The JSE continued its downward trajectory on Tuesday losing over 1% as traders mull over US inflation, which may not have peaked yet as was previously thought.

The local bourse initially traded firmer during the morning session and was up 0.65% at one point but ultimately the All Share Index closed 1.05% down at 65 683.52 points.

In company news, Telkom plummeted 9.52% after the telecommunications provider released a tepid forecast for future revenue and growth following a slowdown in growth for its mobile business. Telkom’s revenue has decreased by 1% over the last year while its fixed-line business continues to decline. The telecom giant has 17 million active mobile subscribers.

Telkom was the biggest loser on the day followed by Sappi (-5.70%), and Sibanye-Stillwater (-5.15%).

Sibanye said flooding at one of its mines in Montana, part of its US operations, had been experiencing flooding since Monday. “The flooding of numerous rivers in the region, follows a warm spell leading to a rapid melt of accumulated snow in the mountains and associated runoff, which was exacerbated by heavy rainfall over the weekend,” the mining counter said.

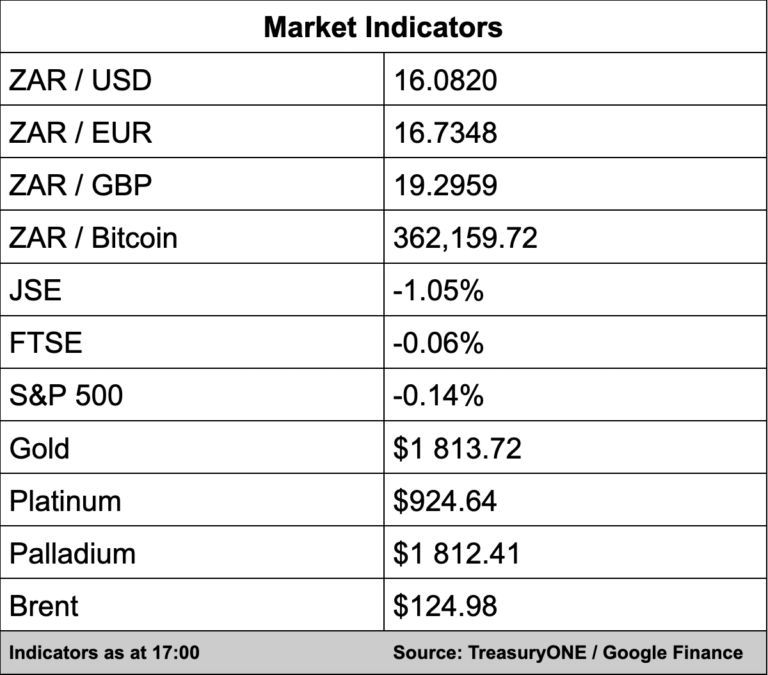

In the currency markets, the rand is still playing catch up against the US dollar, which continues to firm ahead of the US federal open market committee (FOMC) rate decision tomorrow night.

“The expectation that the FOMC could hike the key rates by 75bps has spooked the markets since Friday afternoon and by no means has this helped the cause of any emerging market,” comments TreasuryONE.

“Caution should be made regarding the local market, which will be closed on Thursday, and the impact of the rate decision could be amplified due to a lack of liquidity,” adds the forex trading house.

In other markets, gold has been trading softer in anticipation of a hawkish Fed while treasury yields in the US continue to rise.

“The rising treasury yields place further pressure on US equities, with all major indices trading lower at the moment,” says TreasuryONE.

Copper and platinum trade softer on the day as concerns over rising Covid cases in China halt any gains. Brent crude is trading 2% higher and is currently above the $125 a barrel mark, while palladium regained some of yesterday’s losses.