The JSE fell for a second day running, tracking European peers after US Federal Reserve chair Jerome Powell acknowledged that steep interest rate hikes could tip the country into a recession.

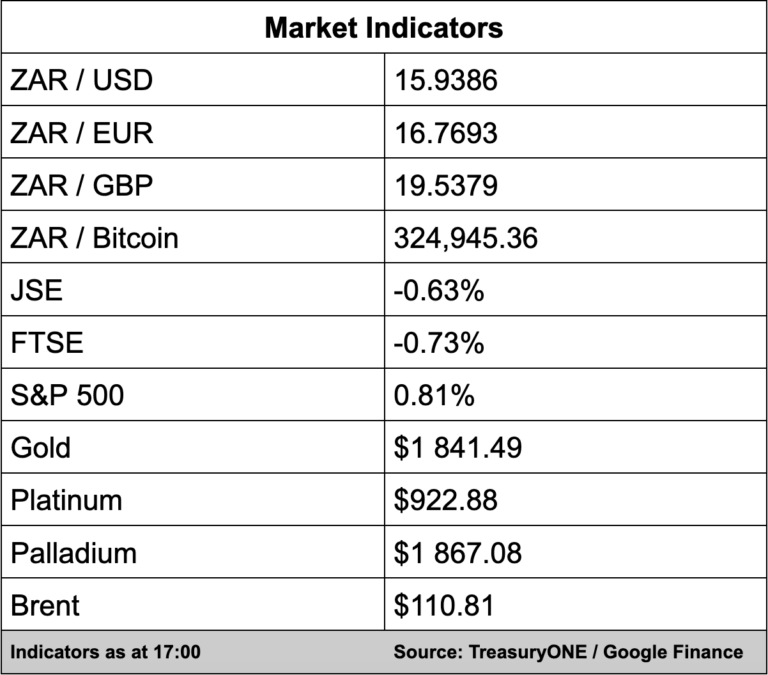

The local bourse traded 0.63% weaker with the All Share Index at 65,295 points.

Significant spikes in oil often precedes a recession with the reason for this typically being that higher oil prices lead to inflation and interest rate hiking cycle to curb inflation, which leads to lower demand and reduced economic activity, comments TreasuryONE.

“The smart money in the market is for a recession to happen in the medium-term, as the current low-growth environment is not conducive to many interest rate hikes before a recession’s door.”

Brent crude has arrested its fall from yesterday and is currently trading at $111.50 per barrel.

Meanwhile, the currency markets barely reacted to Powell’s comments with the market trading sideways. The rand has traded in a narrow range of between R15.95/$ and R16.05/$ for most of the day.

“Should the status quo continue, we expect the markets to take this sideways approach into the weekend with no important data or events out tomorrow.”