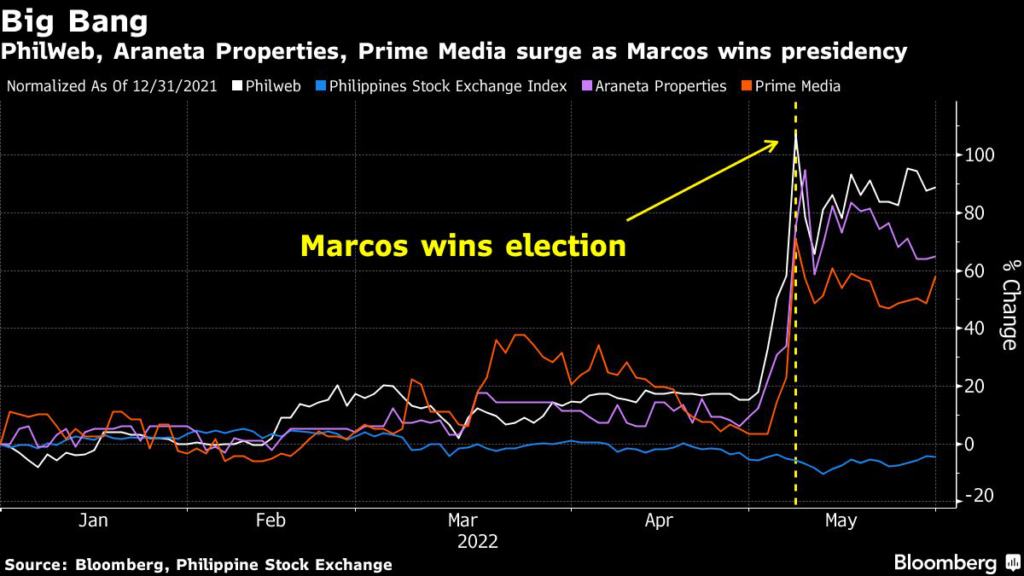

(Bloomberg) — Investors who bought stocks tied to Ferdinand Marcos Jr. and his family ahead of the Philippines’ presidential election this month have enjoyed windfall gains as he coasted to victory.

Three of the nation’s five best performing equities in May were linked to Marcos. PhilWeb Corp., a gaming company owned by his brother-in-law Gregorio Araneta III, soared more than 60% in its best monthly gain in more than seven years. The businessman’s Araneta Properties Inc. returned about 50%, as did Prime Media Holdings Inc., owned by the family of Marcos’ cousin Deputy House Speaker Martin Romualdez.

Nickel miner Marcventures Holdings Inc. and its shareholder Bright Kindle Resources & Investments Inc., two other firms linked to Romualdez, also outperformed the country’s stock benchmark. Shares of both companies rose at least 8%, while the Philippine Stock Exchange Index climbed 1%.

Expectations the stocks would fare better under a Marcos presidency lured investors, like Kevin Khoe, 48, who started buying PhilWeb in January as surveys showed Marcos consistently leading by a wide lead over his rivals.

Khoe, a former stock analyst and who has been trading equities since 1994, named PhilWeb the best play among so-called “Marcos stocks” because he saw catalysts beyond politics. PhiWeb has strong earnings, liquidity and is poised to benefit from the economy’s reopening, he said.

Read: Investor’s Guide to the 2022 Philippine Presidential Election

Every election, investors focus on companies that might gain “accommodation” under a new president, according to Alex Timbol, a former stock broker who’s been an equities investor since 1987. Such firms are favorably valued by the market during a president’s six-year term, but are punished toward the end if they fail to show “they can thrive on their own ability,” he said.

“Speculators like empty companies because they can believe anything, it’s like pointing at the sky and imagining whatever they want,” said Timbol, who prefers Marcventures among the Marcos-linked stocks, citing its earnings recovery and rising nickel prices. “Traders should be astute to identify those opportunities and see where it’s going.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.