The JSE traded 1.61% weaker, to close the week in the red, representing a fourth consecutive day down as investors shifted focus to the US inflation report after traders digested a more hawkish stance from the European Central Bank (ECB) yesterday.

US CPI printed at 8.6% YoY, higher than the expected 8.3%. MoM CPI is also higher than expectations (1.0% vs 0.6%). It seems that inflation is more robust than initially thought.

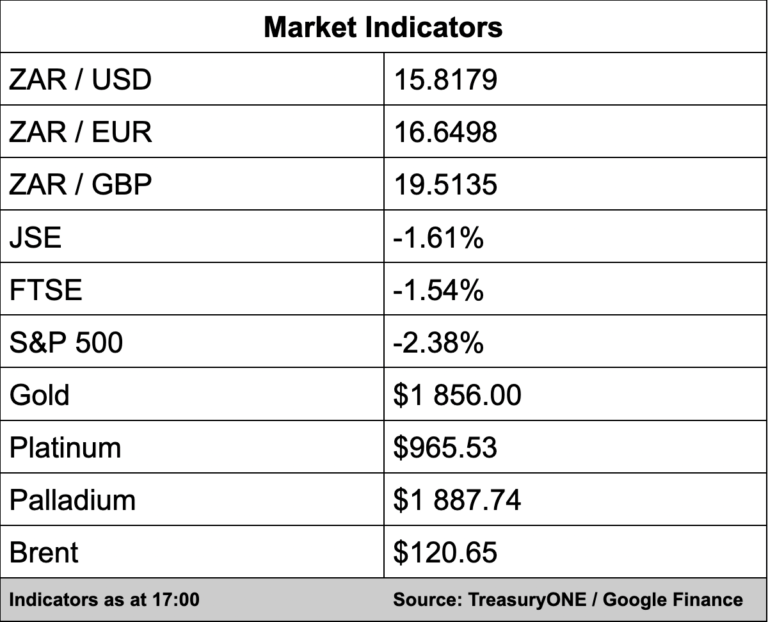

The momentum that the rand had yesterday continued during today, and the rand has lost 70 cents since yesterday morning and is currently trading at R15.82 against the US dollar.

“All other emerging markets are under pressure from the CPI number as the US dollar flexed its muscle after the print. We expected markets are on the back foot,” comments TreasuryONE.

“In contrast, the market needs to make sense of the number with possible tighter monetary conditions across the world in the coming months. Calls of a recession and stagflation will only feed the “risk-off” narrative and could cause emerging markets to come under pressure going forward,” adds the forex trading house.

The ECB indicated on Thursday that it plans to raise key interest rates by 25 basis points next month while also downgrading its economic growth forecasts for the eurozone. The central bank said it would hike rates again in September and indicated that it could be as much as 50 basis points.

In company news, The Foschini Group (TFG) (-3.82%) posted a record year with its retail division recording a double-digit turnover growth in the past year while the retailer cited strong online demands for all its brands as a reason for the good numbers.

TFG, which owns Markhams, American Swiss, Jet, and others said it has seen a 32% increase in its turnover to a record R43.4 billion for the year to end-March. Online sales contributed more than 10% of turnover while cash transactions account for almost 80% of sales.

Orion Minerals requested an immediate trading halt on its securities as it anticipates making a material announcement in relation to a proposed capital raising, said the firm in an update.

“The trading halt is requested until the commencement of trade on Wednesday 15 June 2022, or such earlier time as Orion makes an announcement to update the market in relation to a capital raising.”