(Bloomberg) — The implosion of the algorithmic stablecoin TerraUSD and its sister Luna token sent shock waves through the cryptosphere, crashing prices and roiling the entire ecosystem behind the coins.

The fallout reached across geographies, too.

Stader Labs, based in Bengaluru, India, is among the many crypto startups that were engulfed by the crisis.

Stader, backed by investors including Three Arrows Capital, had built a lucrative business providing a platform for so-called staking, where holders allow their tokens to be used to help order transactions on a blockchain in exchange for earning yield.

Before the crash, almost all of that business came from the Luna coin, which like TerraUSD ran on the Terra blockchain and reached an all-time high in early April.

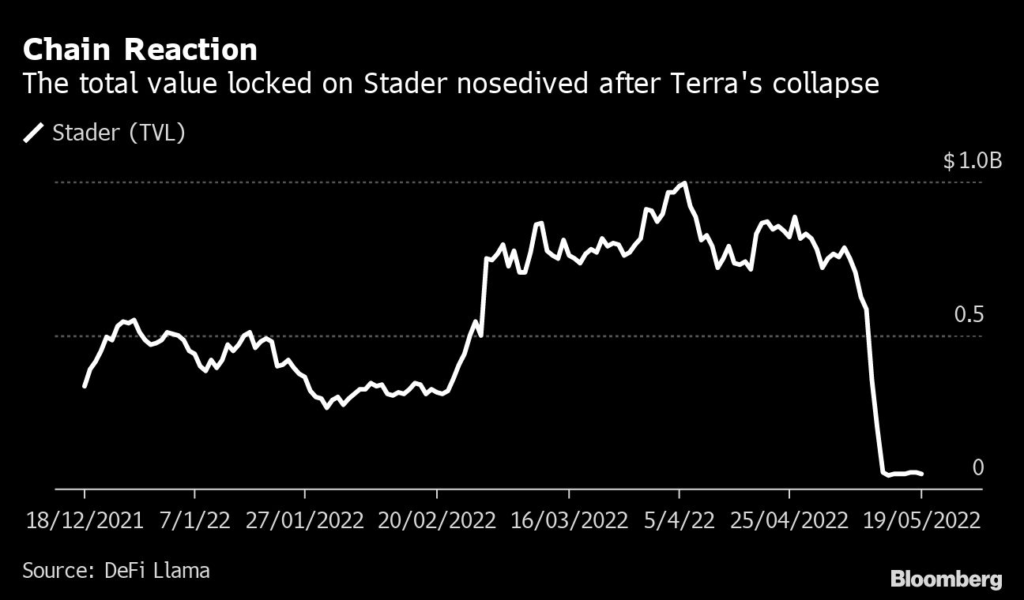

When TerraUSD (UST) collapsed from its intended 1-to-1 peg to the dollar this month and dragged Luna down with it, the impact on Stader’s business was swift.

The total value locked on its protocol has dropped to $50 million from about $750 million just before the event, data from industry tracker DeFi Llama show.

“We had a 40% hit on revenues,” co-founder and Chief Executive Officer Amitej Gajjala said in a text message.

Stader’s monthly fees from its protocol had reached $6.3 million before the crash, he said.

Gajjala’s experience highlights the hazards that lurk in the decentralized-finance space, where crypto holders borrow, lend and stake coins without intermediaries like banks.

Because of the nature of its link with UST, the price of Luna has fallen close to zero, causing staking of the coin on platforms like Stader to evaporate.

To some extent, the Terra implosion also underscores the crypto sector’s ability to quickly pivot after a big shakeout.

Stader is already in rebuilding mode, Gajjala said.

Having started in April last year entirely focused on the Terra ecosystem, it began expanding into rival blockchains like Fantom, Polygon and Hedera shortly before the UST crisis — a process Gajjala is now accelerating.

The company will soon roll out staking on Ethereum, Solana, Cosmos and Near.

There’s a long way to go. Stader now has about $50 million of total value locked on Hedera, according to DeFi Llama.

While DeFi Llama doesn’t show equivalent data for Fantom and Polygon, Stader’s website says it has $3.6 million and $2.4 million staked on the two ecosystems, respectively.

Luna’s market value has dropped to about $840 million from more than $20 billion before the TerraUSD collapse, according to data from CoinGecko.

UST has lost roughly $17.5 billion in value since crashing from its peg.

Gajjala said his startup has enough cash to weather the storm. Stader has raised more than $40 million since its inception, enough to last for more than 10 years, he estimated.

In January, the Economic Times reported that Stader had raised $12.5 million in a funding round led by Three Arrows that valued it at $450 million.

As for the lessons learned from UST’s flameout and the collapse of the Terra blockchain, Gajjala offers a reasonably upbeat view.

He’s still waiting for more details from Terra’s backer Terraform Labs on how the UST crash unfolded, and expressed optimism about Terra founder Do Kwon’s proposal to revive the blockchain.

The ecosystem could be rebuilt if Terraform Labs can retain its community of developers and users, he said.

“Algo stablecoins in current form and shape might not be the sustainable way in the short run,” Gajjala said.

“In the long run there is scope for decentralized stablecoins, collateralized or algorithmic.”

(Updates with a comment from the co-founder in the penultimate paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.