The Auditor-general has ensured parliament that the R1 billion in relief funds allocated for the mop-up efforts in KwaZulu-Natal, following the latest round of flooding in the province, won’t be looted by opportunistic individuals.

That was the message from AG Tsakani Maluleke, who was briefing the Ad-Hoc Joint Committee on Flood Disaster Relief and Recovery on Wednesday.

Maluleke said the report into how funds are used for provinces that were hit by floods could be released in August.

The AG said while it will not take over the role of accounting officers it will conduct real-time audits on national, provincial and local governments’ spend on flood relief in both KZN and the Eastern Cape.

Maluleke said politicians had oversight responsibility for the safeguarding of funds and that the first line of defence lay with the officials who are meant to protect the money.

“There are a number of different players in this ecosystem, but I want to start by highlighting that the key responsibilities for accountability start with those that run government.

[This starts] with the accounting officers, together with their staff, officials, senior managers and supported by the internal auditors.”

The United Nations (UN) will also provide R21 million worth of aid to help victims of the natural disaster.

The body said it will closely monitor the distribution of its funds and will work closely with local NGOs and the communities themselves.

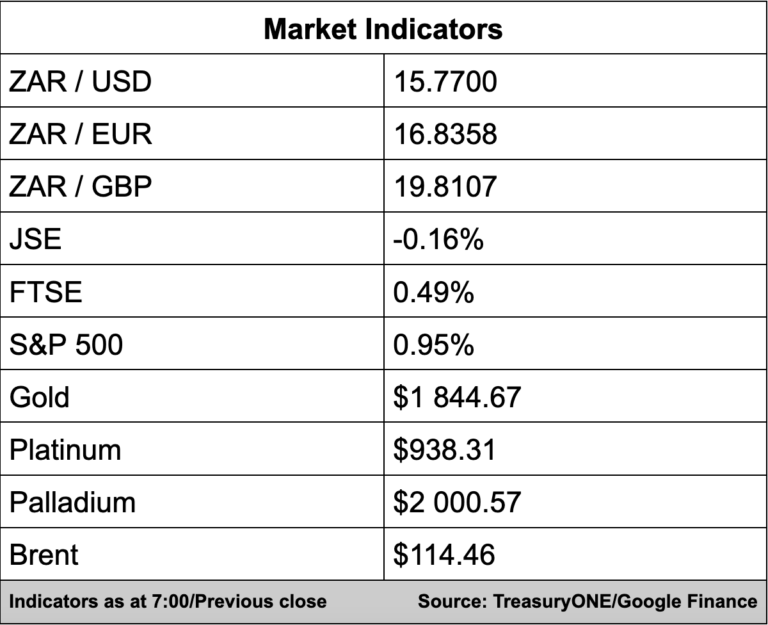

In the markets, “The FOMC minutes released yesterday showed that the Fed is on track for further 50bps rate hikes going forward and that future policy might be more restrictive than previously anticipated.

Markets hardly reacted to the release, with US bond yields closing unchanged, Wall Street closing positive, and currencies settling more or less where they were prior to the minutes,” comments TreasuryONE.

The Rand weakened to R15.76/$ when the US markets opened and eventually closed at R15.73/$.

“This morning, the Rand has opened at R15.77 in line with generally flat EM markets.

Look out for our local PPI numbers due out later today. Economists are forecasting a 12.3% YoY increase,” says TreasuryONE.

On the commodity front, gold and platinum both lost some ground yesterday while palladium closed flat.

This morning all three metals are trading slightly weaker, with gold at $1,845, platinum at $937, and palladium at $2,002. The price of oil remains elevated on the back of constrained supply. Brent is trading at $114.50 and WTI at $110.90.

Here’s a round-up of what we’re reading:

SA Business

Icasa eyes international markets for benchmark of open access network – Fin24

Property market in KZN is resilient despite floods: Expert – SABC

Nxesi blames negotiating parties for failure to resolve Sibanye-Stillwater mine strike – SABC

Global Business

Elon Musk’s revised Twitter bid – BusinessTech

Apple to Boost Pay for US Workers as Inflation Bites – Bloomberg

Lenovo Profit Beats Estimates Despite Lockdown-Sapped Demand – Bloomberg

Markets

Asian markets mixed as traders weigh Li remarks, Fed minutes – AFP

Dollar Down, Less-Hawkish-Than Expected Fed Minutes Improves Sentiment – Investing.com

Global shares rise after Fed meeting notes hint at future rate hikes – SABC

Tech

Starlink map shows huge “dead zone” in South Africa — what it could mean – MyBroadband

Google Takes Yet Another Run at E-Commerce—and Amazon – Bloomberg

Boeing’s Starliner spacecraft returns to Earth, wrapping up critical test mission – The Verge