(Bloomberg) — Delegates at the second annual Qatar Economic Forum, from Tesla Chief Executive Officer Elon Musk and Nouriel Roubini to Atlas Merchant Capital’s Bob Diamond and StanChart’s Bill Winters, warned the United States was heading toward a recession.

“A recession is inevitable at some point, as to whether there is a recession in the near term, that is more likely than not,” Musk told Bloomberg News Editor-in-Chief John Micklethwait.

Diamond also said a downturn is almost unavoidable, and Roubini, nicknamed “Dr. Doom” for his bearish views, forecast a recession by the end of the year.

Exxon Mobil Corp. said it is investing in Qatar’s $29 billion North Field East project to boost Doha’s gas exports, joining other western energy firms.

The Gulf state, among the world’s biggest LNG exporters, is one of few nations that can substantially replace Russian gas supplies to Europe — but the project will start operating only in early 2026.

Qatari Energy Minister Saad Al-Kaabi blamed underinvestment for high gas prices and called for higher spending, and Exxon’s CEO said global oil markets may remain tight for another three to five years.

NOTE: Qatar’s Ministry of Commerce and Industry, Qatar Investment Authority and Investment Promotion Agency Qatar are the underwriters of the Qatar Economic Forum, Powered by Bloomberg.

Media City Qatar is the host organization.

Key Highlights:

- Five Takeaways From What Elon Musk Said at Qatar Economic Forum

- Musk, Roubini and Goldman Warn of Rising US Recession Risk

- Musk Says Supply Constraints Biggest Brake on Tesla’s Growth

- Exxon CEO Warns Oil Markets May Be ‘Tight’ for Up to Five Years

- Kuwait State Oil Firm Says There’s $30 War Premium on Oil Prices

StanChart’s Winters Adds to Recession Warnings (1 p.m.

Doha)

“You’ve got to think that the odds are that there’s going to be a recession,” Bill Winters said. “I think this inflation is quite bad, it’s intransigent, it’s not transitory, and the consequences will be recession.”

Any recession is likely to last “a couple of quarters,” he added.

“There’s a silver lining, which is that the financial system is strong, and when you have a downturn in an economic cycle with a strong financial system it tends not to be amplified — a weak financial system it gets amplified, you get a financial crisis.”

“I think it’s very unlikely we’ll have a financial crisis,” Winters said.

Exxon Invests in Qatar (12:50 p.m.

Doha)

Exxon Mobil joined others, including ConocoPhillips, TotalEnergies SE of France and Italy’s Eni SpA, to invest in a project to boost Qatar’s gas exports.

The U.S. firm will take a 6.25% stake in the North Field East project, which is expected to start operating in early 2026.

The expansion will increase Qatar’s LNG capacity to 110 million tons annually from 77 million, just as demand surges across the world.

Vitol Sees High Energy Prices Persisting (12:40 p.m. Doha)

Vitol Group CEO Russell Hardy said that global consumption of gasoline and jet fuel were still below 2019 levels and that the market could expect to see high prices for energy remain until demand for energy drops.

“There’s still two to three million barrels a day of demand to come back next year,” Hardy, whose company is the world’s biggest independent trader of oil and oil products, said.

Prices for oil and oil products were likely to remain elevated so long as there was more consumption to come from the market, although fuel remaining so expensive risks demand destruction.

“The one thing that everybody’s concerned about is that runaway prices risk recessions,” he said.

Thiam Says Central Banks Need to Shock Markets (11:30 a.m.

Doha)

Tidjane Thiam, the former CEO of Credit Suisse Group AG, said central banks will need to continue to shock markets to fight inflation. Asset prices have not yet reached a bottom given existing levels of inflation, the continuing impact from Covid-19, and geopolitical worries about China, he said.

While the market slump is negative for special purpose acquisition vehicles like his Freedom Acquisition I, the dislocation creates opportunities to invest, he said.

