(Bloomberg) — Microsoft Corp. pared its forecasts for the current quarter, signaling that the surging US dollar will eat into revenue more than it previously expected and underscoring the threat of inflation and tighter economic policy for an industry that’s already been pummeled by a market rout.

Shares of the company were down about 1.8% Thursday mid-morning after Microsoft said it expects earnings per share of at least $2.24, compared with an earlier forecast of at least $2.28. The company sees a $460 million impact on fourth-quarter revenue from currency fluctuations, knocking revenue to as low as $51.94 billion.

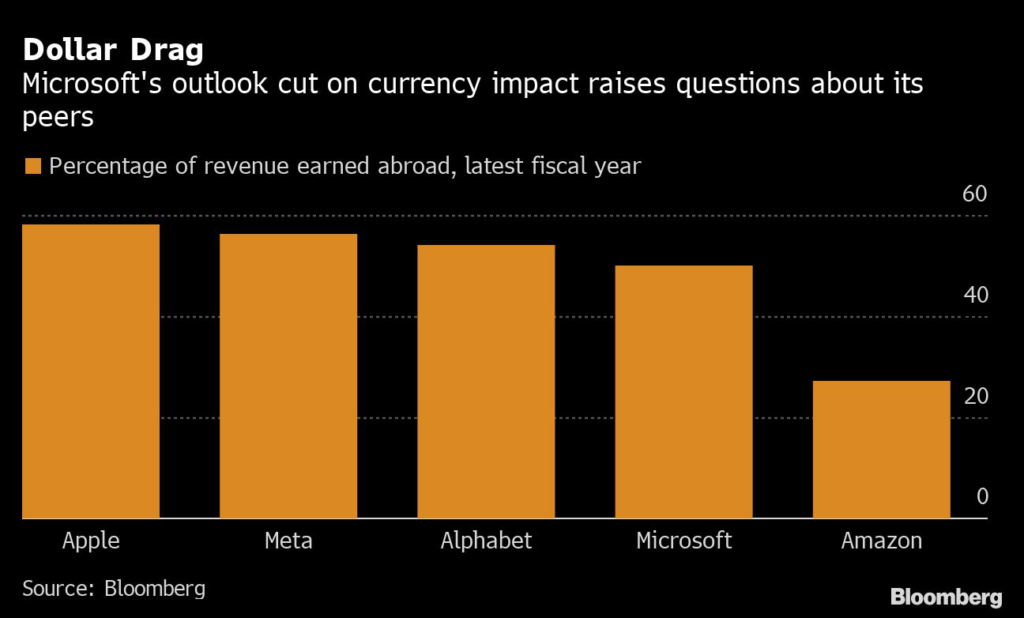

Microsoft’s revised outlook “will be a recurring theme across many large software companies, as most generate over one-third of their sales outside the US,” said Anurag Rana, an analyst at Bloomberg Intelligence. Indeed, earlier this week Salesforce Inc. also pointed to the strong dollar in lowering its sales outlook for the year. The business-software company doubled the impact it expects from the stronger dollar to $600 million.

The speed of US interest rate increases relative to other developed economies and the war in Ukraine have fed a surge in demand for the dollar, which increased more than 7% since the start of the year before paring some of those gains recently. The greenback’s climb has sent the euro, British pound and Japanese yen tumbling.

The strong dollar is good for American consumers, as it makes goods from other countries cheaper. But it can hurt US manufacturers by making the products they sell abroad more expensive, and it can mean US businesses receive fewer dollars for their exports.

Microsoft issued the new guidance in a securities filing “to help investors understand the impact of unfavorable foreign exchange rate movement in the fourth quarter of fiscal 2022 since the forward-looking guidance provided on April 26.” The Redmond, Washington-based company got about half of the $168 billion in revenue generated in fiscal 2021 from overseas.

In its most recent earnings report, issued in April, Microsoft said the impact of currency fluctuations reduced revenue and earnings, though both still rose from a year earlier. Chief Financial Officer Amy Hood said at the time that the company expects foreign exchange to “decrease total company revenue growth by approximately 2 points.”

Treasury Secretary Janet Yellen said in a recent press briefing that the US administration is committed to a market-determined exchange rate, even as she acknowledged that the dollar’s gains have posed concern for other countries. The greenback’s appreciation is an aid to US policy makers as they try to rein in surging inflation, and Federal Reserve Chair Jerome Powell has separately endorsed a tightening in US financial conditions — of which a strengthening dollar is a part.

Rising inflation and the Fed’s efforts to contain it, combined with global supply chain issues, Covid-19 and slowing economic growth, have weighed on big tech stocks this year. The unprecedented confluence of bad news has injected a dose of reality into the outlook for the industry, which had benefited from two decades of low interest rates, making tech companies alluring investments that drew a flood of capital from public markets.

The tech-heavy S&P 500 has lost about 14% of its value so far this year. Among the worst-hit have been Amazon.com Inc. and Tesla Inc., both down more than 25%, and Meta Platforms Inc., which has tumbled 42%.

(Updates with background on tech meltdown. A previous version of the story was corrected to show the reason for the revision was due to exchange rate fluctuations.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.