(Bloomberg) — Global asset managers including BlackRock Inc. and JPMorgan Chase & Co. are facing mounting pressures on profitability in China even as they gain a bigger footing in the nation’s fast-growing mutual fund industry.

The hurdles are piling up: higher distribution fees, new entrants stepping into the arena, and a growing war for talent. On top of that, declines in the local stock market imposed deep losses on new funds, even as a recent rally has started to ease the pain.

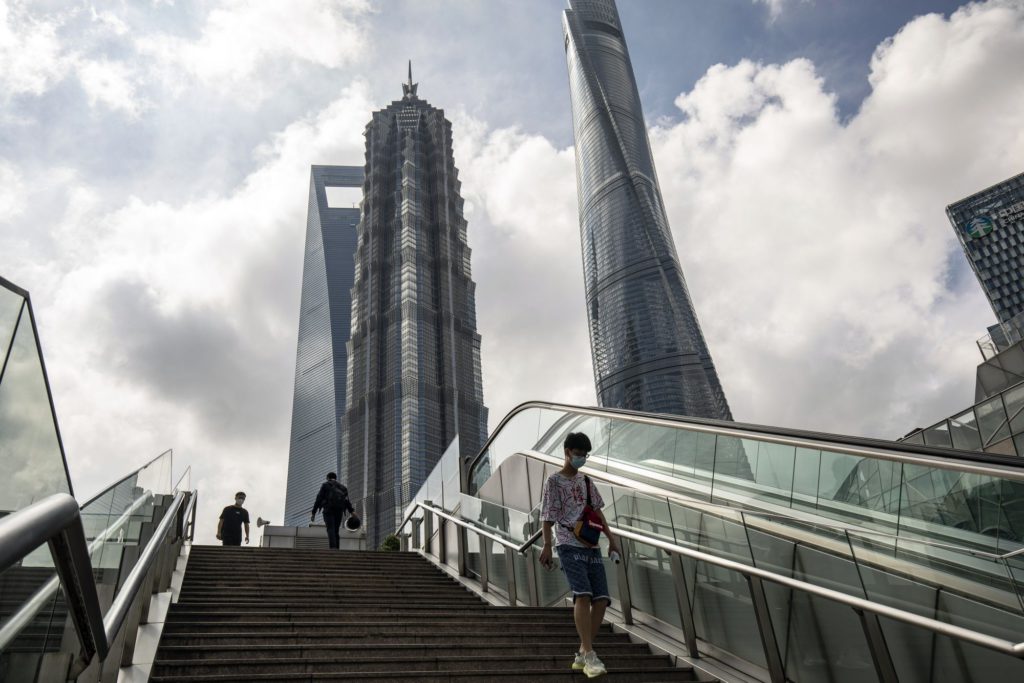

Such challenges are growing more apparent just months after BlackRock became the first global asset manager to launch a fully owned onshore fund business. Fidelity International Ltd. and Neuberger Berman Group are prepared to follow suit. The new reality complicates profit prospects as they deepen their commitment to the 32 trillion yuan ($4.8 trillion) market despite rising geopolitical risks and an economic slowdown.

Read how BlackRock’s China expansion is outpacing peers

“The potential for increased competition and greater difficulty in attracting talent will add to the challenges for foreign firms when executing on their strategies,” which are key to building the scale needed to break even, said Harry Handley, a senior associate at Shanghai-based consultancy Z-Ben Advisors Ltd.

While BlackRock has raised billions of yuan from local investors in two funds since September, it’s not pocketing all its management fees. The US giant’s China unit paid more than 48% to distributors in so-called “client maintenance fees” last year, the highest proportion among locally incorporated fund houses, according to data compiled by Wind Information Co.

Joint ventures of foreign firms including JPMorgan, Morgan Stanley, Credit Suisse Group AG and Prudential Plc paid a higher proportion of fees to distributors last year than the previous year, although those of UBS Group AG and Invesco ceded a slightly lower share, the Wind data show. JPMorgan’s venture, which the US bank is seeking full control of, shared 26.7%, up from 23% in 2020, according to the data.

Bargaining Power

The increase reflects the growing bargaining power of local banks with vast branch networks and online sales platforms. While regulators capped distributors’ share of fees at 50% for retail sales in 2020, funds have since typically been paying close to that level for fresh launches, leaving new players vulnerable.

Overall, distributors’ cut of management fees grew to 28% last year from 26% in 2020, according to Z-Ben.

The common practice of sharing fees in China can be traced back to 2008’s bear market, when fund houses had to sacrifice revenue to incentivize banks to sell their products, according to Xin Hu Wealth Investment Management Co., which also distributes funds.

Paying higher fees still has its merits for new entrants like BlackRock, which needs distributors to tout its biggest selling point — being a globally renowned asset manager — to more investors, according to Lu Haiyang, vice president of Xin Hu Wealth. BlackRock’s ratio will likely stay high for the near term when the US manager launches new products, Lu added.

Fund Losses

The BlackRock China New Horizon Mixed Securities Investment Fund, which raised 6.7 billion yuan, shrank to about 5 billion yuan as of March 31 amid losses and investor redemptions, according to its first-quarter report. It was down as much 27.6% in late April since inception, before a market rally trimmed the loss to 8.8% as of July 11. That’s still better than the benchmark CSI 300 Index, which lost about 13% over the same period.

Its second fund, which was launched in January and focuses on Hong Kong stocks, lost about 7% during the first quarter and managed about 500 million yuan as of March 31.

Not using distributors is also costly. It takes at least 1 billion yuan in outstanding fund sales for a direct-selling entity to break even, and it’s getting more expensive to attract new clients online, according to Zhou Xiaojie, a marketing director at Shenzhen Dollar Technology Co., which advises money managers.

That said, aware of the growth prospects, global managers are playing the long game. The mutual fund industry already makes up the largest segment of China’s asset management market, with assets exceeding banks’ wealth management products as of March 31, according to Hwabao Securities Co.

“While this year’s market has been incredibly challenging, BlackRock’s progress in establishing its platform, launching funds and building capacity in China will set it up for significant growth over the long term,” said Susan Chan, the firm’s head of Greater China.

China’s asset management market provides “huge room” for growth to both local and foreign managers, said Eddy Wong, chief executive officer of China International Fund Management, JPMorgan’s fund joint venture.

Morgan Stanley declined to comment. Representatives for Credit Suisse and Prudential didn’t immediately comment.

Intense Competition

In the near term, global players will need to hunker down. The China Securities Regulatory Commission issued new policies in April to speed up the growth of the industry, encouraging banks, insurers and securities firms to set up fund units and easing controls on the number of licenses they can hold.

The Asset Management Association of China followed up in June with compensation guidelines, requiring performance pay for senior staff and fund managers to be delayed for at least three years. That will make it even harder for global firms to poach local rivals’ best talent, according to Sun Guiping, an analyst with Shanghai Securities Co.

“Global firms are off to a not-too-bad start, but competition is certainly getting more fierce,” Sun said. “They need to find their own positions and build local brand names and relatively good track records.”

(Updates BlackRock fund’s performance in the 11th paragraph)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.