(Bloomberg) — Supply Lines is a daily newsletter that tracks disruptions in global trade. Sign up here.

China’s first batch of trade data for May is due Thursday and the numbers should give an indication of the extent to which an easing of virus outbreaks in the latter part of that month impacted commodities markets.

Expectations for a revival in demand from the world’s biggest crude buyer is one of the main drivers boosting oil at the moment. The overall oil import numbers will be closely watched for any signs that refiners stocked up last month ahead of an anticipated rebound in consumption.

A breakdown of imports by country won’t be released until later in June, however, meaning the market will have to wait a bit longer to get official confirmation of how much Russian crude China is snapping up. Overall fuel export figures may provide clues on how much scope there is for Asia’s biggest refiner by capacity to help ease global shortages of diesel and gasoline.

In metals, whether Chinese aluminum exports had another strong month will be of interest. Shipments jumped to the second-highest total on record in April, fueled by growing shortages of the so-called everywhere metal and more sales to sanctions-hit Russia.

China’s iron ore imports will also be in focus for clues on whether a recovery rally in the steel-making ingredient can be sustained. Beijing has made repeated pledges to ramp up infrastructure spending, so it’s possible that may have triggered more purchases from steel mills last month.

On the agricultural front, China will report import levels for soybeans, which have surged this year amid a worsening global food shortage. Asia’s largest economy is highly dependent on overseas soybeans. And also look out for any recovery in Chinese fertilizer exports — which were down in the first four months of the year — as the country prioritized domestic needs.

Also coming on Thursday will be steel and rare earth exports, and import figures for gas, coal, edible oils, rubber and meat. Later in the month, on June 18, there will be a breakdown of the oil import figures by country, plus aluminum imports and copper exports.

Events Today

(All times Beijing unless shown otherwise.)

- Nothing major scheduled

Today’s Chart

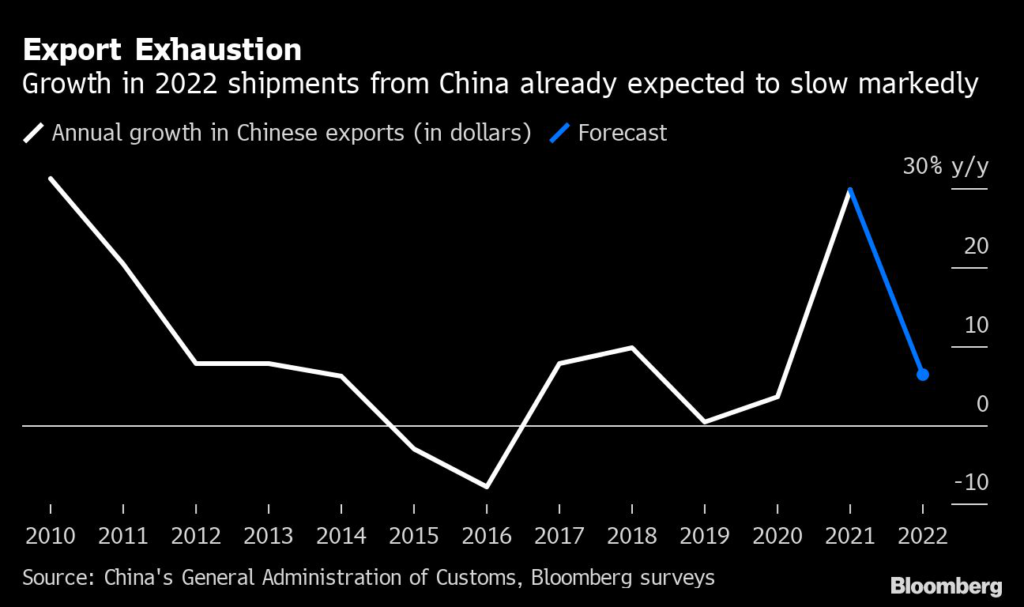

After two years of record exports, Chinese manufacturers are turning downbeat as consumers in their biggest markets curb spending and Covid lockdowns drive customers to competitors in the region.

On The Wire

China Grain Reserves Group, known as Sinograin, is buying newly harvested wheat for national reserves at levels that are about 30% higher than the minimum purchase price, showing the government’s determination to bolster production at a time of global shortage.

- Copper Edges Up as Traders Seen Moving Metals to China on Demand

- China Steel Sector to Turn Around in June as Work Resumes: CICC

- Return of Dine-In Services in Beijing to Boost Food Demand

- China Fears Wind Is Blowing Covid Virus in From North Korea

- Chinese Carmaker Joins SpaceX in Low-Earth-Orbit Satellite Race

- China’s Busy Abbatoirs Signal Limited Gains for Pork, Soybeans: BI

The Week Ahead

Thursday, June 9

- China to release May aggregate financing & money supply by June 15

- China’s 1st batch of May trade data, incl. steel, aluminum & rare earth exports; steel, iron ore & copper imports; soybean, edible oil, rubber and meat & offal imports; oil, gas & coal imports; oil products imports & exports. ~11:00

- USDA weekly crop export sales, 08:30 EST

Friday, June 10

- China inflation data for May, 09:30

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China farm ministry’s monthly crop supply-demand report (CASDE)

- USDA’s monthly world crop supply-demand report (WASDE), 12:00 EST

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.