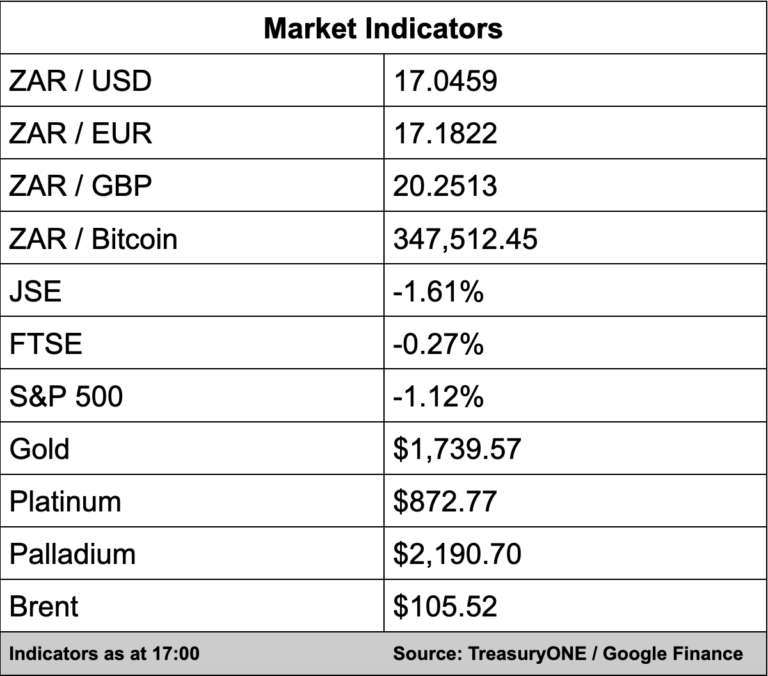

The JSE opened the new week in the red trading 1.61% down with the All Share Index at 67,227 points. Shares and bond yields fell amongst global peers on Monday with traders bracing for another US inflation report that could spell the start of a bout of hikes in interest rates with the threat of recession looming ever larger.

On the currency market, it was the same narrative that has been playing out over the last couple of weeks with the US dollar on the front foot and driving most currencies into the red today.

The dollar is currently trading at 1.0078 against the euro with a strong possibility that the two currencies could come to parity in the coming weeks.

“With the recession fears in the market, we could see the dollar strength continue. The US dollar index is trading at 108.00, showing the strength of the dollar versus other currencies. The Rand and other EM currencies have lost ground again, with the Rand trading at R 17.05,” comments forex trading house TreasuryONE.

The impending recession talk has caused commodities to run for cover alongside currencies.

Gold is trading at $1,738 per ounce, while Brent crude is trading at $105 per barrel. With the copper price also heading in a southerly direction, talks of recessions will only grow louder as a bearish copper market has been a leading indicator of economic downturns.