(Bloomberg) — Japanese Prime Minister Fumio Kishida said the country needed to focus on new areas of growth as a panel laid out proposals for his “new form of capitalism” aimed at reducing social disparities and driving the economy.

“We’ve put together a grand design for a new capitalism,” Kishida said at a meeting of the panel on Tuesday. “We’ll seek new growth, using the problems we face as a source of energy.”

The proposals are likely to get a cabinet rubber-stamp in early June. Kishida and several other cabinet ministers are on the panel, along with outside experts.

The plan calls for more investment in human capital, greater support of innovation and startups as well as efforts to decarbonize and digitalize the economy.

Kishida’s push to make Japan’s capitalist model more equitable and more sustainable has attracted criticism from some investors, who are wary of earlier calls to increase the capital gains tax, curb share buybacks and remove the legal requirement for quarterly earnings reports.

The prime minister has walked back earlier comments that seemed to suggest efforts to spread the benefits of economic growth more widely might hurt shareholder profits.

The plan includes calls for investment in training, proposals for enabling the establishment of blank-check investment companies, a goal to double household income from financial assets as well as a requirement for firms to reveal gender pay gaps among their employees.

Read More: Japan Set to Make Companies Disclose Gender Pay Gap This Year

That suggests the panel may be leaving aside more controversial proposals for now. With recent polls showing the highest approval ratings for Kishida since he took office, he may be encouraged to take bolder steps once a key July election is over and his position is more secure.

The proposals recommend supporting around one million people to develop skills and re-join the labor force. Other recommendations include supporting next-generation semiconductor technology and issuing a new class of bonds to support clean energy industries. Concrete numbers for investment were generally lacking in the proposals.

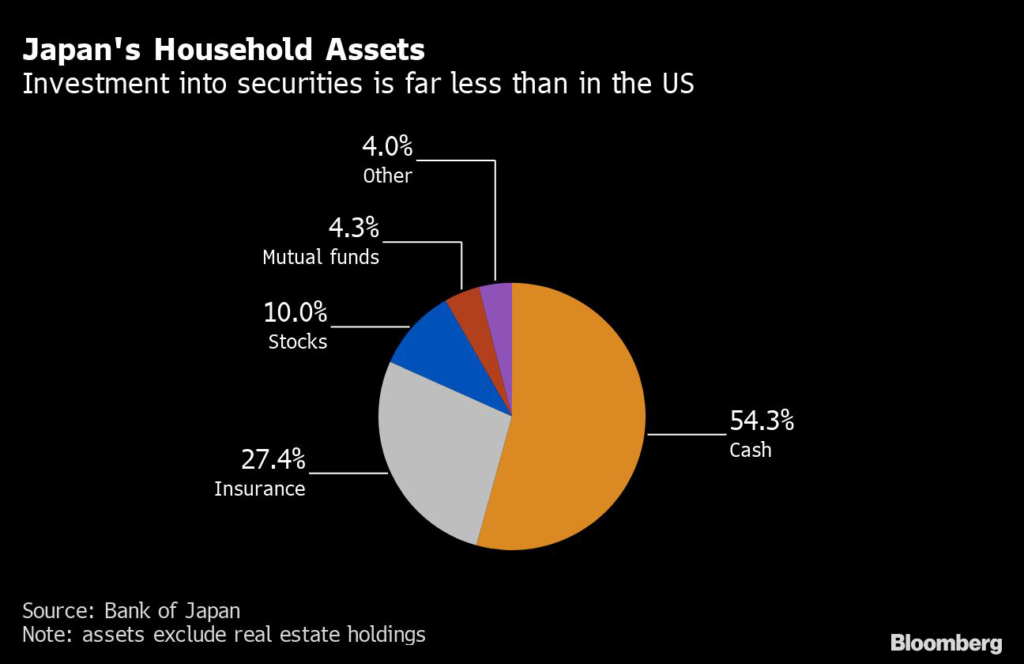

The plan is also aimed at doubling the asset-based incomes of citizens by encouraging people to move their savings into stocks and mutual funds. That move would mean a revamp of existing tax-free investment plans that were promoted during former Prime Minister Shinzo Abe’s administration, according to the proposal.

One of the current programs allows up to 1.2 million yen ($9,370) of tax-exempt investment per year for five years. The plan echoes Japan’s postwar hyper-growth period in the 1960s, when Prime Minister Hayato Ikeda aimed to double household income, and succeeded.

Earlier this month, the premier called on an audience in the City of London to “invest in Kishida.” Still, financial markets are likely to remain wary over his earlier comments about raising capital gains tax and limiting stock buybacks, moves that detractors say are against market interests.

(Updates with comments from Prime Minister Fumio Kishida in second paragraph.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.