(Bloomberg) —

Climate change, cost-of-living pressures and cryptocurrency regulation are among the policy issues Australia’s new Prime Minister Anthony Albanese should have at the top of his agenda, according to market watchers.

Albanese takes control at a time when households are feeling the pinch of accelerating inflation. He’s also facing calls for more aggressive climate action. With the possibility that his Labor Party could fall short of a majority in the lower house of parliament of 76 seats, he’ll likely need to negotiate with the Greens party and a slew of climate-warrior independent lawmakers who want more ambitious targets.

Here’s what analysts are expecting from the government under Albanese:

David Bassanese, chief economist at BetaShares:

- The government needs to provide more clarity on climate change policy, as well as tax and investment incentives “to promote Sydney as a leading Asian financial hub as a rival to Hong Kong”

- The government should focus on economic decentralization and development to address housing affordability issues in major cities

Caroline Bowler, chief executive officer of BTC Markets:

- The government is expected to continue work that’s already started around cryptocurrency regulation

- For the crypto market, “the primary concern would be to put together the appropriate regulatory regime for the marketplace, but also to leave room for innovation”

- “There is a real opportunity for the government to assist with innovation and support it, relating to the significant role that financial services play in the Australian economy, but also its position globally”

Su-Lin Ong, head of Australian economic and fixed-income strategy at Royal Bank of Canada

- The likelihood that a Labor government increases spending will have an impact at the margin on RBA policy and therefore on markets

- “This keeps pressure on the RBA to continue to normalize policy and move toward neutral sooner rather than later. This has more mixed longer-term implications for markets all else being equal -– slightly positive for the Australian dollar and marginally negative for bonds”

Craig James, chief economist at CommSec:

- With the job market continuing to tighten, a priority of the new government will need to be on measures to expand labor supply and broader economic capacity issues

- The electorate will also be keen to see what measures the government will employ to address cost-of-living issues

Chris Nicol, equity strategist at Morgan Stanley:

- The government will need a bolstered climate agenda to placate independents and Greens, and “we would look for policy that drives faster adoption rates from both consumer and business in the first instance”

- “Labor will inherit a recent strengthening of defense-linked ties with Western allies, as well as a challenged relationship with its key trade partner in China. Ideological differences will sustain a persistence of friction, but also investors should be on watch for any off ramps a new government and conversation could bring”

Matt Ingram, Bloomberg Intelligence analyst:

- Australian banks are more likely to reach their A$215 billion ($152 billion) renewable finance target following Albanese’s win

- The rise of climate-focused independents may make the execution of Labor’s A$47 billion green investment commitment over the next decade more of a priority

Shane Oliver, head of investment strategy at AMP Capital:

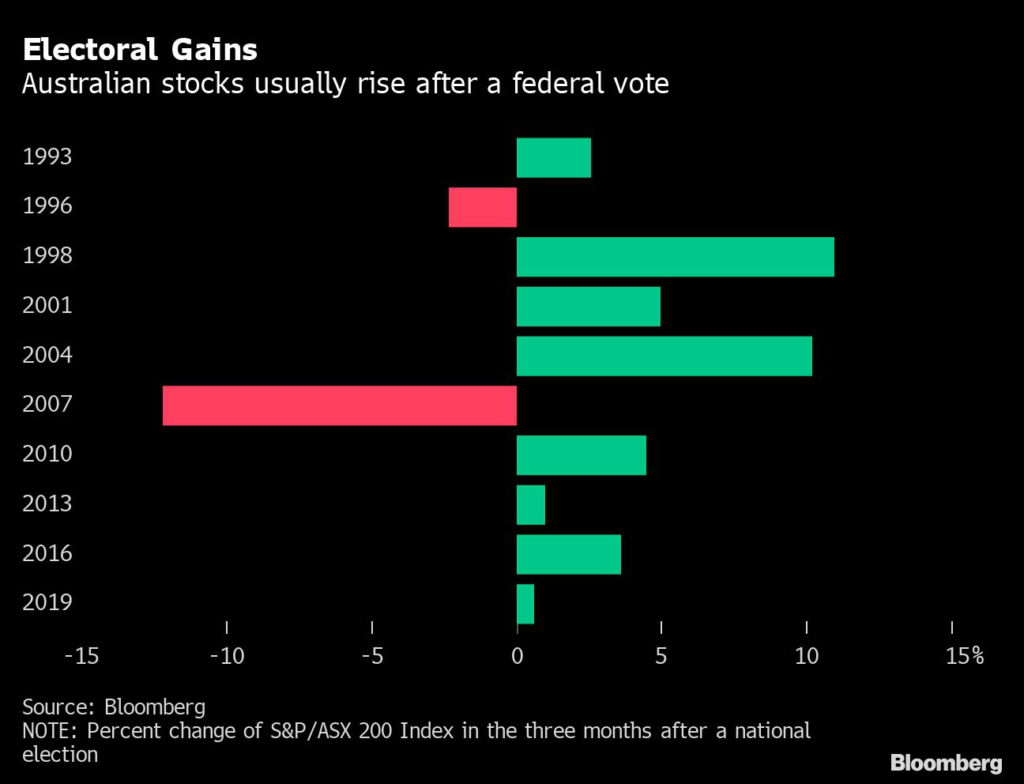

- Macro policy similarities between Labor and the Coalition suggests minimal investor reaction to the election and that markets “will quickly move on to other things”

- Key challenges for the new government include inflation, interest rates and housing affordability

(Updates with additional commentary)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.