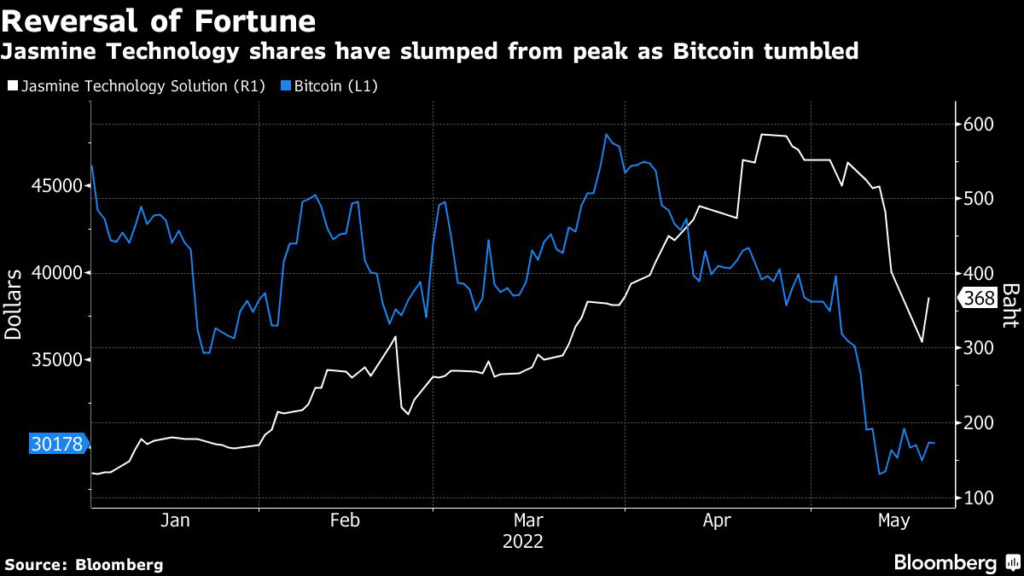

(Bloomberg) — For Thailand’s market authorities, the rout in Bitcoin has been one of the few tools to cool down the once-unstoppable Jasmine Technology Solution Pcl.

The telecom-turned-crypto company has lost more than a third of its value in the past month, cutting its market capitalization to 260 billion baht ($7.6 billion).

That tumble also pared the wealth of its seven biggest individual shareholders, who had enjoyed earlier gains after the firm unveiled a plan in July to expand into Bitcoin mining.

“The only frenzy has been from the company’s claim to be the pioneer of the Bitcoin-mining business in the country and region,” said Jitra Amornthum, an analyst at Finansia Syrus Securities Pcl.

“That appeal has evaporated with the slide in Bitcoin.”

The Securities & Exchange Commission in February urged Jasmine Technology’s shareholders to make a “careful study and decision” of an independent financial adviser’s call to reject the company’s mining plan.

The investment was ultimately approved in spite of the recommendation.

Recent downturns in crypto exchanges and currencies including Bitcoin highlight the vulnerability of new fortunes, such as those of Jasmine Technology’s front-runners.

The company, based just outside Bangkok, rode the digital-asset wave to become the 10th most-valuable company on the Stock Exchange of Thailand, prompting the bourse to halt trading in the stock for a day in April, citing a rally “without fundamentals.”

The stock has also been hit by concerns about the regulatory environment, with Thailand banning the use of crypto for payments in March.

The biggest paper loss has been to the fortune of Pete Bodharamik, who controls the parent company, broadband-network provider Jasmine International Pcl, founded by his father.

Pete holds no official role in either, as he was forced to resign in 2019 after being found to have traded shares of the company, then known as Jasmine Telecom Systems, using non-public information.

His stake has dropped below $1 billion since reaching a peak on April 22.

Pete, 49, said he is unfazed by the drop.

“JTS’s target is to become the largest Bitcoin mining company in Southeast Asia,” he said in an email. He said cryptocurrencies and blockchain technology are key to fintech and the metaverse.

Another six shareholders have seen the value of their stock drop by about $1.3 billion in the same period.

* Stake values as of May 19

The firm, whose net income more than doubled in the first quarter, said in its quarterly report that it aims to boost the proportion of revenue it makes from mining to 80% by late this year from less than 1% in 2021.

Crypto-related activities accounted for about 5% of revenue in the first quarter.

Jasime Technology remains under scrutiny. The stock was suspended again on Friday, the second suspension in a week, with the SET citing “abnormality” in its trading.

The paper losses of Jasmine Technology’s top shareholders pale in comparison to hits taken by some digital-asset entrepreneurs elsewhere.

Coinbase Global Inc. founder Brian Armstrong has seen his fortune plummet more than $11 billion to $2.2 billion in six months. Michael Novogratz, CEO of crypto merchant bank Galaxy Digital, also lost $6 billion in his fortune.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.