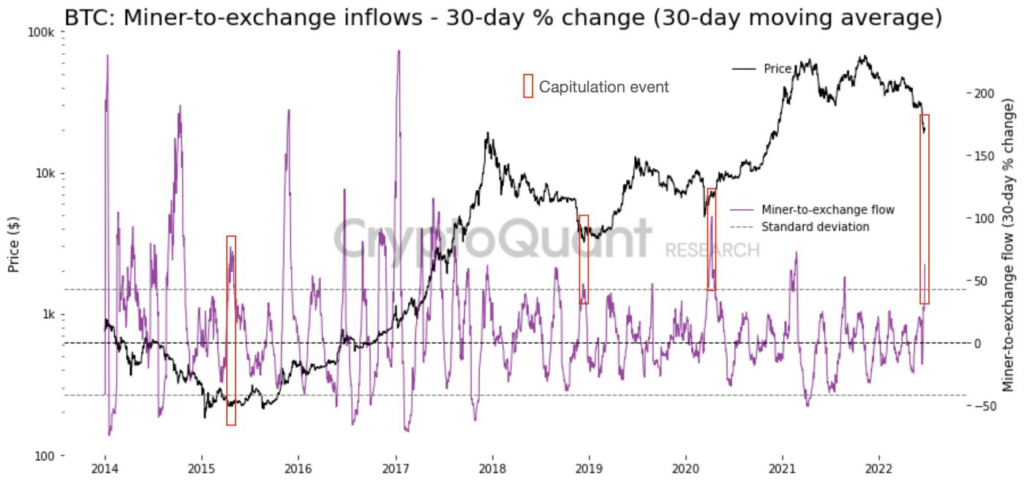

(Bloomberg) — A major “capitulation event” in which Bitcoin miners funnel thousands of tokens to exchanges could signal an approaching bottom for the world’s largest cryptocurrency, if history is any guide.

In an effort to salvage plunging profits, Bitcoin miners are turning sellers after seeing the price of the bellwether token more than halve in 2022. This past month, miners moved 23,000 Bitcoin to exchanges, representing the highest monthly flow since May 2021, when China initiated a crackdown on its domestic crypto industry, data from tracker CryptoQuant shows. Earlier this week, Canadian mining firm Bitfarms Ltd. sold 3,000 Bitcoin for $62 million, following in the footsteps of Riot Blockchain Inc., which started selling off holdings in April.

Market watchers have said that the slew of selloffs is only likely to continue, driving coin prices down further. But some, like CryptoQuant senior analyst Julio Moreno, say they’re a sign of an approaching market bottom.

CryptoQuant has dubbed the phenomenon a “capitulation event” or the start of a “capitulation period” for miners. Moreno says this typically comes right before a bottom, in line with past market cycle patterns.

“With miners’ revenue dropping and mining difficulty still at high levels, miners are now in the “extremely underpaid” territory,” he wrote in a note dated June 23. “Some miners’ revenue can’t meet the break-even point, so they have to cash out to cover expenses/loans,” he wrote.

At the moment, Bitcoin is trading at around $21,500 and seems to be resting on a crutch of at least $20,000 after falling as low as about $17,600 on June 18. Between June 13 and 17, miners offloaded about 9,769 Bitcoin to exchanges, according to CryptoQuant data, after crypto lending platform Celsius halted withdrawals and news broke that hedge fund Three Arrows Capital may face insolvency.

The selloff in coins was initially triggered by the collapse of Terra’s algorithmic stablecoin amid unfavorable macro conditions across the cryptosphere. Total crypto market capitalization has sunk by more than $800 billion since May, according to CoinGecko.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.