The JSE traded weaker for a second consecutive day with investors worried about stagflation after the World Bank cut its forecast for global economic expansion.

The World Bank cut its forecast on Tuesday for economic expansion in 2022 further and warned that several years of above-average inflation and below-average growth lie ahead.

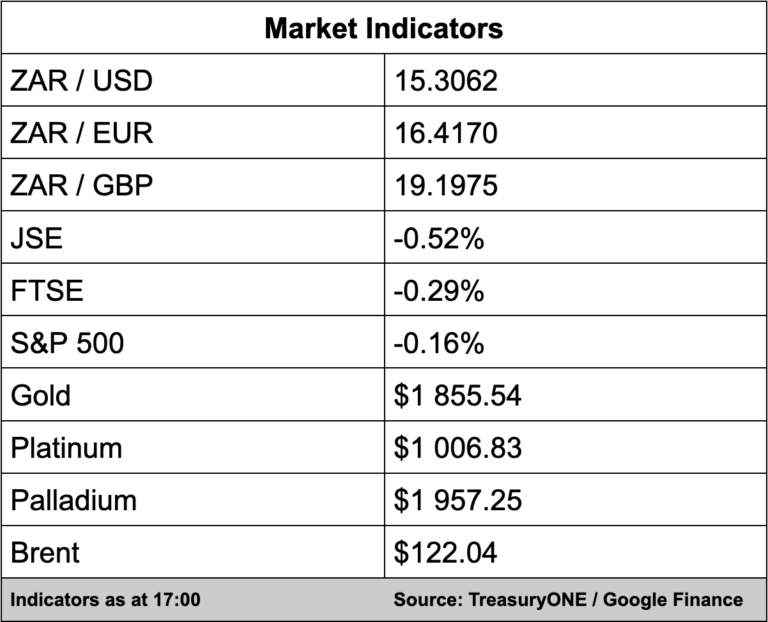

The local bourse lost 0.52% with the All Share Index at 69,950.21 points.

In company news, Naspers and Prosus rocketed 8.91% and 6.81% respectively due to their exposure to the Chinese market via their shareholding in tech firm Tencent.

China’s National Press and Publication Administration said Tuesday it had approved 60 new games, following the year’s first batch of approvals in April.

While none of Tencent’s video game titles was included in the latest batch of approvals there is hope that video games produced by the firm would be approved in coming batches.

The Spar group (-0.83%) reported a 5% rise in group sales to R67.6 billion while operating profit increased by 7% to R1.6 billion in the six months to end-March.

The diluted headline earnings per share rose by nearly 4% to 641.1 cents and the retailer declared an interim dividend of 175 cents per share.

The group’s liquor brand TOPS had strong returns following the lifting of the alcohol ban with a growth of almost 42% in sales compared to the same period the previous year.

Retail peers Shoprite (-0.17%) and Woolworths (-0.84% also closed in the red while Pick ‘n Pay (0.66%) bucked the trend.

In an operational update for the four months end-April, Sanlam (-1.84%) said it posted “creditable earnings, with strong results in the life insurance and investment management businesses offsetting weak general insurance and credit results.”

In the currency markets, the rand continues to trade stronger after dipping below R15.30 to the US dollar.

“The 100-day moving average is still holding up the rand for further gains but closing the week below this mark could set the rand up for more momentum,” comments TreasuryONE, adding, “Still disconnected from the other EM’s, this recent bullish sentiment on the rand does not seem like an emerging market play but has more to do with strong fundamentals currently supporting the rand.”

On the commodity front, gold is currently trading flat at $1,855 while platinum hovered in a tight range for the day and is currently at $1,006 while palladium lost more ground today and is below the $2,000 mark.

Brent crude has moved higher and is trading at $121.90 a barrel.