The JSE slipped on Thursday as investors kept one eye on the European Central Bank (ECB) policy announcement where the central bank indicated it would end large-scale asset purchases and hike key interest rates in July and again in September.

The ECB said it would raise interest rates by 25 basis points next month but resisted pressure to speed up the timeline of the hikes.

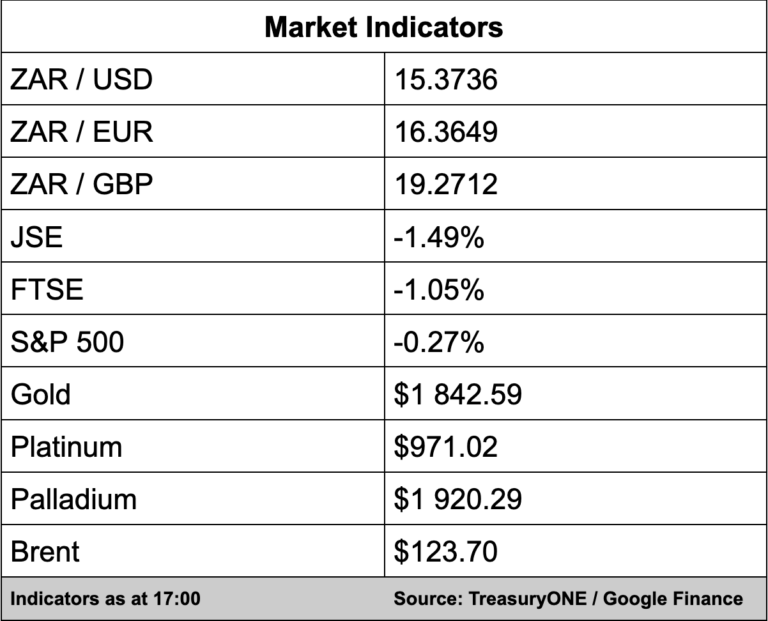

The local bourse closed 1.49% down with the All Share Index at 68,910.80 points.

In the currency markets, it was an exciting day with the rand tracking the US dollar for most of the day.

“The rand initially liked the weaker dollar and touched the R15.17 level in morning trade. Since the reversal of the dollar’s fortune, the rand has been caught on the back foot and has since weakened to the R15.38 level against the dollar,” comments TreasuryONE.

The forex trading house added that other EM peers have also moved in the same way as the rand as a stronger dollar dominates the market currently.

On the commodity front, it was a red day across the board with precious metals all trading down. Gold is currently hovering around the $1,841 level, while platinum is down by 3% and currently trading at $975 per ounce. Palladium is currently trading at $1,924. Brent crude is trading flat at $123.60 per barrel.

In company news, Sappi (-2.64%) said in a trading update that the Public Investment Corporation (PIC) has increased its ownership stake in the paper and pulp producer to 20.011%.

DStv owner Multichoice (1.10%) said it has seen a decline in trading profit to R11 billion within SA, indicating a 1% decline as consumers continue to face pressure from tougher economic conditions and making the decision to cut satellite television subscriptions.

But it wasn’t all bad news, with SA revenue increasing by 4% to R35.6 billion as advertising revenue recovered while subscriptions for video streaming service Showmax also increased by 68% year-on-year.

Mr Price (-1.97%) announced record profits as the group hit R4.95 billion in operating profit in its 2022 financial year, representing a 28% increase for the fashion and apparel retailer.