(Bloomberg) — Tesla Inc.’s grip on its retail trading fans is hard to shake.

Retail buyers have remained steadfast even as the company’s troubles have mounted since April, sparking a dizzying drop in the electric-vehicle maker’s share price. And after last week’s 14% surge, that loyal following could supercharge a recovery with investors again starting to turn to growth stocks.

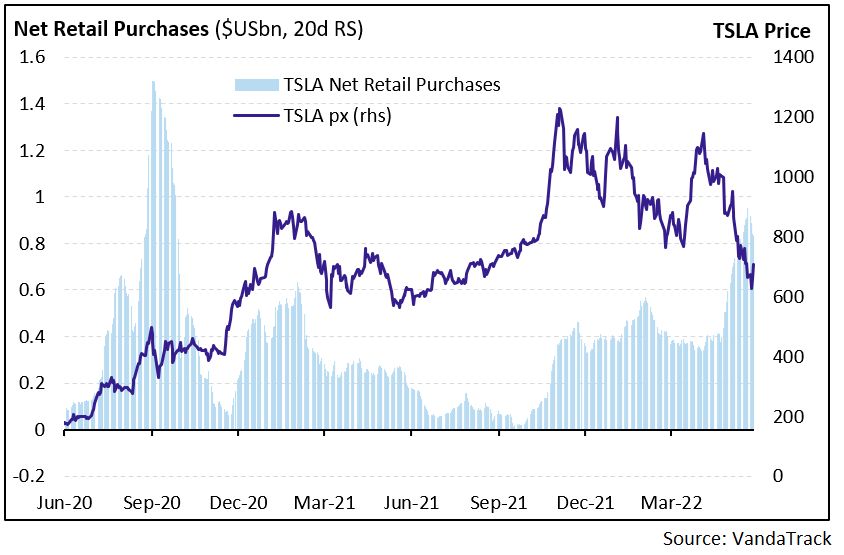

“In May, we’ve seen the strongest monthly buying of Tesla shares by retail investors since August 2020, when the company announced its first stock split,” Vanda Research analyst Fabian Birli said. Whatever the reason — anticipation of another stock split, the army of Musk-fans doubling-down after the Twitter deal or just plain dip-buying — there has been a “clear uptick in retail sentiment for Tesla since the start of the month,” Birli added.

Net buying of Tesla shares by retail investors in May was $708 million as of Friday, the second most among mega-cap technology stocks, trailing only Apple Inc. Tesla was the top gainer on the NYSE FANG+ Index last week and the third biggest contributor to the S&P 500 Index as it posted its biggest weekly gain since November 2020.

Tesla shares are down 34% since a recent peak on April 4 due to the company’s manufacturing troubles in China and investors’ fears about growth slowing worldwide. The noise from the CEO Elon Musk’s bid for Twitter Inc. also hasn’t helped. But the stock is still hardly cheap compared to Tesla’s peers, as the company’s $786 billion market capitalization is head and shoulders above any other global auto company.

Musk’s retail fans have a lot to do with that strength.

“A good way to look at the situation is to compare the cult following that Elon Musk has versus the cult following that Bitcoin and other crytpos had until recently,” said Matthew Maley, chief market strategist for Miller Tabak + Co. “Musk has produced game changing products in several areas, so confidence level is much higher… and that’s why the stock has been able to bounce nicely now that the broad market has stabilized, while Bitcoin is still languishing,” the strategist said.

Tesla did not respond to a request for comment. The company’s shares closed down 0.2% on Tuesday.

As retail traders’ ability to influence the stock market has increased in recent years, companies have recognized the value in attracting these investors with maneuvers like stock splits, which reduce the price of a share and makes them more appealing to individual investors.

Tech behemoths Alphabet Inc. and Amazon.com Inc. also recently split their shares in an effort to bring in retail buyers. In fact, Tesla’s own stratospheric rise in its stock price in 2020 was in part fueled by a stock split, and the company on March 28 announced its plan for another via a tweet.

“The loyal retail following for Tesla holds an advantage for long-term shareholders in the company as these investors are willing to look through near-term negatives which softens the drops in the stock and can accelerate any upward trends,” said Gene Munster, former technology analyst who’s now a managing partner at venture-capital firm Loup Ventures.

(Updates stock move in fifth and eigth paragraphs.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.