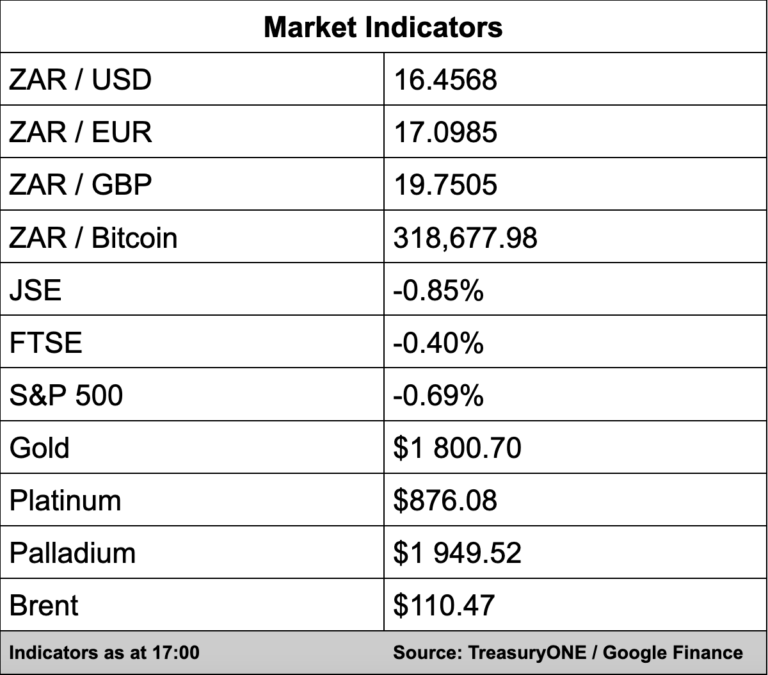

The JSE closed the week just under a percentage point down while recession concerns continue to weigh on global stock markets as the second half of the year started with another battering of stocks on Friday.

The All Share Index closed 0.85% down at 65 661.73 points.

On the currency front, the US dollar continues to bulldoze its way forward with the dollar index trading back at its highest levels since before covid-19.

“Being the biggest contributor to the index, we see the EURUSD currency pair trading back below 1.04 this afternoon. The pound is also trading under pressure below 1.20 as the market continues to assess the hawkish sentiment provided by Jerome Powell earlier this week,” comments TreasuryONE.

The forex trading house says “the rand is back at the highs we saw yesterday afternoon with the dollar still trading firm. The rand has lost over 4% during this week and would likely close at its weakest levels this year.

“We are, however not trading on our own and see similar trading patterns on other EM currencies.”

The local unit is currently trading at R16.46/$.

On the commodity front, global concern that supply-demand will dry up for metals in the coming months due to the likelihood of a recession has led to copper falling below $8,000, comments TreasuryONE.

“The trade-off between recession fears and the gradual recovery from Chinese lockdowns is skewed more towards the fear of recession, and we have seen other base metals like aluminium also under pressure.

“It is not only base metals that have felt the pressure, but precious metals as well. Palladium has gained back some of the steep losses during the week, while platinum has lost nearly 2% today.”

Gold is slightly down for the day but back above $1,800 after trading in the $1,780’s earlier today.

Brent crude oil is currently trading at $110.47 a barrel.