(Bloomberg) — The number of active cryptocurrency users at Bank of America has declined by more than half amid the prolonged rout in the digital-asset market.

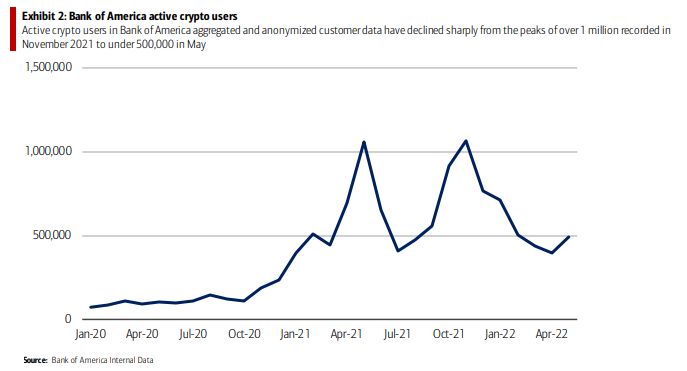

The bank’s crypto users shrunk to below 500,000 in May from more than 1 million in November 2021, when Bitcoin and some other tokens hit all-time highs. Since then, crypto prices have cratered, with sentiment among fans also souring. Bitcoin has tumbled nearly 60% this year and is trading just above $19,000. The bank said there has been “a grave decline” in prices.

“Crypto markets have been rocked by sharp declines in the prices of digital currencies and the collapse of certain stablecoins,” a Bank of America Institute team that includes David Tinsley wrote in a report.

The bank looked at anonymized internal customer data that showed the number of clients who had made investments in crypto assets by sending or receiving a payment to or from a digital-asset platform, though the data doesn’t show what specific transactions were made. While Bank of America’s data doesn’t offer a comprehensive view of all crypto users, it can be reflective of broader trends in the space.

Cryptocurrencies, like other riskier assets, have suffered in a tighter monetary-policy environment, where the Federal Reserve and other central banks are raising interest rates to slow down growth and dampen rising prices. The market capitalization of cryptocurrencies has dropped to less than $1 trillion, from a peak of about $3 trillion in November 2021.

Amid these conditions, sentiment toward digital assets has also fallen. Between April and June, Bank of America saw a rise to 30% from 21% in those saying they haven’t invested in the space and have no plans to do so.

Still, the wider effects of the crypto-market slump might not be detrimental to the broader economy. Crypto assets comprise less than 1% of overall US household financial assets, Bank of America said, suggesting that “relatively few people view crypto assets as a reliable long-term investment.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.