(Bloomberg) — US auto sales slumped in the second quarter as chip shortages continued to choke car supplies and rising sticker prices put new vehicles out of reach for a wider swath of prospective buyers.

The declines affected most automakers, including General Motors Co., but were steepest among Asian brands such as Honda Motor Co. and Nissan Motor Co.

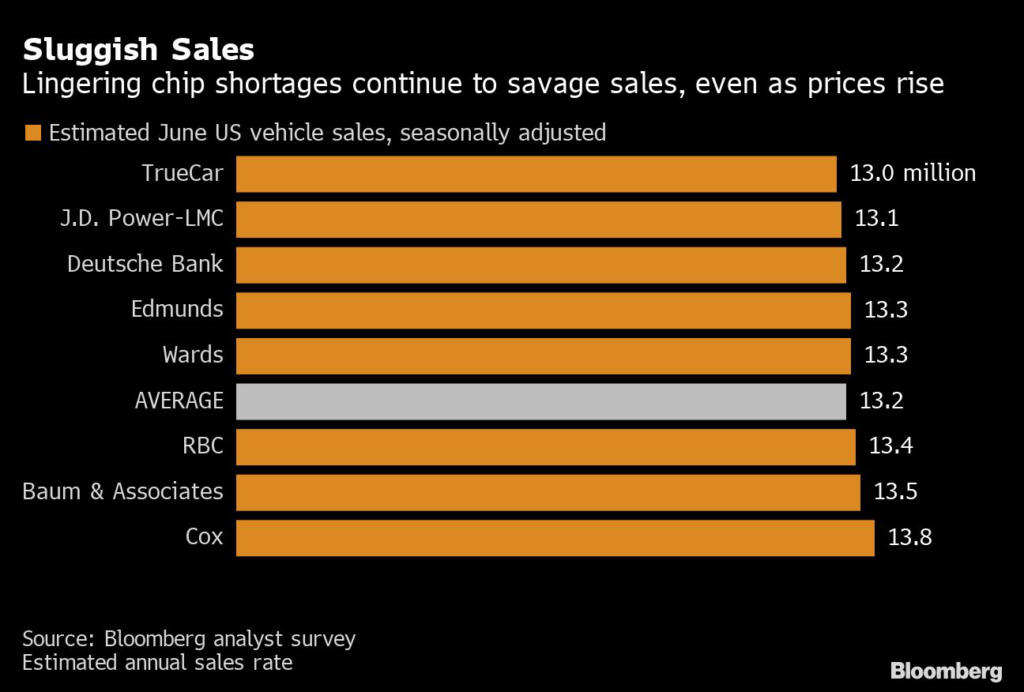

Some carmakers are optimistic a global chip shortage is easing while others doubt the crisis will abate anytime soon. The supply-chain stress points to the lowest production levels in a decade, with the annualized selling rate slipping to 13.2 million in June, according to the average forecast of six market researchers surveyed by Bloomberg. Prior to the pandemic, annual US auto sales topped 17 million vehicles for five consecutive years from 2015 to 2019.

General Motors said Friday second-quarter sales and profit will take a hit from 95,000 vehicles it can’t sell because it’s waiting on chips to complete them.

Inventory shortages drove the average price of a new vehicle to nearly $47,000 in May, up more than 13% from a year ago, according to automotive researcher Edmunds.com. Dealers can charge more and negotiate less, padding profits for them and the car manufacturers.

With interest rates rising, it’s also becoming harder to spread the pain of higher pricing with long-term financing. The average monthly payment on a new car loan was almost $700 in June, up 13% from a year ago, researcher J.D. Power reports.

Despite the sales slow-down, GM wrested back the crown as the second-quarter leader from Toyota Motor Corp., which had bested its Detroit-based rival the two previous quarters. Others reporting deliveries on Friday, included Stellantis NV and Hyundai Motor Co.

Ford Motor Co. reports on July 5 and Tesla Inc., which provides global numbers, has not specified a release date.

