(Bloomberg) — MicroStrategy Inc. may need to post additional collateral for a loan as Bitcoin tests a key price range flagged by the company last month.

The software firm that invested heavily in Bitcoin said on a conference call in May that if the token’s price dropped enough, it would need to add to the digital asset originally pledged for the $205 million loan it took out in March. The initial value committed was around $820 million at the time but has since fallen to about half that.

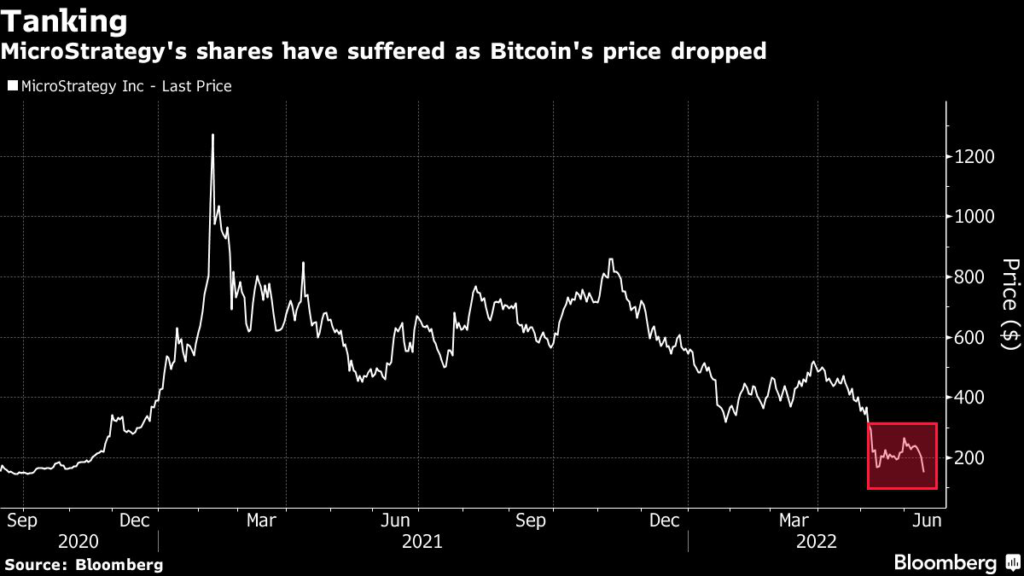

MicroStrategy has become closely linked with Bitcoin, after it was one of the first major companies to buy the tokens for its corporate treasury. Chief Executive Officer Michael Saylor frequently touts the world’s largest cryptocurrency on social media and at conferences — including a tweet on Monday amid the selloff saying “In #Bitcoin We Trust.” The shares fell 25% Monday as cryptocurrencies tumbled.

“Bitcoin needs to cut in half for around $21,000 before we’d have a margin call,” Phong Le, MicroStrategy’s president, said on the call in early May. “That said, before it gets to 50%, we could contribute more Bitcoin to the collateral package, so it never gets there.”

Bitcoin has now reached that level, falling for an eighth straight day to as low as $20,824 on Tuesday. As of May 2, MicroStrategy held about 129,218 Bitcoins, with an approximate average purchase price of $30,700 each, according to a company filing.

A tokenized version of MicroStrategy’s stock on crypto exchange FTX was down about 1% as of 12:30 p.m. in Hong Kong. The company’s market cap is around $1.7 billion.

Read more:

- MicroStrategy Leads Crypto Stock Selloff as Bitcoin Unravels

- MicroStrategy’s Losses From Bitcoin Bet Approach $1 Billion

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.