The JSE traded firmer on Thursday ahead of the weekend while global peers remained mixed as traders digested the US Federal Reserve’s open market committee minutes. The Fed minutes were less hawkish than what investors and markets had expected.

Officials from the US central bank agreed that they needed to raise interest rates by a half-point in the next two meetings, which continues the aggressive recent trend and would leave them with the flexibility to shift position at a later stage if needed.

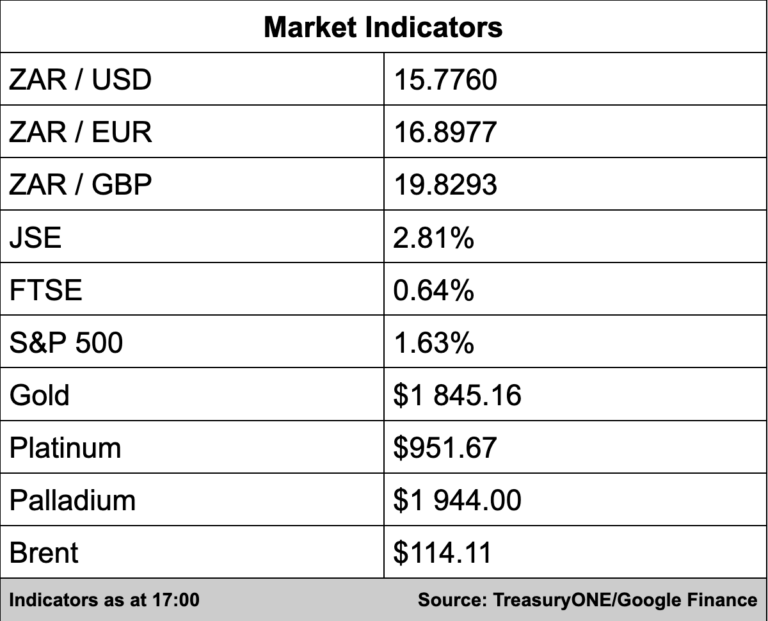

The local bourse added a solid 2.81% with the All Share Index closing at 69,484 points while the top 40 added 3.01% and is at 63,019 points.

The big company news today was that African Bank has agreed to purchase Grindrod Bank from JSE-listed Grindrod Limited for R1.5 billion as it increases its plans to enter the competitive South African business banking market.

“Our acquisition of Grindrod Bank enables us to further realise our business banking aspirations and advance our ambitions in this respect in acquiring valuable sectoral expertise and an existing customer base,” said Kennedy Bungane, African Bank’s CEO.

Grindrod Limited saw its share price surge 9.81% on the back of the announcement with African Bank set to take 100% ownership of Grindrod Bank.

In other company news, strong sales growth and the acquisition of Yuppiechef will lead to an expected earnings jump said Mr Price in a trading update.

Mr Price (2.42%) expects a 17% to 22% jump in headline earnings per share, to at most 1302.8 cents.

Retailer, Lewis, said merchandise sales had increased by 11.5% to R4.4 billion while revenue increased by 7.9% to R7.3 billion for the year ended March 2022.