South Africa faces record-high fuel price increases this week, and time is running out to help ease the burden for consumers.

The treasury department, and the mineral resources department met over the weekend to discuss how to elevate the steep rise, with finance minister Enoch Godongwana saying a plan would be announced this week.

Economists from Absa bank estimate the increase and the return of the R1.50 general fuel levy (GFL) would see prices pushed as high as R25 a litre, based on data from the Central Energy Fund.

“The latest CEF data shows an average under-recovery on petrol of between R2.32 – R2.43 per litre in June, before the R1.50 levy is added. The current petrol price is R21.84, and R21.99 for diesel, which currently shows an under-recovery of R1.06 – R1.09 per litre in June,” reports BusinessTech

During the African Development Bank (AfDB) 2022 annual meetings in Accra, Ghana, last week, Godongwana said the government was looking into proposals to help mitigate the issue.

Opposition parties have been pleading with the government to come up with solutions and have urged them to continue to not implement the GFL.

Godongwana said on the sidelines of the AfDB meetings, “Everyone understands that an increase in petrol prices is a blunt instrument — it cuts across food prices.

It is just really going to raise the cost of living in the economy and therefore something must be done.”

But he added a caveat saying South Africans would not be “saved” by any measures implemented by the government, but mitigation plans would be looked into.

Godongwana stressed that everyone looks to him for economic relief, whether it be an extension of social grants or a fuel price increase reprieve.

The finance minister said he was in a difficult position because NGOs and civil society groups often look at problems in isolation and criticise the treasury when money isn’t allocated to social grants or fuel price reduction.

But the finance minister must consider the whole picture and when relief is allocated to one area, another might suffer.

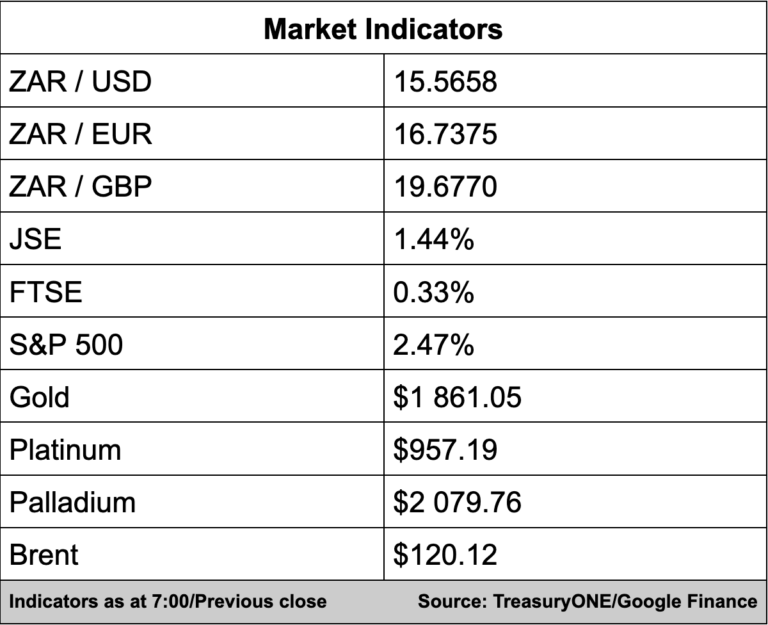

In the currency markets, the Rand closed firmer last week at R15.57 against the US dollar as the greenback slid against the Euro and Pound.

This week, the local unit is trading unchanged on what will be a fairly quiet day of trading due to the Memorial Day holiday in the US.

The Rand’s EM peers are all trading flat except for the Russian Ruble, which is weaker at 66.50 against the Dollar.

The Ruble lost close to 17.0% last week after the Russian central bank slashed interest rates by 3.0% to stem the Ruble’s recent strength.

On the commodity front, metal prices firmed on Friday ahead of the US holiday long weekend and there are further gains this morning.

Gold is up at $1,862, platinum up at $958, and palladium up at $2,080.

Oil continues to rally on tight supply, and increasing demand buoys the price. New Covid cases in China appear to be declining, and this has seen brent crude rise to $120.0 a barrel.

Here’s a round-up of what we’re reading:

SA Business

For the economy to recover, ‘we must improve Eskom’s performance’ – ANC – News24

South Africa will have crowdfunding for funerals soon, a ‘death care’ app promises – Business Insider

Top business leaders are looking at a four-day work week – and permanent hybrid working – BusinessTech

Global Business

EU fails to agree on Russia oil embargo, to try again Monday before summit – TimesLIVE

Russia’s raking in billions in oil revenue, but running out of buyers – Business Insider

The Richest Game in World Football Isn’t the One You Think – Daily Maverick

Markets

Oil Up, Investors Await EU Decision on Russian Oil Sanctions – Investing.com

Asian markets extend Wall St rally as China eases curbs – AFP

Asia Stocks, US Futures Rise as China Curbs Eased: Markets Wrap – Bloomberg

Tech

South African Internet traffic surged 442000% in 10 years – MyBroadband

Where the price of Bitcoin could go – MyBroadband

3 most common — and dangerous — holes in companies’ cyber defenses – Venture Beat