less than that, one can expect the rand to trade at vulnerable levels and perhaps have another stint back above R16.20,” comments TreasuryONE.

On the commodity front, gold is trading flat this morning at $1,813, platinum is down 0.8% while palladium is up 0.5%. Brent crude prices were on a rollercoaster ride yesterday closing just above the $108 mark, today it has gained 1% and is currently trading at $110 a barrel.

Here’s a round-up of what we’re reading:

SA Business

Office and retail sparkle in South Africa, Investec says – BusinessTech

South Africa moves ahead with plan to launch own satellite – Fin24

Godongwana: Ubank had enough time to devise action plan, but couldn’t make it work – Fin24

Global Business

Age of scarcity and higher prices begins – BusinessTech

G7 finance ministers to thrash out Ukraine aid plan – EWN

Google is filing for bankruptcy in Russia – Mashable

Markets

Oil Up as Economic Growth Worries Continue – Investing.com

Asian shares tumble as global growth fears mount – SABC

Wall Street ends sharply lower as Target and growth stocks sink – SABC

Tech

Tencent Leads China Tech Selloff as Earnings Worries Mount – Bloomberg

China now world’s 2nd-biggest bitcoin miner after activity bounced back from government’s crackdown – Business Insider

North Korean scammers are posing as American job candidates to infiltrate crypto startups, recruiters say – Business Insider