Embattled power utility, Eskom, has approached the Constitutional Court to argue that it should not have to provide two indebted municipalities with more electricity than what has been agreed upon in prior arrangements.

Eskom is looking for leave to appeal a high court ruling from August 2020 that directed it to provide more electricity to the Nqwathe municipality in the Free State and the Lekwa municipality in Mpumalanga.

In total, the two municipalities owe Eskom a whopping R2.8 billion with Lekwa carrying the bulk of the debt at R1.51 billion while Nqwathe owes the power utility R1.31 billion, according to records.

In 2020, Eskom made the decision to reduce the electricity supply to the two municipalities to the maximum level allowed in the supply contracts, which is known as the Notified Maximum Demand (NMD) agreement.

The agreements have a maximum threshold of power a municipality can obtain from Eskom and have a sliding scale of penalties for when a municipality runs over the stipulated threshold.

The agreements can only be renegotiated with Eskom if a municipality does not owe the power utility money.

When Eskom decided to cut back on the electricity it was providing, ratepayers from the two municipalities won an urgent interdict from the North Gauteng High Court, which compelled Eskom to keep providing electricity at “full” power.

In KZN, clean-up efforts have begun in earnest after the province was hit with another barrage of inclement wet weather over the weekend, just six weeks after storms, flooding, and heavy rainfall battered the province.

In April, when KZN was first hit with flooding, around 40,000 homes were destroyed and more than 400 people were killed while infrastructure was destroyed and was yet to be fixed when the latest flooding occurred.

Many were still living in community halls from the last round of flooding while infrastructure that did survive was destroyed during the latest round of flooding.

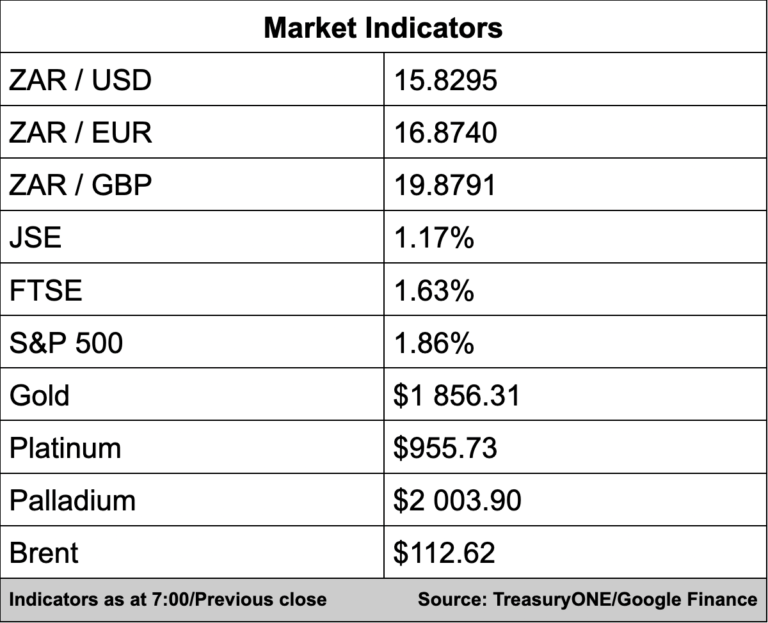

In the currency markets, the rand had a good day yesterday as it closed firmer at R15.75/$ on the back of a softer dollar and the positive outlook upgrade by S&P Global.

“The rand briefly traded to the R15.65 level at one point as the euro firmed sharply against the greenback.

The rand has opened weaker this morning at R15.80 as the dollar has regained some ground ahead of tomorrow’s FOMC minutes,” comments TreasuryONE.

This morning sees gold and platinum trading fairly flat at $1,955 and $955 respectively while palladium is up around 0.7% at $2,007.

The price of brent crude closed higher last night but recession and demand fears have seen the price fall back this morning. Brent is currently quoted at $112.60 a barrel.

Here’s a round-up of what we’re reading:

SA Business

Nicky Oppenheimer is now richer than Johann Rupert again, as markets mess with billionaires – Business Insider

President Cyril Ramaphosa must come and address us: Sibanye-Stillwater employees – SABC

Here’s how much Andre de Ruyter and other top Eskom directors are paid – BusinessTech

Global Business

15,300 UK KPMG staff could lose part of their bonuses if they don’t attend unconscious bias training – Business Insider

Davos returns under Ukraine cloud after Covid break – EWN

One in five employees expect to change jobs this year – BBC

Tech

Activision Illegally Threatened Staff, Labor Officials Find – Bloomberg

Facebook boss Mark Zuckerberg personally sued over massive Cambridge Analytica data breach scandal – Sky News

Ukraine Urges Musk’s Starlink to Keep Helping Alongside Weapons – Bloomberg

Markets

Asian markets fall on China growth concerns – AFP

Asia stocks restrained as US futures retreat – SABC

Gold Up, Near Two Week High as Dollar Stabilizes – Investing.com