The JSE traded firmer for a third consecutive trading day while global stocks also traded in positive territory while oil prices firmed following China’s decision to ease some quarantine restrictions for travellers entering the country.

Brent crude has traded higher at $117 a barrel due to the United Arab Emirates (UAE) announcing they are at full supply capacity, countering expectations that the UAE could boost supply in a tight market.

“The UAE and Saudi Arabia have been seen as the only two countries with spare capacity available to make up for lost Russian supply and weak output from other member nations,” comments TreasuryONE.

China moved to slash the quarantine time in half in one of the world’s strictest covid-19 curbs still in effect. Asian stocks rose following the announcement while European shares also opened in the green.

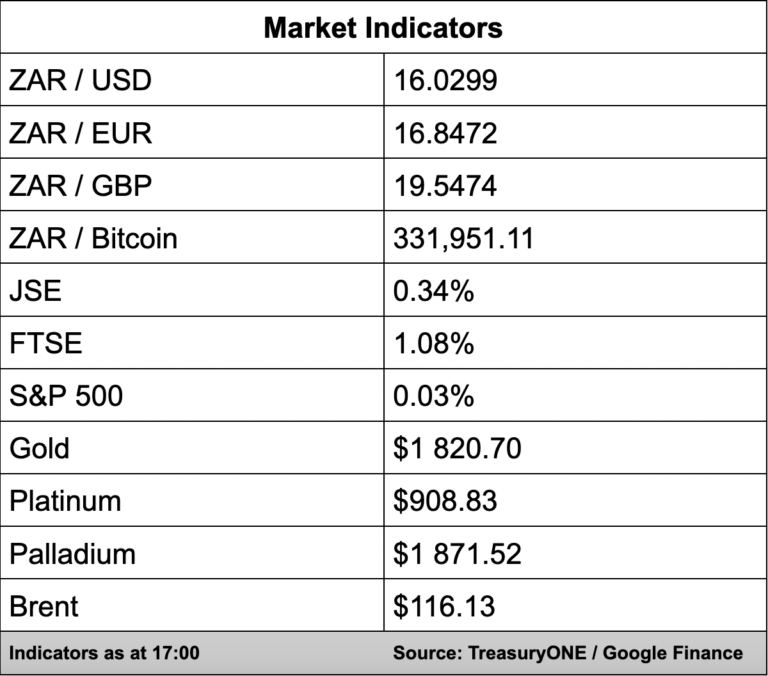

The local bourse closed 0.34% up with the All Share Index at 68,058.12 points

In a trading update, hotel and leisure group Sun International (3.90%) said its covid-19 recovery continued with the release of strong annual earnings, which have increased by more than 80%.

The group’s hotel and resort business had a 62% earnings increase to R977 million while Sun Slots saw income growth of 15% while Sun Bet’s income grew by a healthy 34%.

Grindrod (3.05%) said it expected headline earnings per share to jump “at least” 100% for the six months to end 30 June. This is compared to a loss per share of 63.1 cents and headline earnings per share of 0.7 cents for the previous corresponding period.

The top three movers on the day were South32 (5.42%), Hammerson (3.98%), and the Multichoice Group (3.25%).

The biggest losers were Alaphamin (-4.31%), Shoprite (-2.87%), and Pepkor (-2.65%).

In the currency markets, the rand came under pressure on two fronts today. The first was a stronger US dollar while the announcement of stage 6 load shedding gave the rand impetus to break through the R16.00/$ level.

Forex trading house TreasuryONE believes the local unit could test the R16.20/$ mark last hit earlier this month.