The JSE closed higher on Thursday having faced mixed global markets amid British prime minister Boris Johnson’s resignation and hawkish US Federal Reserve minutes, which came out on Wednesday evening.

The All Share Index traded 3.27% higher at 67,909 points.

In company news, the JSE-listed Mediclinic (8.57%) said its board would support the latest takeover offer from Johann Rupert’s investment holding firm Remgro (1.82%) and MSC after the hospital group rejected three previous cash offers in recent weeks.

Mediclinic said in a statement that the board remains confident in the strategic direction of the company and its long-term prospects.

“However, having weighed all relevant factors, including the current macro-economic conditions, the independent board is of the view that the near-term value realisation of the latest proposal provides Mediclinic’s shareholders an attractive alternative to the group continuing as an independent company.”

Meanwhile, French media company Groupe Canal+ increased its stake in DStv operator Multichoice to 20%. Multichoice Group (-0.29%) said in a market disclosure on Thursday morning that the Vivendi-owned company acquired an additional interest in its ordinary shares to bring its holding to 20.12%.

Groupe Canal+ has been buying and increasing its stake in Multichoice Group since its initial 6.5% stake in 2020.

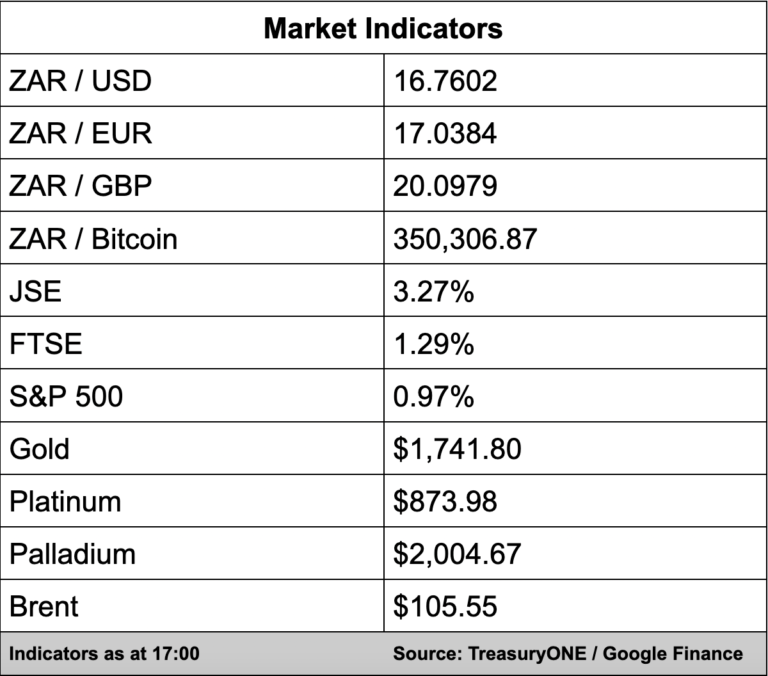

In the currency markets, there was some consolidation today with the US dollar taking a breather.

“The rand traded within R16.71 to R16.81, with EURUSD trading around the 1.02 level. Even with Boris Johnson resigning as UK prime minister, the GBP made a bit of a jump but still sits below 1.20,” comments forex trading house TreasuryONE.

Commodities have given up 20% over the past month, which has resulted in the Bloomberg commodity index shifting to a bear market. The commodity index is back at levels last seen in December.

“This can lead to some relief on inflationary pressures that are being felt. Oil has, however, risen by over 5% today, pushing Brent and WTI well above $100 a barrel again,” says TreasuryONE.

“Copper is also up over 5% today as well as palladium. Gold is flat and has not had the same bounce as the rest of the commodity space.”