Read more: Tesla Braces for Delivery Slump on China Plant Shutdown

GM In Line

General Motors sold 582,401 vehicles from April through June, a 15.4% drop from a year ago that’s roughly in line with the 15.8% decline forecast by researcher Cox Automotive. The Silverado pickup and Chevy Equinox SUV were it’s top sellers; light-duty Silverado deliveries plunged 25% from a year ago, while the Equinox managed a 9.4% gain to 60,642.

Despite the quarterly drop, GM said it gained share in the lucrative pickup truck market, and noted fleet sales were up 29% thanks to a rebounding economy and more activity in the travel and leisure sector. It delivered 272 electric Hummers, its flagship EV model, and 7,300 EVs in total after resuming production of the Chevy Bolt EV models and delivering its first electric commercial vans.

Toyota Tumbles

Toyota’s second-quarter sales fell 23% to 531,105 units as supply chain issues caused production problems. The automaker had just 17 days supply in June, less than half the 41 days worth of vehicles that GM and Ford were carrying at that time, according to Cox Automotive.

Japan’s largest automaker managed to limit the drop in sales for its top-seller, the RAV4 compact SUV, to just 7% over the three-month period. But other big volume vehicles such as its Highlander mid-sized SUV and Camry mid-sized sedan saw double-digit declines.

Jack Hollis, executive vice president of sales at Toyota’s North American operations, said the chip crisis won’t even start to get better until summer of 2023, because even though suppliers are running their factories at full blast, there’s so much unmet demand it’s hard to catch up.

“There’s pent up demand that’s significantly more than people are calculating,” Hollis said in an interview Friday. “We’re all waiting to be able to have the microchips catch up to the speed at which the demand is, and that’s going to be a long time.”

Stellantis Stumbles

Deliveries at Stellantis, which owns the Jeep and Ram brands, sank 16% in the second quarter to 408,521 vehicles, slightly worse than the 15% drop forecast by Cox. Sales of the Ram pickup slid 28% to 117,867 but it remained Stellantis’ best seller, followed by the all-new Grand Cherokee SUV, sales of which rose 12%.

Pacifica minivan sales more than doubled in the quarter and the Dodge Charger muscle car was up 3%. Key Jeep models– the iconic Wrangler and Gladiator pickup — fell 22% and 30%, respectively.

Nissan’s Nosedive

Nissan Motor Co. had a rough second quarter in the US as sales fell 39% to 172,612 vehicles. Deliveries of its Altima sedan rose, but chip shortages hurt production of most other vehicles. Its perennial best seller, the Nissan Rogue crossover SUV, fell by 56% in the quarter.

Judy Wheeler, Nissan’s top U.S. sales executive, said China’s two-month pandemic lockdown this spring upset production plans just as the automaker was getting used to operating with leaner inventory.

“We had been managing it so well going into it, and that kind of took us by surprise,” she said in an interview. “It will get better as the year progresses, but we’re at a low point and that’s reflected in the numbers.”

Hyundai Cheap Chic

Hyundai’s namesake brand sold 63,091 vehicles in June and 184,191 in the quarter, marking a 23% quarterly drop from a year ago and a 16% decline for the first half of 2022. Deliveries of its Palisade mid-sized SUV notched a 15% jump in June, with the Korean brand’s Santa Fe compact SUV and Elantra sedan also seeing gains.

Randy Parker, Hyundai’s head of U.S. sales, said vehicle inventories will get better as the year progresses. The automaker expects to produce 30% more vehicles than last year, in line with internal targets, he said. It’s discontinuing its Accent sedan and making the Venue, a compact crossover, its entry-level vehicle to cater to Americans’ taste for sport utes.

Hyundai’s head of US operations, Jose Munoz, said earlier this week that the company’s strategy is to keep its models affordable, even as average industry car prices surge.

Honda’s ‘Severe’ Quarter

Honda Motor Co. said US sales fell 51% amid what the company called, “severe second-quarter supply issues.” The company’s namesake brand had 50,000 vehicles in pre-order in the first half, indicating customer demand remains strong.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.