(Bloomberg) —

It’s been seven months since a consumer-facing firm last listed in London, and offerings look scarce for the rest of the year as a cost-of-living crisis rips through people’s wallets.

Rampant inflation, already at a 40-year high and heading toward double digits, is heaping fresh misery on retailers after a torrid few years dominated by pandemic lockdowns. Add in volatile stock markets and plunging valuations, and initial public offerings look like a hard sell.

The toxic combination means London’s IPO market is on track for its worst first half since the depths of the financial crisis in 2009, with just over $800 million raised so far in 2022, according to data compiled by Bloomberg.

That’s a sharp reversal in fortune after a record year in 2021, which included the likes of bootmaker Dr. Martens Plc, greeting card retailer Moonpig Group Plc and food-delivery platform Deliveroo Plc. In total over the past two years, firms raised $34.7 billion in London, with consumer-facing businesses accounting for $13 billion, more than a third of the total.

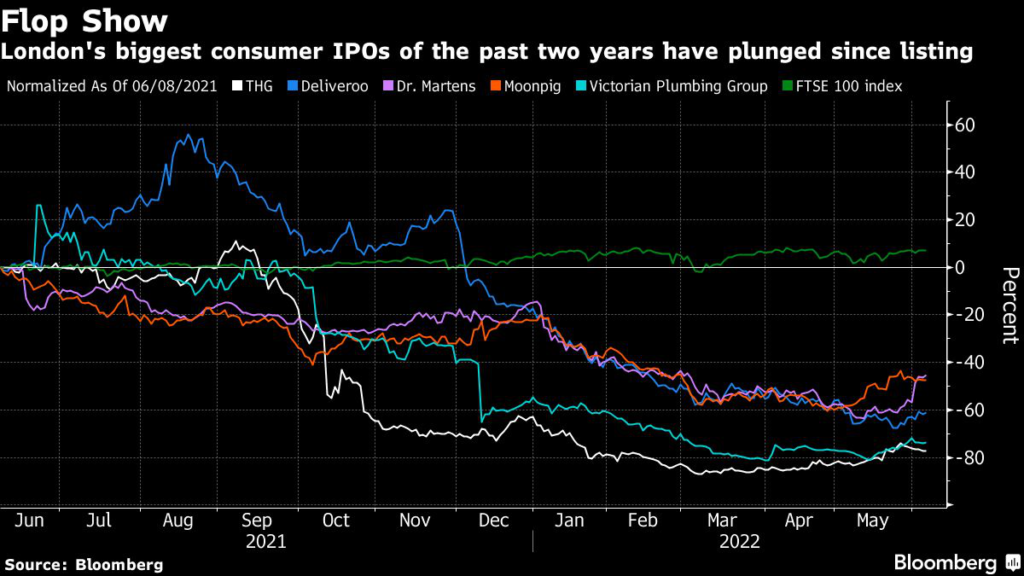

But any initial hype surrounding those retail listings has long faded. Many have tanked since going public, with Deliveroo, e-commerce group THG Plc and furniture retailer Made.com Group Plc all down more than 60%.

“I haven’t seen an IPO cross my desk in almost three months, which is very telling,” said Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. “I felt like a full-time IPO analyst this time last year, but the market has cycled from frenzied to desolate since then.”

There’s a long line of potential IPO candidates in London, among them Burger King’s UK franchise, fitness apparel business Gymshark, plant-based food firm Huel, YO! Sushi-owner Snowfox Group, online retailer Very Group and leisure firm Virgin Experience Days.

But with almost two-thirds of UK listings since the start of 2021 trading in the red, any IPO right now would face an uphill struggle.

For consumer-facing firms, there’s the additional inflation hurdle that’s dominated the investment backdrop this year. Food and gasoline prices are surging, retail sales fell 1.1% in May from a year earlier, and households are cutting back on everything from essentials to dining out. The FTSE 350 Retail Index is down more than 30% this year, compared with 3.6% for the broader stock index.

Some businesses are looking at the option of a sale over a listing, given the impact of market volatility on investor interest right now.

LELO, a Swedish sex-toy designer, is exploring that route after pulling the plug on a London IPO, Bloomberg reported. It had at one point been seeking a valuation of more than £1 billion in a listing.

Mishcon de Reya LLP, which has already delayed its share sale twice, on Wednesday said it’s stopped working on its London IPO, halting plans to create the world’s largest listed law firm.

When IPO activity resumes “will depend on investor appetite for new issues and a sustained period of lower volatility,” said Lawrence Jamieson, head of UK equity capital markets at Barclays Plc. “While many fund managers are prioritizing opportunities within their existing portfolios amidst equity outflows, others are more optimistic and are taking the view that the market has already digested much of the worries about inflation and rising interest rates.”

That optimistic argument may soon be tested, as there’s one large London listing in the offing. GlaxoSmithKline Plc, the UK drugmaker, plans to spin off a unit that makes Panadol painkillers and Sensodyne toothpaste. While the new company, Haleon, won’t raise any money, investor reaction will be closely watched to gauge appetite for other offerings from the sector.

“Consumer stocks have sold off so much, with some down 40% to 60%, that investors are pricing in very rough scenarios, but it’s important to remember that the UK stock market is not the economy and vice versa,” said Jackson. “The spinoff of GSK’s consumer health unit will be an interesting valuation exercise.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.