Thiam said his vehicle looked at 75 companies before announcing Monday that it signed a letter of intent for a combination with Human Longevity, a company focusing on life sciences.

Read More: Thiam Says He Turned Down Offers After Credit Suisse for SPAC

Delegates Warn of Rising US Recession Risk (10:50 a.m.

Doha)

“A recession is inevitable at some point. As to whether there is a recession in the near term, that is more likely than not,” Musk said in an interview with Bloomberg News Editor-in-Chief John Micklethwait at the Qatar Economic Forum in Doha.

Bob Diamond also said a US recession is “almost unavoidable.” A cooling of the economy is part of the economic cycle and central banks should continue to act to stem inflation, he said.

The Fed’s rate hike was the “correct move” and another 75 basis point increase in July is “probably appropriate,” the Atlas Merchant Capital founding partner said. “The more the Fed acts now, the more likely it is to be quick or short, not deep and longer.”

Earlier, Roubini forecast a US recession by the end of the year.

“We’re getting very close,” as measures of consumer confidence, retail sales, manufacturing activity and housing are all slowing down sharply while inflation is high, he said on Bloomberg TV. He sees further downside for both stocks and bonds in this environment.

The comments come after Goldman Sachs economists cut their US growth forecasts and warned that the risk of recession is rising.

The outlooks will stoke fears of a hard landing for the world’s biggest economy as the Fed jacks up interest rates to counter the fastest pace of inflation in decades.

Musk Says He can Balance China, Tesla, Twitter (10:10 a.m.

Doha)

Musk said he doesn’t think there’ll be any issue balancing his Tesla interests in China with the future acquisition of Twitter Inc. The platform doesn’t operate in China and “China does not attempt to interfere with the free speech of the press in the US, as far as I’m aware,” he said in an interview.

Musk said there are still a few “unresolved matters” about Twitter, and is still waiting for a resolution on the matter of how many bots are on the social media platform.

“There is the question of, will the debt portion of the round come together and then will the shareholders vote in favor,” he said.

The billionaire also said supply constraints are the biggest brake on Tesla’s growth, rather than competition from rival automakers.

Jobs cuts at the electric-car maker will lead to a 3.5% reduction in headcount, he said.

EU Was ‘Unfair’ to Georgia, Premier Says (9:40 a.m. Doha)

Georgia considers it “unfair” for the European Union not to grant candidacy status to the country after recommending it to Ukraine and Moldova, Prime Minister Irakli Garibashvili said in an interview at the Qatar Economic Forum with Bloomberg Editor-in-Chief John Micklethwait.

The Caucasus nation “would be the first country to be granted the status” on the merits of complying with the EU’s requirements, and the bloc gave it to Ukraine and Moldova because of the situation created by Russia’s war, he said.

While Georgia supports Ukraine politically, it’s in a “very vulnerable” position and can’t impose national sanctions on Russia over the invasion, though it won’t let Russian companies use Georgian territory to bypass sanctions, Garibashvili said.

Georgia remains determined to join the North Atlantic Treaty Organization, but understands it must first resolve its territorial problems with 20% of Georgian territory under Russian occupation since a 2008 war, the premier said.

Namibia GDP May Double by 2040 on Oil Finds (8 a.m.

Doha)

Namibia and its partners are “all aligned” on bringing country’s first two oil discoveries to production as soon as possible, Jennifer Comalie, chairperson of National Petroleum Corp.

of Namibia, said in a Bloomberg TV interview Tuesday on the sidelines of the QEF.

TotalEnergies SE said in February it had made a “significant” oil discovery, weeks after Shell announced a find in the southwest African nation.

“At peak, these two discoveries could bring $5.6 billion to a very small economy, doubling the GDP by 2040,” Comalie said, without giving details on when fields could start production or how much oil will be pumped.

ConocoPhillips Invests in Qatar Gas (June 20)

ConocoPhillips CEO Ryan Lance said volatility in global gas markets may last years, as the Houston-based firm joined other Western energy companies investing in Qatar’s North Field East project, which is expected to start operating in early 2026.

