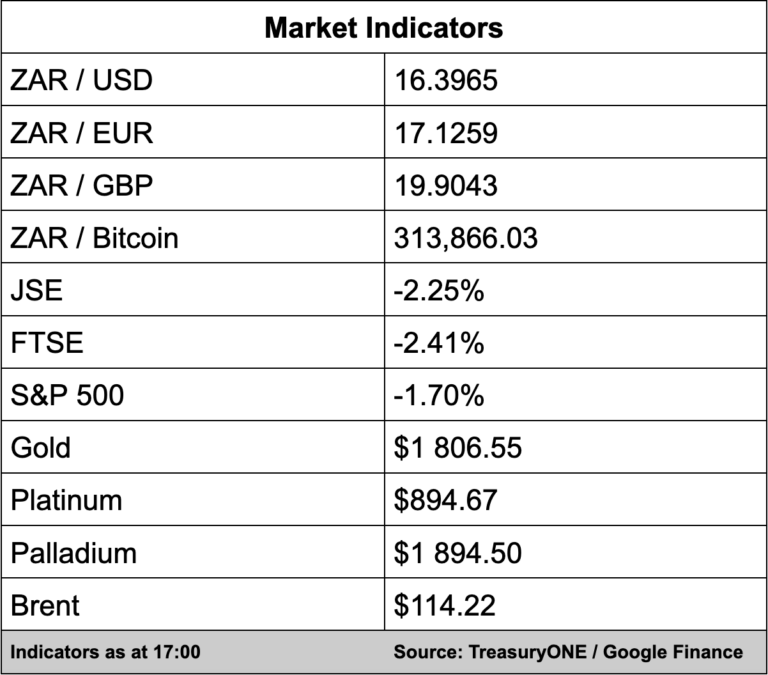

The JSE slipped further on Thursday as investors’ concerns around hawkish comments from central banks weighed on sentiment. The local bourse closed 2.25% lower with the All Share Index at 66 223.31 points.

While speaking with his other central bank counterparts at the European Central Bank forum on Wednesday, US Federal Reserve chair Jerome Powell said policymakers would not allow inflation to rule the roost over the US economy over the long term.

On the local front, the SA trade balance printed a surplus of R28.35 billion against the forecasted R22 billion.

The rand has been under pressure all day as it battles against a rampant US dollar while other emerging market currencies have also lost ground, says TreasuryONE.

“We saw the rand trade at its highest level for the year as the dollar marched stronger on the back of yesterday’s comments by Jerome Powell,” comments the forex trading house.

The local currency saw a high of R16.47/$ earlier on, after opening in the mid-R16.20s.

“The continuation of intensified load shedding is also not helping but does seem to be the second tier if we look at what is impacting the market at the moment.”

Fears of a recession and a slowdown in demand continue to weigh heavily on the commodity sector with platinum, palladium, and copper all losing ground today.

Copper is trading at $8,230 and palladium at $1,893, while platinum is trading below $900 again.

Brent crude fell over 1% and is quoted at $114.30 a barrel.

Back on the JSE, some of the biggest movers included Alphamin, which surged 12.66%, Vivo Energy added 3.20%, and bourse heavyweight Naspers gained 1.05%.

The biggest losers were Thungela Resources (-6.45%), Hammerson (-6.14%), and Italtile (-5.85%).