The JSE slipped on Wednesday as investors mulled over poor consumer confidence and ongoing power cuts, which have renewed worries over a gloomy economic outlook.

US consumer confidence weighed on Wall Street overnight while on local shores, “the FNB/BER Consumer Confidence Index (CCI) plunged to -25 in the second quarter of 2022, having already slipped from -9 to -13 index points during the first quarter of 2022,” reports BusinessTech.

Meanwhile, SA Reserve Bank governor Lesetja Kganyago said the central bank may increase interest rates by half a percentage point in July with annual inflation surging past the Reserve Bank’s target range for the first time in more than five years in May.

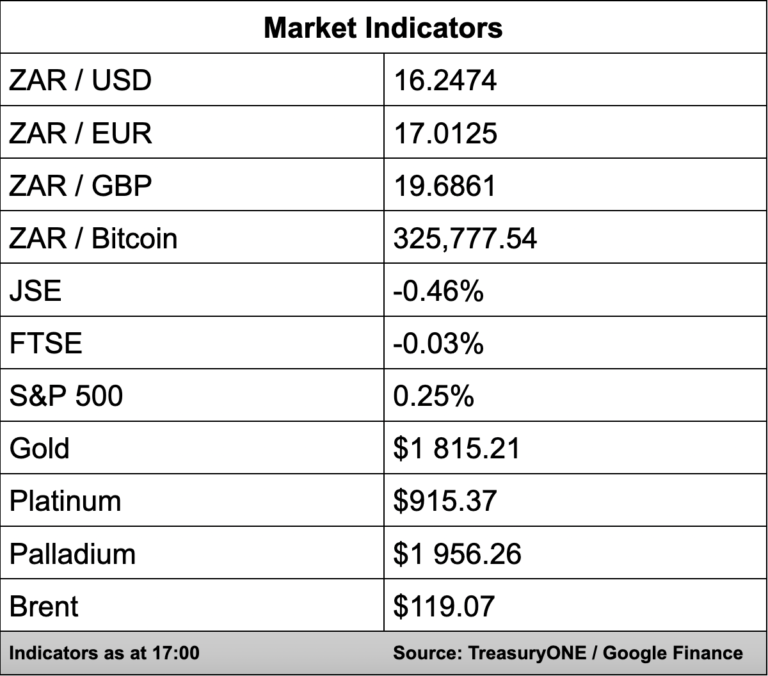

On the currency front, the rand is still under pressure from the ongoing fallout from stage six load shedding and the strong US dollar performance. The rand broke above the R16.23/$ mark with forex trading house, TreasuryONE, saying the local unit will remain under pressure in the short-term as the aftershocks of the past few days reverberate through the market.

“Brent crude is under pressure due to supply constraints in the oil market and the talk of recession has done nothing with the price of oil,” comments TreasuryONE.

Crude oil is currently trading at $119 per barrel.

“Other commodity markets are also in the green except for gold, which has taken a bit of a knock today and is currently trading at $1,815 per ounce,” says TreasuryONE.

The local bourse was 0.46% down with the All Share Index at 67,747.41 points.

The JSE said it expected to report a jump in headline earnings per share of between 24 and 32% for the six months to end June 30. This is compared with the same period from 2021.

In a trading update, the JSE attributed the jump to strong revenue growth, cost management and higher net finance income. The results are expected on August 2.

In other company news, Grant Hardy will officially take over as Capitec’s chief financial officer and financial director next month.

Hardy will take the reins from André du Plessis, the bank’s co-founder, CFO and financial director after Capitec announced his retirement back in January.

Capitec is 1.43% down.

Banking peers, Absa (1.51%), Nedbank (-2.65%), FirstRand (1.71%), and Standard Bank (-1.21%) all closed in the red.