TotalEnergies SE of France and Italy’s Eni SpA have also bought stakes, while Shell Plc and Exxon Mobil Corp.

are among the others making bids. The expansion will increase Qatar’s LNG capacity to 110 million tons annually from 77 million, just as demand surges across the world.

European buyers have rushed to secure non-Russian supplies since Moscow’s invasion of Ukraine.

Gazprom PJSC last week reduced pipeline gas flows, underscoring the continent’s vulnerability and raising the specter of fuel rationing. Prices in Europe surged 43% last week.

Once the extra gas is flowing, Qatar expects to send more shipments to Europe.

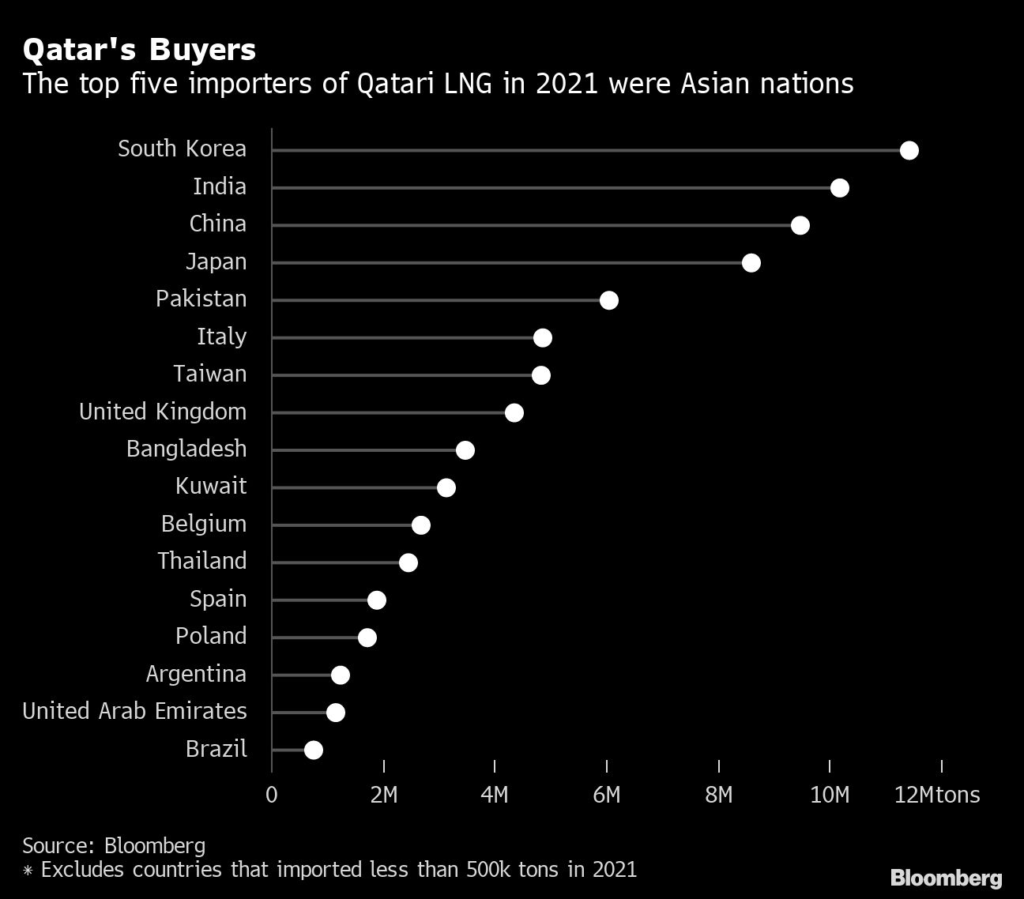

Around 80% of Qatari LNG currently heads to Asia, but the proportion being shipped to Europe will rise to 40%-50%, according to QatarEnergy CEO Al-Kaabi.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.