Good morning, here’s what you need to know today.

Survivors of the Enyobeni tavern tragedy have come forward with new chilling details, Outa wants government to extend the fuel tax relief ahead of another big fuel price hike, and Russia defaults on its bond payments for the first time in 100 years.

Tavern tragedy: We ‘jumped off the balcony’ to escape after bouncer locked door – survivors – News24

The tragedy that saw 21 teenagers aged between 13 and 17 years old found dead at the Enyobeni tavern, took another chilling turn. When News24 spoke to some of the survivors, they claim the deaths were not a mistake but a “well-planned murder.”

Some of the surviving patrons claimed the bouncer at the popular East London night spot kept dumping the bodies of those who died outside of the establishment back inside before closing and locking the door. In the process, the bouncer trapped more than 200 people inside the overcrowded tavern who were left screaming, coughing, and fearing for their lives.

The circumstances surrounding the deaths remain unclear, but police are said to be investigating claims that the teenagers were smoking a hookah pipe that contained a deadly substance. Read more here. (for subscribers)

Push to extend South Africa’s R1.50 petrol relief – with another big price hike coming next week – BusinessTech

With another large fuel price increase just around the corner, civil society group, the Organisation for Undoing Tax Abuse (Outa) has called for an extension of South Africa’s R1.50 fuel tax relief.

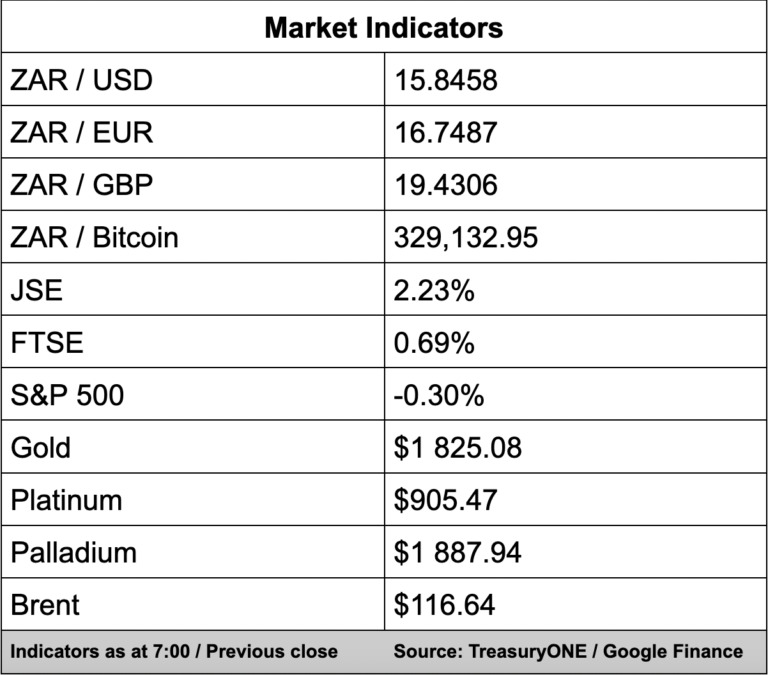

The group says the ongoing war in Ukraine, the steep oil price fluctuations, and the rand being weaker than the US dollar for most of June will give rise to an under-recovery in the current petrol price.

As it stands, the petrol price is due to increase by an estimated R1.75 next week, says Outa. Read more here.

Russia in historic default as Ukraine sanctions cut off payments – Daily Maverick

It was the first time in more than 100 years that Russia defaulted on its international bond obligations. Credit rating firm Moody’s confirmed the default, but the Russian finance ministry denied this to be the case, of course.

The Russians claim they have made the payment, which was due primarily in euros and dollars, but that the payment had not yet been cleared by clearing house Euroclear. In turn, officials in Moscow said it was not their problem if the payment had not cleared. Read more here.

Here’s what else we’re reading today:

Eastern Cape tavern tragedy: They danced, fell and died – Bheki Cele – News24

Protesters demand the arrest of the owner of East London’s Enyobeni ‘death tavern’ – Daily Maverick

Royal House of Mandela calls for alcohol ban after Enyobeni tavern tragedy – TimesLIVE

Eskom’s rolling blackouts may worsen at short notice: Eskom – SABC News

Employees at Eskom powers stations in Mpumalanga continue with their strike – SABC News

Discovery is the latest JSE Top 40 company to join rival stock exchange A2X Markets – Business Insider

I intend to lay criminal charges against Zondo, says former Prasa boss Lucky Montana – Fin24

Prosus unlocks the $140bn Tencent treasure chest – better late than never – BizNews

Iran applies to join BRICS group of emerging countries – Daily Maverick

G7 denounces ‘war crime’ as Russian strike kills shoppers – EWN